Red Capitalism (30 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

From 1985, a group of research students and staff at the State Committee for the Reform of the Economic System (SCRES) had developed a critique of state planning and state ownership of all aspects of industrial production. This group provides a clear insight into who among today’s Party leadership belong to the market reformers. The SCRES group included Guo Shuqing (now Chairman of CCB), Lou Jiwei (now Chairman of CIC), Zhou Xiaochuan (now Governor of the PBOC), Li Jiange (now Chairman of CICC and previously Zhu Rongji’s personal assistant) and Wu Jinglian (Zhu Rongji’s favorite economist), all of whom today continue to make contributions to China’s market-reform effort. Based on their work, as well as on ideas brought back from New York by Gao Xiqing (now CEO of CIC), Wang Boming (Founder and Publisher of

Caijing magazine) and others, by late 1988, the State Council and SCRES had initiated a project that would lead Beijing to co-opt the 1980s experiment with stocks for the benefit of SOEs.

magazine) and others, by late 1988, the State Council and SCRES had initiated a project that would lead Beijing to co-opt the 1980s experiment with stocks for the benefit of SOEs.

At the historic Xizhimen Hotel Conference of December 1988, the framework for China’s future stock markets was set. Discussion centered only on the question of how to improve the performance of SOEs and the recommendations related only to SOEs. The conference report concluded that the critical conditions to proceed with what was called the “shareholding system experiment” included: 1) avoidance of privatization; 2) avoidance of the loss of state assets; and 3) the guarantee of the primacy of the state-owned economy. If such objectives could be achieved, the conference concluded, the new form of companies limited by shares was attractive for two reasons. First, the corporate structure of a company limited by shares could address the perceived problem of excessive government involvement in enterprise management. Second, if properly managed, the sale of a minority stake in such a company could raise capital from sources other than the state budget and the PBOC printing press.

Efforts to obtain State Council approval of the conference’s proposal prepared by the SCRES came to nothing in 1989, but a year later, the “social unrest” generated by a populace trying to get rich revived the reformers’ suggestions. The government in Beijing saw exchanges as a way to close the street markets by moving them “inside the walls.” In May 1990, the State Council approved an updated version of the SCRES recommendations that included: 1) no individual investors; only enterprise investment in the share capital of other enterprises; 2) no further sale of shares to employees; 3) development of OTC markets limited to Shanghai and Shenzhen alone; and 4) no new public offerings. On June 2, just a month later, the State Council gave the go-ahead to the formal establishment of the two securities exchanges.

So the opening of the Shanghai Stock Exchange in December 1990 and the Shenzhen Stock Exchange in July 1991 were highly symbolic historical events—but not for the reasons usually given. Outside observers saw them as signs that China had shrugged off the disaster of Tiananmen, picked up the torch of reform and was again embarking on the brave new world of capitalism when, in fact, the exchanges were opened to put an end to free private-capital markets. In their place, the exchanges and entire experiment were harnessed in support of the development of state enterprises only. What China got as a result, however, was of historical importance, but not in the way the Party had foreseen at the time.

WHAT STOCK MARKETS GAVE CHINA

Had it not been for two events in 1992, however, even this state-centric version of stock markets might not have eventuated and China might have developed in a very different direction. First, Deng Xiaoping in early 1992 affirmed the value of stock markets, which gave rise to the country’s first huge equity boom. The political cover Deng gave for supporters of this experiment with modified capitalism was perhaps the critical political decision that led to the China we know today. But Zhu Rongji, then vice-premier in charge of banking and finance, also contributed greatly to China’s future development when he agreed to open international markets and their limitless capital to China’s SOEs. The first decision led to China’s first truly national capital market; the second let in the ideas and financial technologies that created its great National Champions. Together, these decisions led to a centralization of financial power in Beijing that it had never had before, and changed—if not destroyed—old government institutions.

A national financial market and beyond

What did Beijing own in 1979? The answer is, everything and nothing. In some sense, it owned the entire economy, with an estimated official GDP that year of RMB406.2 billion (US$261 billion). The country’s industrial landscape, however, was bare of anything resembling enterprises with economies of scale and China had extremely limited financial resources to invest. Over the course of the 1980s, neither the national budget nor the banking system could adequately support even the 22 major industrial projects designated in state plans as critical national investments. Given the dearth of state-supplied capital, it is no wonder that other ideas emerged.

Aside from the national budget, the banks were the primary providers of capital, but their capacity was very limited. Organized on the lines of the administrative hierarchy reaching to Beijing, the provincial branch bank was the key to this system and it operated independently of other provincial branches. Limited to a single province, its deposit base was geographically circumscribed, forcing it to rely either on a slowly growing national inter-bank market from 1986 and central budget grants, or on intra-provincial government, retail and SOE deposits. The central government for its part had limited taxable resources and also lacked the financial technology that would help it raise large amounts of capital by issuing bonds: a functioning bond market did not exist, nor was one permitted.

The Yizheng Chemical Fiber project in Jiangsu, one of the 22 key projects, is a case in point. This ambitious project became famous in 1980 when its sponsor, the Ministry of Textiles, approached China International Trust and Investment (CITIC) for funding it could not source elsewhere, either from banks or from the MOF. CITIC, led by Rong Yiren (its founder and the survivor of a successful pre-revolution Shanghai industrial family), proposed an international bond issue in Japan to raise 10 billion yen (US$50 million). This novel—many said counter-revolutionary—idea caused a political furor. Ultra-nationalists claimed it was a disgrace to rely on capitalist countries, much less Japan, to fund Chinese projects. It took an entire year for the political finger-pointing to die down and only after it had become clear that the money, in truth, could be found nowhere else in the country. The State Council approved the bond and it was successfully issued in 1981. The point is that such a small amount could not be sourced domestically even for a critically needed project. Yizheng was later one of the first nine candidates for overseas listing chosen by Zhu Rongji in 1993.

