Red Capitalism (40 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

Given China’s geographical size and huge population, it is unlikely that its economy will grind to a halt in the way that Japan’s did after its magnificent run in the 1980s. Unlike the Japanese banks then, China’s banks are not deregulated nor are they near being sufficiently international to consider “going out,” even if the Party would allow them to do so. To this can be added the very big lesson China’s government appears to have learned from Japan: keep a tight lid on currency appreciation. China knows well that when Japan freed up the yen to appreciate and deregulated its financial markets, it was entering the last stage of its wild asset bubble. The Party will perhaps allow the RMB to appreciate a little to defuse diplomatic tensions, but it will never make the currency freely convertible. All of the talk around the internationalization of the RMB has proven its weight in gold diplomatically, but it cannot be any more than that unless holders of the RMB are able to use it freely offshore like any other currency. Until then, “internationalization” of the yuan is simply another form of barter trade.

In sum, China’s growing dependence on debt to drive GDP growth implies that there will be no meaningful reform of interest rates, exchange rates or material foreign involvement in the domestic financial markets for the foreseeable future. Nor will there be any further meaningful reform or internationalization of the major banks, although future recapitalizations will inevitably take place. The events of the fall of 2008 have put an additional seal on this outcome. “Don’t show me any failed models,” is the refrain of Chinese officials these days. But is its own financial system a model for the world to study? Can China be thought of as an economic superpower, either now or in the future, with such a system?

IMPERIAL ORNAMENTS

Against this background, the question has to be asked: why go to the trouble of building debt and stock markets when the banks stand behind everything? Why don’t the banks simply lend directly to the MOF or the CDB, just as they do to the local governments and their projects? What is the advantage of creating such a complex and difficult-to-manage financial system?

The answer to such questions is complicated and has many aspects. These include that the system serves as: i) an important catalyst for corporate transformation; ii), a mechanism allowing money to flow among various groups; and iii) a familiar surface for local business and politics that attracts foreign support and admiration. First of all, in the late 1980s as it considered SOE and other economic reforms, the Party wanted to make use of the most advanced economic practice available. The Western financial model, involving shareholding and capital markets, seemed to offer this. With strong support from Deng Xiaoping, a consensus formed around the active pursuit of equity-capital markets and SOE IPOs as channeled by Western legal, accounting and regulatory practices. In just a few short years, experimentation with international listings led to the creation of perhaps the largest Chinese enterprises in history: the National Team began to form.

This can only have been seen by the Party as a great success, but the National Team was also, in many ways, the gamechanger in China’s political economy. Endowed with great economic and political power, why should these huge state enterprises want a domestic (or international) regulator or any other government agency to have a significant influence over their operations? Would such corporations want China’s stock markets, including Hong Kong, to develop toward international best-practice standards? The answer at this point appears to be “No.” The National Champions have the clout to slow, if not halt, market development if it is not in their interest. This explains why China presents such a mixed picture to international observers. Its markets have all the trappings of Western finance: B-shares, H-shares, locally incorporated bank subsidiaries, local-currency derivatives, QFII, QDII, securities, mutual fund and commodities joint ventures—all have been tried, some with great success, but they remain small extensions to the vast grounds of the Forbidden City.

There has been talk of an international board on the Shanghai Exchange since at least 1996 when Mercedes Benz sought a listing in Shanghai. In the debt markets, only the Asian Development Bank and the International Finance Corporation have been allowed to issue bonds, and only within the existing interest and investor framework and to fund state-approved projects. China’s lively and important non-state sector has been allowed access to the Shenzhen stock market since 2004, but of the 400 companies listed, only four have made it to China’s Top 100 by market capitalization and altogether they account for just 2.2 percent of total capitalization. In addition, the non-state companies are to be found in such areas as consumer, food, certain areas of hi-tech, pharmaceutical and other light industrial sectors in which the Party historically has had little stake. In short, the non-state sector, no matter how important to China’s exports and employment, has not been allowed to develop into a challenge to the National Team.

