unSpun (11 page)

A Taxing Argument

As a general rule, the source of evidence matters. Snyder's figures should have been viewed with a critical eye from the start both because he was lobbying for more federal spending to aid homeless people and because he was a bitter critic of the Reagan administration. While there are certainly scrupulously honest advocates out there, it's clear that Snyder's figures were “data in the service of ideology.” But we can place more trust in studies and data from sources that have no horse in the race, and who haven't deceived us in the past. Such sources often give us a picture very different from the one painted by self-interested people who are trying to sell us something, whether it's a product or a policy.

*2

Examine, for example, the dubious charges made against the federal estate tax by the lobbyists and partisans who sought its repeal.

“Death Tax” Bunk

RADIO AD:

When you die, the IRS can bury your family in crippling tax bills. It can cost them everything. What's worse, the death tax is a double tax on all you've worked to build.

(American Family Business Institute, June 2005)

PRESIDENT GEORGE W. BUSH:

We also put the death tax on the road to extinction because farmers and small business owners should not be taxed twice after a lifetime of work.

(Radio address, January 21, 2006)

Farmers and small businesses were under attack in the year 2005, if a radio ad from that year is to be believed: “When you die, the IRS can bury your family in crippling tax bills. It can cost them everything.” That claim was in a radio ad that ran in eight states in 2005, part of what the sponsor said was a $15 million campaign to repeal the tax permanently. The ad was paid for by the American Family Business Institute, a group made up of about 500 businesses and including three billionaires, according to organizers. Others known to have funded anti-estate-tax lobbying include the billionaire Mars candy and Gallo wine clans.

The same claim had been picked up by the Republican party and had become part of its antitax orthodoxy. President Bush repeated it throughout his tenure of office, saying six weeks after his inauguration that Congress should “eliminate the death tax so family farmers aren't forced to sell their farms before they want to.” But the notion that farmers are forced to sell out and that families can lose “everything” is simply false.

The fact is, as the nonpartisan Congressional Budget Office said in a report issued in July 2005: “The vast majority of estates, including those of farmers and small-business owners, had enough liquid assets to pay the estate taxes they owed.” In other words, the “vast majority” had no need to sell any assets at allâlet alone “everything”âto pay estate taxes. The CBO said that returns filed in 2000 showed only 138 farmers and 164 family business owners left estates without enough liquid assets to pay their estate taxes. And the CBO estimated that those numbers would fall to fifteen farmers and sixty-two family business owners by the year 2006, when only estates valued at $2 million or more would be subject to any tax.

The CBO was putting matters cautiously.

The New York Times

reported in 2001 that one of the leading advocates for estate tax repeal, the American Farm Bureau, “said it could not cite a single example of a farm lost because of estate taxes.” The Farm Bureau, a huge lobbying organization that calls itself “the voice of agriculture,” then went scrambling to find such an example. Within days of the

Times

report, the organization's president issued an internal bulletin saying: “It is crucial for us to be able to provide Congress with examples of farmers and ranchers who have lost farms or have had to sell off portions of their land that makes [

sic

] the remaining parcel âinefficient,' due to death taxes.” The memo was quoted by

Congressional Quarterly Daily Monitor,

which also said no examples had been found. When we called the Farm Bureau in early 2006, they weren't very happy to hear from us, and they still could not point to a farm lost to pay estate taxes.

That anyone could “lose everything” to the estate tax is a logical impossibility, anyway. As of 2006, there is no tax at all on the first $2 million of any estate (effectively, $4 million for a couple that takes certain estate planning steps). The maximum tax rate is 46 percent (and set to go down to 45 percent in 2007) on anything above those amounts. Far from losing everything, heirs keep most.

We're not arguing for or against estate taxes. We are saying that hard data from tax returns, analyzed by a nonpartisan body noted for its consistent use of reliable methods, show that one of the principal claims made against the estate tax is false. There's another argument, with which economists generally agree, that taxing wealth reduces the incentive to invest and in turn holds back economic growth and job creation. That argument isn't very popular with the public, but at least it's honest. We can't say that about the radio ad warning that “your family” could be “buried” by the tax. In fact, the estate tax fell upon only 1.17 percent of the estates of adults who died in 2002, according to the IRS Statistics of Income. In other words, nearly 99 percent of the people who heard those radio ads wouldn't be touched by the tax at all. With respect to them, the ads were flatly untrue.

LESSON:

Saying It Doesn't Make It So

C

RITICS OF THE ESTATE TAX BASED THEIR YEARS-LONG CAMPAIGN

on the idea that repealing the tax would primarily benefit farmers and small-business owners. But most of the wealthy few who pay the tax aren't farmers or small-business owners by any definition. And the vast majority of small-business owners and farmers will never pay a penny of estate tax. Constant repetition of the claim may have caused people to believe it, but repetition didn't make it true.

An Abortion Distortion

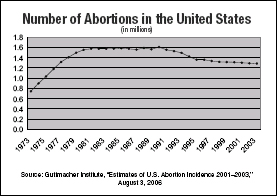

Bogus studies pop up in politics all the time. In 2005, Democrats were gloating over a macabre statistic that would have embarrassed President Bush, if it had been true. They said the number of abortions had gone up since this anti-abortion president took office, and they blamed his economic policies for driving poor women to end pregnancies rather than bear children whom they would be unable to support. Citing “the draconian policies” of Republicans, John Kerry proclaimed, “And do you know that in fact abortion has gone up in these last few years?” The Democratic National Committee chairman, Howard Dean, even went so far as to quantify the purported increase during an appearance on NBC News's

Meet the Press:

“You know that abortions have gone up 25 percent since George Bush was president?” In fact, the respected Guttmacher Institute, whose figures on abortion trends are systematically gathered using a disclosed method and are used by both sidesâreported that the number of abortions performed in the United States had continued its twenty-year decline after Bush took office. According to the institute's most recent figures, published in 2006, abortions declined in each of the first three years of Bush's tenure, for a total drop of nearly 2 percent.

