Simply Complexity (15 page)

Authors: Neil Johnson

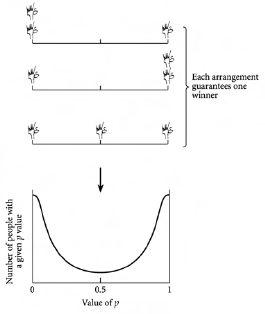

A better arrangement, at least in terms of guaranteeing that not everybody loses, is to have two people with

p

= 0 and one with

p

= 1. That way there will always be one person who wins. Either two people attend the bar, and hence the one who doesn’t will win – or only one person attends the bar and hence he wins. Similarly, the arrangement with one person having

p

= 0 and two with

p

= 1 also guarantees that there will always be one person who wins. These are the top two arrangements in

figure 4.4

. In addition, consider the arrangement with one agent having

p

= 0, one with

p

= 0.5 and one with

p

= 1. This is also shown in

figure 4.4

. Depending on the random outcome of the coin-toss of the

p

= 0.5 person, either the

p

= 0 or the

p

= 1 agent will lose. But again this guarantees that one person will win every turn. So the three arrangements in

figure 4.4

are the ones in which one agent always wins. And if the system moves between these arrangements over time – very much like the system of files moved between arrangements in

chapter 2

– the person winning won’t always be the same. Instead, winning will be shared around the three of them. Hence it makes sense that the average distribution which is observed should be some kind of average of these three favorable arrangements, and hence favorable to the three-person population overall. We can see from

figure 4.4

that an average of these three arrangements will indeed be biased toward the edges

p

= 0 or

p

= 1, rather than toward the center

p

= 0.5. The resulting U-shape at the bottom of

figure 4.4

closely resembles the result seen in

figure 4.3

, thereby explaining the segregation phenomenon into crowds and anticrowds.

Figure 4.4

Three possible arrangements of three people among the three

p

values 0, 0.5 and 1. Since each of these arrangements will always result in two people making the same decision and one making the opposite decision, each arrangement will always produce one (and only one) winner for the situation of a bar with a comfort limit of one. Notice that the top two arrangements have nobody at

p

= 0.5, hence an average over these three arrangements will give the U-shape which is shown at the bottom. This then explains the U-shape observed in

figure 4.3

.

So we can now see why a collection of people will segregate themselves into a crowd and anticrowd. It is a truly emergent phenomenon and is characteristic of a collection of decision-making objects competing for some limited resource. Hence this idea of the emergence of crowds should arise across the entire range of real-world problems discussed in this chapter and in

chapter 1

, most notably within financial markets and traffic.

Now, if we had restricted the possible

p

values that a particular person could take up, we might have prevented certain of the

arrangements in

figure 4.4

from occurring, or at least reduced the probability that they would occur. This is exactly the effect of frustration that we saw in

chapter 2

. It is clear that if favorable arrangements are prevented, the system will perform less well overall in that the actual number of winners falls below the maximum possible number of winners. In other words the system will tend to under-utilize its resources, which is another signature of frustration. In such cases of frustration, the U-shape corresponding to

figure 4.3

typically will be prevented from fully emerging. Instead it will be distorted in some way according to the precise nature of the frustration. In other words, either the crowd or anti-crowd may dominate. Since the cancellation between the two will then be reduced, so the output – such as the price in a financial market setting – will move around much more. In other words the volatility or, equivalently, the fluctuations will be larger than before. The references in the Appendix include many studies of this crowd and anticrowd phenomenon in a variety of different situations, and result from an ongoing research program with Pak Ming Hui at the Chinese University of Hong Kong. In each of the different situations studied the results of the computer simulations can be understood and explained using the mathematical theory of crowds and anticrowds – the so-called

crowd-anticrowd theory

.

Finally, we will discuss very briefly the second popular set-up for adding feedback into such collections of decision-making objects. We mentioned in section 4.4 that this other set-up involved the bar-goers acting essentially systematically. Once again, the potential bar-goers all have access to the past

m

outcomes – but now they hold a couple of strategies, each of which is a fixed response to each of these outcomes. Because of this fixed response and the fact that people only have a few strategies to choose from – as opposed to the whole range of

p

values in the first set-up – the amount of frustration is large. In particular, the crowd tends to be much larger than the anticrowd. There is a regime of this set-up where this cancellation is reasonably large but it only occurs for a small range of

m

values. In addition to ourselves, this particular set-up has been studied in detail by D. Challet and Y.C. Zhang of the University of Friburg, R. Savit

and R. Riolo of the University of Michigan, and D. Sherrington of Oxford University.

Given these set-ups, we have been able to explore a large number of variations and generalizations of such binary-decision games. These papers are listed in the latter part of the Appendix. For example, we have been able to explore whether someone who is fed larger packets of information will automatically find himself better off

at the expense of

others in the population who are being fed with less information. Interestingly the answer turns out to be no. The reason is that information becomes like food – and someone who feeds off of large chunks will tend to ignore the crumbs which are then left lying around for these others to eat. Hence they can all happily coexist in a sort of information ecology without getting in each others’ way. Even more interesting is the finding that someone who is feeding off of such large chunks may unwittingly be generating smaller crumbs themselves – very much like someone who is eating large chunks of food will tend to leave small crumbs lying around. So there is a very real sense in which everyone can benefit from diversity within the population.