The second aspect to answering this question is that it suits China’s powerful interest groups to have a complex yet primitive financial system in which money frequently changes hands. Multiple products, regulators, markets and rules all disguise the origin and destination of China’s massive cash flows. In this business environment, the National Champions, their family associates and other retainers plunder the country’s large domestic markets and amass huge profits. With nationwide monopolies or, at worst, oligopolies, these business groups do not want change, nor do they believe that foreign participation is needed. How can China use its Anti-Monopoly Law when the Party owns the monopolies? The addition of foreign participants simply makes things more complicated than a simple consideration of the possible value they might add; why share the wealth? If Zhu Rongji’s intention in signing China up to the World Trade Organization was to open it up to foreign competition and, therefore, economic change, after 2008, this goal seems to have faded from sight.

Can it be fairly said that these business interests are, in fact, China’s government? Is it simply that, lacking a strong leader, the government presently cannot set its own agenda if it is in conflict with that of the National Team? The answer may well be “Yes.” As far as the financial sector goes, the collapse of Lehman Brothers in September 2008 undermined the influence of those in the Party who sought a policy of greater openness and international engagement. The global financial crisis eliminated the political consensus in support of the Western financial model that had been in place since 1992. This has allowed the pre-reform economic vision of an egalitarian socialist planned economy to re-emerge. There are many in the Party and the government who never supported Red Capitalism in the first place. Like the old cadre quoted at the start of Chapter 1, these people have always wondered what the revolution had been for if it simply meant a return to the pre-revolution era of the 1930s and 1940s, with all its excesses. They see today the re-emergence of the same issues that led to the revolution in the first place. What they misunderstand is that without Western finance and open markets, China would not have achieved the extraordinary rise of which they are so justly proud.

There has been a great cost to China as a result of the Party’s support for the National Team but the entire intention of creating National Champions should be understood against the backdrop of the globalization of industries taking place in the late 1990s.

4

In almost every industrial sector, China was beginning to face international competitors of a scale, expertise and economic clout that its own companies simply did not possess. The success of the US$4.5 billion China Mobile IPO in 1997 showed a way forward. The goal of placing companies on the

Fortune

500 list for Zhu Rongji became the equivalent of America’s Apollo moon program. Ironically, however, the new National Champions were born with too much political power—the Party should never have allowed their chairmen and CEOs to remain on the

nomenklatura

and enjoy such great political influence. As a result, these companies grew fat, wealthy and untouchable as they developed China’s own domestic markets and always with the unquestioning support of a complaisant financial system.

Since they are so comfortable in a domestic market closed to meaningful foreign competition, the National Team faces great difficulties developing into an International Team. If China’s banks are the strongest in the world, where were they when Western commercial and investment banks were on the ropes, ready to be bought for a song? It is entirely disingenuous to say, as a major Chinese banker has said, that the developed markets do not present significant profit opportunities for China. Rather, the government appears to be far happier working in weak economies, where its mix of economics and politics is quite effective. But this still demands the question: where is China’s International Team?

There is a third aspect to China’s mixed financial scene and involves a picture that outside observers, whether political, business or academic, feel comfortable with since it makes China resemble other emerging markets. In this regard, the infrastructure is the thing. Over the past 18 years, China has developed stock and debt-capital markets, a mutual-funds industry, pension funds, sovereign-wealth funds, currency markets, foreign participation, an internationalist central bank, home loans and credit cards, a burgeoning car industry and a handful of brilliant cities. As it looks like the West, international investors easily accept what they see; they are excited by it because it is at once so familiar and so unexpected. There is the feeling that all can be understood, measured and valued. They would not feel this way if China explicitly relied on a Soviet-inspired financial system even though, in truth, this is largely what China remains.

