Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (2 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

From Jeremy

There are many people to whom I owe gratitude and appreciation:

To Howard Schilit, who inspired me to pursue my passion for financial sleuthing, taught me the art of forensic accounting research, and graciously welcomed me into his house, both figuratively and literally.

To the incredibly talented team of accounting detectives at Risk-Metrics Group (and CFRA before it), whose unique blend of curiosity, acumen, ingenuity, and passion helps me grow every day.

Financial Shenanigans

benefited immensely from their bodies of knowledge and work; indeed, it is they who unearthed many of the vignettes featured in this book, in particular, Dan Mahoney (my co-director of research), Enitan Adebonojo, David Bassett, Alisa Guyer Galperin, Jill Lehman, and Matt Schechter. Many other colleagues (past and present) were instrumental to this book as well, sharing enlightening stories and shouldering an extra workload.

To the leadership team at RiskMetrics, especially Ethan Berman and Garvis Toler, whose professional support and personal devotion are both endearing and enduring.

To Marc Siegel, a mentor, colleague, and friend, who led me to the crossroads of accounting and the financial markets and showed me how to direct traffic.

To the accounting faculty at the University of Michigan’s Ross School of Business, who cultivated my curiosity for navigating a financial

maize

and

blue

the wind that lifted my accounting sails.

To my parents, Vicki and Arthur, who stocked my tool bench and taught me how to build; and to my brothers, Ari, Elie, and Jacob, who filled my foundation.

And most of all, to my wife, Andrea, who strengthens and inspires me every day with her brilliance, benevolence, and endless love. And to our two beautiful girls, Shira and Orli, whose loving eyes and contagious smiles provide me with eternal harmony.

PART ONE:

Establishing the Foundation

1 - As Bad as It Gets

Like millions of other movie lovers, our families look forward to the late-winter evening each year when Hollywood stages its most prestigious night: the Academy Awards ceremony. The Oscars rank the year’s best films, certifying their place in cinematic history.

Like the title of a particularly Academy-honored film from 1997, the competitors for the Best Picture Oscar are

As Good as It Gets

. If we were going to hand out awards for financial shenanigans, however, the competitors would be vying for the title of

As

Bad

as

It Gets

.

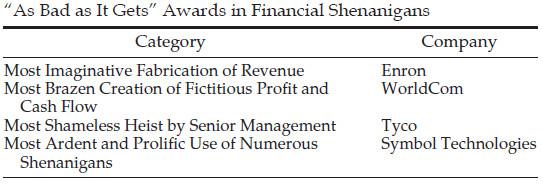

Awards for Most Outrageous Financial Shenanigans

In reviewing the most colossal financial reporting scandals of the last decade, we added our own Creative Accounting Award category,

As

Bad

as It Gets

, to highlight those in management who possessed the talent, vision, and chutzpah to mislead investors with financial shenanigans.

And the winners are . . .

Enron: Most Imaginative Fabrication of Revenue

Houston-based Enron Corp. quickly became synonymous with the term

massive accounting fraud

in the fall of 2001 with its sudden collapse and bankruptcy. Many people have described the utility company’s ruse as a cleverly designed fraud involving the use of thousands of off-balance-sheet partnerships to hide massive losses and unimaginable debts from investors. While that story line is essentially correct, detection of red flags required no special accounting skills or even advanced training in reading financial statements. It simply required the curiosity to notice and question a stupendous five-year jump in Enron’s sales revenue from 1995 to 2000.

Warning for Enron Investors—Revenue Growth Defied Reality

Enron ranked number seven in

Fortune

magazine’s list of the 500 largest companies in 2000 (ranked by total revenue), surpassing such giants as AT&T and IBM. In just five short years, Enron’s revenue had miraculously increased by an astounding factor of 10 (rising from $9.2 billion in 1995 to $100.8 billion in 2000). Curious investors might have questioned how frequently companies tend to grow their revenue from under $10 billion to over $100 billion in five years. The answer:

never

. Enron’s staggering increase in revenue was unprecedented, and the company achieved this growth without any large acquisitions along the way. Impossible!