Several years later, the MOF was able to sell limited amounts of “special” bonds to fund similar industrial projects. For example, in 1987, it raised US$1.5 billion in support of new refinery projects at five centrally owned enterprises and, in 1988, another US$1 billion equivalent for projects at seven steel companies. Again the funds were limited in scale, especially given the capital intensity of such industries. The inability of central government, at this point 30 years into its revolution, to raise large amounts of capital is not unique to modern China. One scholar argues persuasively that the very absence of a national capital market and its ability to mobilize large amounts of money explains China’s historical inability to develop economically beyond small-scale manufacturing.

4

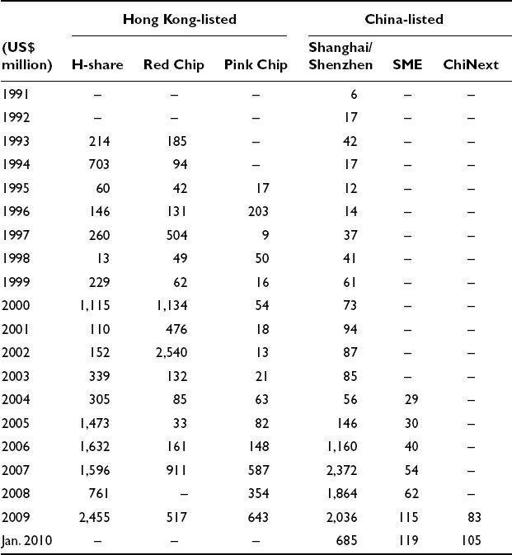

Given this dearth of capital, it is easy to understand why, despite ideological compunctions, local governments from the early 1980s were so attracted to the idea of stock markets. The image of Zhu Rongji finding the treasury bare on his appointment as Mayor of Shanghai in 1988 is priceless; he rapidly became the political godfather to the movement to establish formal stock exchanges. But like the banking system, the Shanghai and Shenzhen exchanges at their inception were geographically limited to listing local companies and relying on local retail investors. This changed rapidly, however, and by 1994, both had become markets open to issuers and investors on a national basis. This made it possible for provincial governments to raise incremental amounts of capital on top of what local banks and taxes could provide. Although small by international standards, the top 10 listed companies in Shanghai were by 1996 larger than any of their predecessors (see

Table 6.3

) and three years later larger still. It is noteworthy, in light of the discussion later in this chapter, that the top 10 companies in 2009 were all financial institutions and oil companies.

TABLE 6.3

Top 10 Shanghai-listed companies: Then and now (US$ billion)

Source: Shanghai Stock Exchange and Wind Information

Note: Capitalization calculated based on domestic market practice, which includes all domestic company shares but excludes overseas-listed shares; *denotes additional overseas listing in Hong Kong or New York.

These companies, however, are the exception; the vast majority of companies listed on the domestic exchanges were tiny, with market capitalizations of under US$500 million. In the primary markets, as well, A-share IPOs on the whole remained small throughout the 1990s. With the exchanges operating only from 1992, one could hardly expect Chinese markets to reach their full size overnight or even by the end of their first 10 years. Nonetheless, the domestic markets would have remained sideshows for far longer had Zhu Rongji not permitted Chinese companies to list their shares on overseas markets.

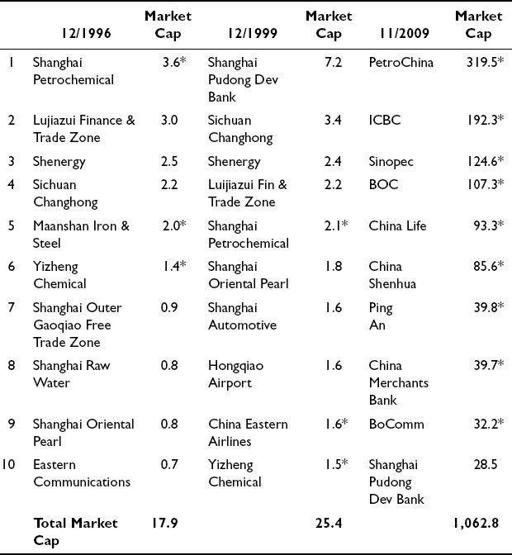

This decision led to the dramatic growth of the Hong Kong Stock Exchange (HKSE) from its position as a small regional exchange in 1993 to a global giant in the twenty-first century. From its boast in 1993 of hosting IPOs of as much as US$100 million for local taipans within 10 years, thanks to Zhu, it was raising billions of dollars for Chinese SOEs. By approving the first batch of nine so-called H-share companies, Zhu changed Hong Kong’s game entirely. His internationalism accounts for the huge capital raisings and market capitalizations of the top 10 listed companies in 2009. Of these companies, nine were also listed either in Hong Kong or New York. In the period 1993–2009, Chinese SOEs raised US$262 billion in new capital from the international markets, with the year 2000 marking the turning point (see

Table 6.4

). For the first time in its history, China and its companies had access to the financial techniques and markets that enabled them to raise meaningful amounts of capital. They took these techniques and brought them back at last to Shanghai.

TABLE 6.4

Average IPO size per listing class

Source: Wind Information and Hong Kong Stock Exchange