The Chinese commonly explain the complexity of their system saying: “Our economy is different from the West, so our markets work differently than those in the West.” It turns out that this is a simple statement of the truth. China is an economy that, from the outside, appears as a huge growth story; one extraordinary boom that has continued over the last 10 years. This is just the surface. China has been a series of booms and busts within its overall growth story; it deserves and repays far closer scrutiny from all sides including the Chinese themselves, but especially from those in the West. One cannot simply assume that words such as “stocks” or “bonds” or “capital” or “yield curves” or “markets” have the same meaning in China’s economic and political context. To do so reflects a lack of curiosity and seriousness that can rapidly lead to misunderstanding and wasted opportunity. It is a luxury that neither China nor its foreign partners can afford. The prolonged efforts of the Party and government to mix Western capital markets with state planning have produced spectacular change in a short period. This has obscured the fact that all able bodies are desperately engaged in “the primitive accumulation of capital” in an unprecedented social experiment. If Karl Marx were alive today, he would without doubt find plenty of material for a new version of his masterpiece which he might call

Das Kapital with Chinese characteristics

.

ENDNOTES

1

This is derived as follows: 2009, RMB9.56 trillion actual; 2010, RMB10 trillion based on annualized 1Q 2010 actual lending.

2

Bond issues are accounted for as revenue in China’s budget accounting. Since 2000, interest expense has been included in expenditure budgets, but repayment of maturing bond debt is not included as an expenditure item.

3

Since 2008, the government has adopted the old 2001 policy of paying 10 percent of the shares of listing companies into the National Social Security Fund. Even so, the fund continues to be seriously underfunded.

4

See Nolan 2001 for an extensive discussion of SOE reform in the context of the global consolidation of industry.

Appendix

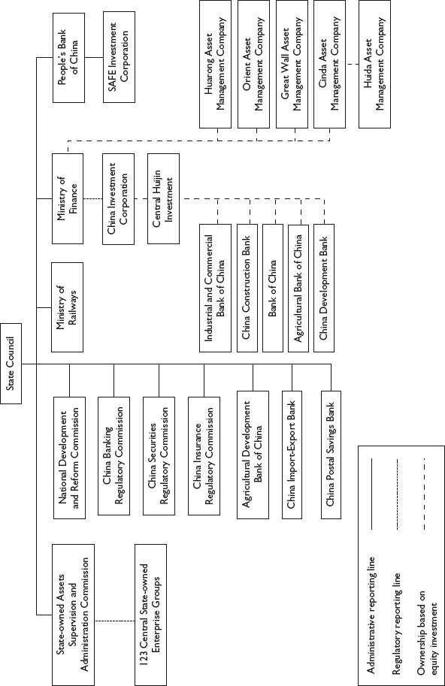

Central Government Organization of Major Financial System Participants

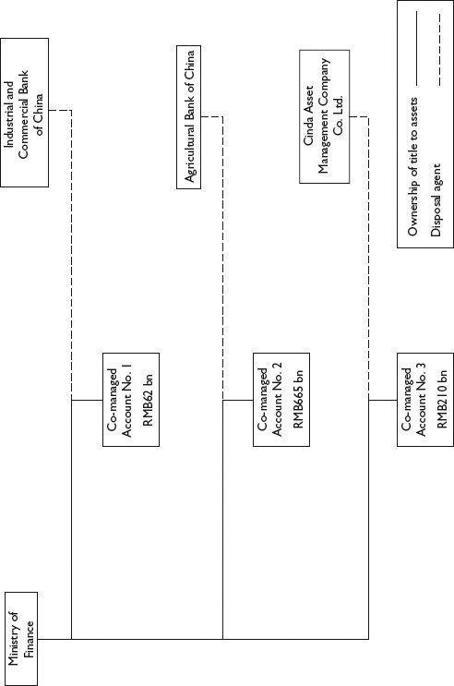

Ministry of Finance Off-Balance Sheet Debt Obligations in Co-managed Accounts