The false claim that abortions were rising originated with a flawed “study” by Glen Harold Stassen, who is neither a statistician nor a healthcare expert, but an ethics professor at Fuller Theological Seminary. Stassen's article originally appeared not in any scientific journal but in a liberal Christian publication,

Sojourners,

in October 2004. “Under President Bush, the decade-long trend of declining abortion rates appears to have reversed,” he wrote. “Given the trends of the 1990s, 52,000 more abortions occurred in the United States in 2002 than would have been expected before this change of direction.” Stassen cited data from sixteen states. The claim was picked up and repeated uncritically on many Internet web logs, both liberal and conservative, and by Democrats including Kerry and Dean.

LESSON:

Extraordinary Claims Need Extraordinary Evidence

A

S THIS TABLE ILLUSTRATES, THE DRAMATIC CLAIM THAT ABORTIONS

had suddenly begun to increaseâafter twenty years of almost uninterrupted annual decreasesâbegged for confirmation.

Before accepting any such claims, it is wise to first look carefully at the source. In this case, the claim that the trend had suddenly reversed came from a critic of Republican policies who had no track record of evaluating abortion statistics and no special expertise in the field; in addition, the claim was based on fragmentary information.

Stassen got the data wrong for two reasons. First, he tried to project a national trend from an unscientific, nonrandom sample. He used the first sixteen states to report their official abortion data to the federal Centers for Disease Control, without waiting for the other thirty-four states to report. That's like trying to predict the outcome of a presidential election after the first sixteen states close their polls and report their results. Second, in two of the states among Stassen's sixteen, the Guttmacher Institute found the reporting system unreliable. In Colorado, where Stassen claimed that rates “skyrocketed 111 percent,” the reporting procedure had been changed in order to compensate for historic underreporting. What Stassen thought was an increase in the number of abortions really reflected an improvement in procedures for counting them.

CASE STUDY:

Is Cold-Eeze “Clinically Proven?”

E

VEN A GOOD STUDY FROM A REPUTABLE SOURCE CAN BE MISLEADING

, if the results can't be replicated. If you've ever gotten the sniffles and shopped for a drugstore cold remedy, you've probably noticed a product called Cold-Eeze, which contains a zinc compound and claims to be “clinically proven to cut colds by nearly half.” Science has proven this zinc stuff works! Or has it? A close look at the evidence shows that the Cold-Eeze claimâindeed, the entire companyâis based largely on a single study from 1996. But several other studies have produced starkly different results.

The original study, still cited on the Cold-Eeze website as we write this, was done at the Cleveland Clinic Foundation by Dr. Michael Macknin. That study and Macknin's many subsequent news interviews sent Cold-Eeze flying off drugstore shelves. He told Barbara Walters on ABC's

20/20

in January 1997 that he “got goose bumps” when he tabulated the data, and added, “here was something that actually seemed like it was helping the common cold, and nothing had really worked like this before.” The price of stock in the Quigley Corporation, which sells Cold-Eeze, soared, going from about $2 a share before the study was published to a high of $37 at the time of the

20/20

broadcast.

The first study seemed solid enough. It was published in a reputable, peer-reviewed journal,

Annals of Internal Medicine.

And it was a double-blind study: forty-nine subjects got the Cold-Eeze lozenges, fifty got a placebo, and neither the subjects nor the persons dispensing the lozenges knew which was which until the time came to tally the results. But when Macknin conducted a second study, of 249 suburban Cleveland students in grades one through twelve, he found that the kids who received the placebo got over colds just as quickly as those getting Cold-Eeze. The lozenges “were not effective in treating cold symptoms in children and adolescents,” said the report, published in

The Journal of the American Medical Association

in June 1998. It added that further research was needed “to clarify what role, if any, zinc may play in treating cold symptoms.” Quigley's stock plunged. The company had actually paid for Macknin's second study, but it doesn't display that one on its website.

Since that 1996 study that launched Cold-Eeze sales, the evidence has continued to be mixed. Over the years some scientific studies have found that zinc gluconate (the featured ingredient of Cold-Eeze) seemed to reduce the duration and severity of cold symptoms, but several other scientific studies have found no such effect. The National Institutes of Health have concluded: “Additional research is needed to determine whether zinc compounds have any effect on the common cold.” Zinc might work, or it might not.

So Cold-Eeze turns out to be another brand built on spin, like Listerine. In 1999, the Federal Trade Commission accused Quigley of false advertising for claiming on the QVC shopping network that its lozenges could actually

prevent

colds. The FTC said Quigley had no reasonable evidence to support such claims, and Quigley settled the case by agreeing to stop making them. Also false, in our view, is the company's biggest selling point, its claim that Cold-Eeze is “clinically proven” to cut cold symptoms by 42 percent. The best the company can say truthfully is that Cold-Eeze has been clinically

tested,

with inconclusive results.