Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (23 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

The options backdating scheme was really quite simple. Before finalizing an option grant, executives pulled up the stock chart and looked back in time to find a date on which the stock price was at a much lower level. They then said

hocus pocus

and “backdated” the paperwork to make it seem as if the stock option had really been granted on that earlier date. And voilà, the stock options had instant value. Of course, options backdating had accounting implications as well. By not reporting the compensation expense resulting from these “in-the-money” grants, companies were overstating their earnings to shareholders.

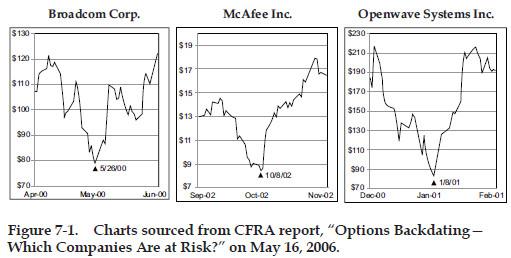

Few companies abused options backdating as much as semiconductor giant Broadcom Corp. The saga began when Broadcom’s board initiated a review of option-granting practices on May 18, 2006, two days after a seminal CFRA (Center for Financial Research and Analysis) survey on options backdating listed Broadcom as one of the companies “presenting the highest risk of having backdated options” (Figure 7-1 shows one of Broadcom’s backdating charts).

After two months of investigating, Broadcom finally admitted what it had done and estimated that this abuse of the system had allowed the company to avoid a whopping $750 million in compensation expense. But that was not the end of the story. The following January, Broadcom shocked investors by announcing an unbelievable $2.2 billion expense, which tripled the original estimate and trumped the $1.5 billion estimated restatement record held by former backdating champion UnitedHealth Group.

Some executives still argue to this day that the media blew the backdating scandal out of proportion and that the misdated grants were simply caused by “careless record keeping.” Au contraire. (We weren’t permitted to use stronger language in this PG-rated book.) The sheer pervasiveness of this scandal across hundreds of companies actually makes it seem that many executives considered backdating to be a perk of running a public company. But don’t take our word for it—see for yourself. Figure 7-1 provides some snapshots depicting one of many dates on which three companies granted options to executives. Can anyone really say with a straight face that these grants were the result of careless record keeping?

Failure to Record a Portion of an Expense Related to a Transaction

Remember our earlier discussion of the quirky two-part transaction between Intel and Marvell? Intel sold a business to Marvell in 2006 at what seemed to be a discount, and, simultaneously, Marvell agreed to pay above list price for a certain amount of product later to be purchased from Intel. (See Marvell’s footnote box.) As explained in Chapter 3, Intel appeared to structure this transaction in a way that allowed it to understate the gain from the one-time asset sale and overstate the more desirable stream of revenue (by overcharging on the product sales).

MARVELL’S 10-Q DISCUSSION ABOUT ITS TRANSACTION WITH INTEL

In conjunction with the acquisition of the ICAP Business, the Company entered into a supply agreement with Intel. The supply agreement obligates the Company to purchase certain finished product and sorted wafers at a contracted price from Intel for a contracted period of time. The contracted period of time can differ between finished products and sorted wafers.

Intel’s pricing to the Company was greater than comparable prices available to the Company in the market in almost all cases

. In accordance with purchase accounting, the Company

recorded a liability at contract signing representing the difference between Intel prices and comparable market prices

for those products for which the Company had a contractual obligation. [Italics added for emphasis.]

Now, let’s look at this same two-way transaction, but from Marvell’s perspective. Marvell essentially paid Intel less money up front to purchase the business, and in exchange, agreed to purchase inventory from Intel at an inflated price. While it sounds as if this transaction will cause Marvell’s earnings to be lower in future periods, as it is overpaying for inventory, this is actually not the case. It appears that Marvell accounted for the entire overpayment by recording a liability (or reserve) on its Balance Sheet, which it would draw down over time as a reduction of cost of goods sold (to “offset” the inflated prices). There was no need for Marvell to record an expense to create this reserve, since it already had been set up in the purchase accounting for the acquisition. In essence, Marvell created a “cookie jar” reserve without recording an expense, and it used this reserve to offset overpayments as it saw fit. Indeed, this transaction actually provided Marvell with more discretion over its earnings each quarter.

2. Failing to Record an Expense for a Necessary Accrual or Reversing a Past Expense

Management sometimes fails to record the necessary expense accruals for expected costs. These accruals are generally company estimates of routine liabilities incurred in normal business operations, such as a manufacturer’s warranty. Often these costs are estimated and recorded at the very end of a quarter. In the previous chapter, we introduced the concept of expense accruals (reserves) and highlighted reserves that are recorded as reductions to assets, such as the allowance for doubtful accounts and the inventory obsolescence reserve. In this section, we discuss reserves for estimated obligations that are shown as liabilities.