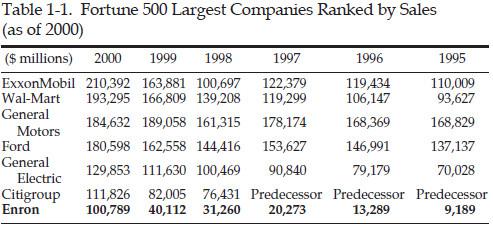

As Table 1-1 shows, in 2000, only seven companies produced revenue of $100 billion or more. Except for Citigroup (with its 1998 merger of Citicorp and Travelers), these large companies’ growth essentially came organically, not through acquisitions.

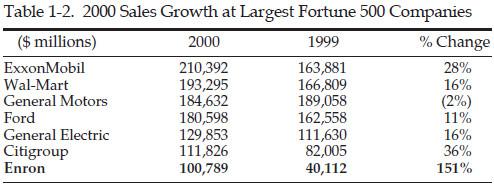

Notice in Table 1-2 that in 2000, Enron’s sales grew a staggering 151 percent, from $40.1 billion to $100.8 billion.

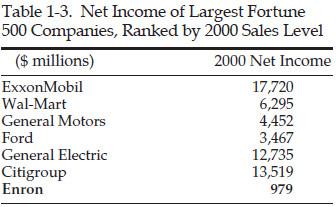

Curiously, even though Enron made the list with the big boys, its reported profits, totaling less than $1 billion (or 1 percent of sales), paled in comparison to the others. Moreover, profits never grew proportionally with sales, a pretty unusual occurrence and a definite warning sign of accounting tricks. If sales grow by 10 percent, for example, investors generally would expect expenses and profits to rise by a similar amount at a business with steady margins. At Enron, no logical pattern existed except that sales shot to the moon and profits barely moved at all. In 2000, sales grew by more than 150 percent, yet profits increased by less than 10 percent, as shown in Table 1-3. How was that possible?

Let’s go back a few years further and track Enron’s meteoric revenue rise and its race up the Fortune 500 list of largest companies from a middling rank of 141 in 1995 to its lofty top 10 position in the 2000 results (see Table 1-4).

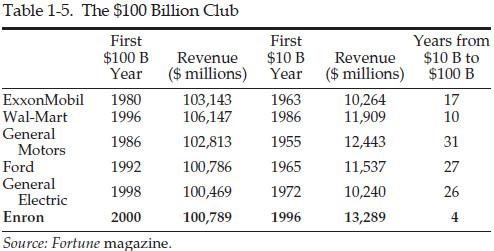

Few companies ever reach $100 billion in revenue, as Enron did in 2000, and the climb from $10 to $100 billion generally takes decades. As Table 1-5 shows, ExxonMobil first reached $10 billion in revenue in 1963, and not until 1980 did it join the $100 billion club. General Motors first reached $10 billion in 1955, yet it took the company 31 more years to join the more exclusive club. Yet, nimble Enron, which hit $10 billion in 1996, raced to the $100 billion mark in only 4 years. Such a rapid ascent had never taken place before. In fact, the previous record was set by Wal-Mart, which did it in 10 years. It might have seemed implausible, to an observer, that Enron could have found a legitimate formula to achieve business success immortality. Sure enough, as we will explore throughout this book, this immortality came through perpetrating a gigantic fraud.

The Enron Fraud Revealed

The first signs of a massive fraud were revealed when an Enron committee and the firm’s auditor, Arthur Andersen, reviewed the accounting for several unconsolidated (“off-balance-sheet”) partnerships in October 2001 and concluded that Enron should have consolidated some of these partnerships and included them as a part of the company’s financial results. Things went from bad to worse the following month when Enron disclosed a $586 million reduction in previously reported net income and took a $1.2 billion reduction in its stockholders’ equity. Investors began to flee, and Enron’s stock price sank like a boulder. Before Enron’s final descent, credit rating agencies cut its rating and virtually all borrowing froze. In early December 2001, Enron filed for bankruptcy with assets of about $65 billion. It was the largest corporate bankruptcy in U.S. history—until WorldCom declared bankruptcy seven months later (WorldCom was subsequently surpassed by Lehman Brothers in 2008).