So now we have understood how Complexity can emerge in collections of decision-making objects such as people. But what about our goal of actually managing such a Complex System so that we avoid any unwanted behavior? It turns out that the prospects are good – in particular David Smith of Oxford University has shown, using sophisticated mathematical analysis, that this is indeed possible. The details are in his research paper listed in the Appendix, but without going through all the steps I will give a sense here of what he has done.

Imagine a car with shuddering wheels. Obviously this would be a potentially dangerous situation, but we all know how such a car could be driven in practice: grip the steering wheel firmly to help reduce the shudder, and then turn it right or left as usual. As long as you are gripping the wheel firmly and hence are able to make the wheel turn more than it shudders, you will make the car go

right or left as desired. Now imagine that this car has an underlying “Complex Systems” design; as a consequence, you might neither have complete knowledge of, nor direct access to, the steering mechanism itself. Instead, let’s suppose that there is a very complicated set of inter-connected levers between you and the car’s wheels – in other words, in true Complex Systems-style, the steering mechanism consists of a very complicated arrangement of interacting objects. So now you have two problems. First, there is the prediction problem: you need to predict where the car is going in the next few seconds in order to determine whether it is heading toward danger or not. Second, there is a control, or management, problem whereby even if you manage to work out where the car is going to move, and hence whether to try to steer it, you are still left with the problem of what levers to adjust in order to produce the desired steering effect.

Of course, if this were a standard car you would probably try instead to find a mechanic who has knowledge of, and can gain access to, the relevant parts of the vehicle. Given all the prior available information about the make and year of car, he would then know how to fix the problem – even if this meant the maximally intrusive step of taking the car off the road, stripping it down to its component pieces and rebuilding it. But such levels of intervention are not generally possible in real-world Complex Systems, nor indeed is the precise nature of their constituent parts and interactions generally known. Hence, even if one could work out what intervention is actually needed, its implementation could only ever be indirect, infrequent, and generally broad-brush in terms of its level of specificity. And to make matters worse, most real-world Complex Systems cannot be “shut down” – hence any such interventions would need to be carried out in real-time, like a car being repaired while it is speeding along a highway.

Despite these seemingly insurmountable challenges, David Smith’s research shows that such online Complex Systems management is indeed possible. In particular, he has shown that both the prediction problem and the subsequent control/management problem have relatively straightforward solutions for the type of Complex Systems considered earlier in this chapter based on multi-object competitive games.

In terms of the prediction problem, David has shown that with relatively little knowledge of the past behavior (i.e. the global output), one can produce corridors into the future along which the system is then very likely to move. These corridors have two important features: their width, which he calls the Characteristic Stochasticity, and their average direction, which he calls the Characteristic Direction. In most real-world Complex Systems, from biology through to financial markets, the observed dynamics is so complicated – more specifically, the way in which the system moves between order and disorder is so complicated – that neither the width nor the average direction of these corridors will be constant. They will change in time and that is what makes traditional time-series prediction schemes so poor at predicting the future of real-world Complex Systems. However, David’s work shows that with relatively little information about the past global output – in particular, without knowing precisely what the individual objects are each doing – he can produce such corridors into the future. The system’s subsequent behavior is such that it then moves along these corridors with remarkable accuracy.

David’s work shows that as time evolves, the widths and average direction of these corridors can vary significantly. In particular, there are moments when the width is much larger than the average direction, and vice versa. This just reflects the feature that I have emphasized in this book, that a Complex System exhibits pockets of order. In particular, it continually slips between order and disorder and hence so does the predictability of its future movements. In a situation where the width of the corridors is larger than the average direction, it would not be wise to make a firm prediction as to a particular direction for future movements – as for example, in trying to predict whether a price goes up or down in a financial market. Having said this, even a small “edge” may be enough in a financial setting: you can still make money even if you can’t predict the direction of future price movements all the time. I will return to this in

chapter 6

when we discuss financial markets. But for now, we can just think of David’s corridors as providing an accurate view of how risk in the system evolves as the system itself evolves. In short, the behavior of these corridors over time indicates the appearance and disappearance of pockets

of predictability, which in turn reflects the emergence of pockets of order in the system.

Now comes the control/management problem. As suggested earlier, just because we might know our system is heading “off course” it doesn’t necessarily mean we can do anything about it. One might suspect that we have to master all the parts of the system in some way in order to make a significant change – and this sounds like an extremely intrusive level of control. Again, David’s work shows that such extremes are not always necessary. He finds that it is typically enough to make a few general “tweaks” to the population’s composition. In particular, we don’t have to know very much about the precise composition of the population nor the precise change that we are making. The secret lies not so much in how big the tweak is but

when

we make it. In particular, we do not even need to have direct access to all the objects in our system – after all, they may be largely hidden such as cells in the body, robots searching a dangerous area for bombs or mines, or collections of spacecraft sent into outer space. All we generally need to do is tweak the subgroup that we do have access to. Even in a scenario where we don’t have access to any of the objects, David has shown that we can then simply add some more objects to the collection in order to induce the effect of steering the system.