Failing to appropriately record an expense for these costs, or reversing past expenses, will inflate earnings. Since these costs rely on management assumptions and discretionary estimates, all management needs to do to generate more earnings (and achieve Wall Street targets) is to tweak these assumptions. To illustrate, consider the shenanigans that occurred at Dell Computer from 2003 through the beginning of fiscal 2007. The published findings of a special investigation conducted by Dell’s audit committee in 2007 (as presented here) provide some fantastic, juicy details about Dell’s games with reserves (don’t skip the box; there is some amazing stuff in there).

DELL’S DISCUSSION OF ITS AUDIT COMMITTEE

INVESTIGATION FINDINGS IN AN AUGUST 2007 8-K

The investigation raised questions relating to numerous accounting issues, most of which involved adjustments to various reserve and accrued liability accounts, and identified evidence that certain adjustments appear to have been motivated by the objective of attaining financial targets. According to the investigation, these activities typically occurred in the days immediately following the end of a quarter, when the accounting books were being closed and the results of the quarter were being compiled. The investigation found evidence that, in that timeframe, account balances were reviewed, sometimes at the request or with the knowledge of senior executives, with the goal of seeking adjustments so that quarterly performance objectives could be met. The investigation concluded that a number of these adjustments were improper, including the creation and release of accruals and reserves that appear to have been made for the purpose of enhancing internal performance measures or reported results, as well as the transfer of excess accruals from one liability account to another and the use of the excess balances to offset unrelated expenses in later periods.

Watch for Declines in Reserves for Warranties or Warranty Expense.

Many companies bundle expensive warranties with their products, covering potential problems that could arise years after the purchase. For example, if you were to purchase a laptop from Dell, it might come with a two-year warranty promising that Dell will replace or repair all defective parts during that period.

Dell cannot just wait and see how much it will wind up spending on warranty costs for your computer before recording the expense. Accounting rules require Dell to record an expense for expected future warranty costs at the time the product is sold. Naturally, management can exercise great discretion in the amount it records as warranty expense each period. If it chooses too little, the profits will shoot up; if it chooses too much, profits will be constrained (or simply held back for a rainy day).

Indeed, part of Dell’s restatement involved improper accounting for warranty liabilities. Again, the audit committee’s discussion of its findings is quite revealing and did such a great job of explaining the mechanics that we figured we’d let the committee teach you directly.

DELL’S DISCUSSION OF ITS AUDIT COMMITTEE

INVESTIGATION FINDINGS IN AN AUGUST 2007 8-K

There were also instances where warranty reserves in excess of the estimated warranty liability, as calculated by the warranty liability estimation process, were retained and not released to the Statement of Income as appropriate. Additionally, certain adjustments in the warranty liability estimation process were identified where expected future costs or estimated failure rates were not accurate.

Tip:

A decline in warranty expense or warranty reserve relative to revenue may signal that earnings are being inflated through underaccruing for warranty obligations. Monitor these trends quarterly!

Watch for Declines in the Employee Bonus Accrual.

Employees earn bonuses over the course of the year, and naturally, accounting rules require that the expense be spread throughout the year even if the employees receive a single lump-sum payment. If management fails to record this accrual in any particular quarter, earnings for that period will be overstated. Moreover, the inappropriate reversal of past bonus accruals will inflate earnings as well. Dell certainly was familiar with this simple trick, as the investigation found.

DELL’S DISCUSSION OF ITS AUDIT COMMITTEE

INVESTIGATION FINDINGS IN AN AUGUST 2007 8-K

Certain employee bonuses were not accrued correctly, including the timing of the recording of the accrual for the employee bonuses. Additionally, in certain cases when excess accruals resulted from differences in the actual bonus payments, the excess accruals were not adjusted as appropriate.

Be Alert for Companies that Fail to Accrue Expenses for Loss Contingencies.

Occasionally, management may be required to establish a contingency reserve and record an expense (or loss) for outstanding, yet unsettled disputes. Accounting rules require that losses be accrued for such contingencies (e.g., expected payments related to litigation or tax disputes) when the following two conditions exist:

(1)

there is a probable loss, and

(2)

the amount of the loss can be reasonably estimated.

Accounting Capsule: Estimating a Loss Contingency

When both requirements for a contingent loss have been met (i.e., the loss is probable and can be reasonably estimated), an expense should be accrued. For instance, assume that a company is about to lose in litigation and almost certainly will have to pay out $6,000. Since both conditions for accruing the loss are present, the following entry should be made:

Recording this transaction increases liabilities and reduces net income. Conversely, failing to record the transaction would overstate profits.