Financial Markets Operations Management (48 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

At some stage the loan will be repaid. When repayment takes place depends on whether the original duration was on a term basis or an open basis.

The loaned securities must be delivered by the borrower to the lender and an appropriate amount of collateral returned by the lender to the borrower, in accordance with the original transaction terms.

The lender can recall a loan at any time and the borrower can return a loan at any time (with an appropriate amount of collateral). A typical reason for a lender recall is that the lender has sold some or all of the securities being lent.

Recalls and returns are covered under Section 8: Delivery of Equivalent Securities of the GMSLA. The lender must give notice of no less than the standard settlement time for the securities. By contrast, the borrower simply has to deliver the securities to the lender.

One risk for the lender is that it might not initiate a recall sufficiently early for the sale transaction to be settled on time. Another risk is that the borrower fails to return the securities to the lender.

Failure to deliver securities or collateral is covered in Section 9 of the GMSLA:

Para. 9.1: Borrower's failure to deliver equivalent securities

The lender may either continue the loan or terminate the loan.

Para. 9.2: Lender's failure to deliver equivalent collateral

The borrower may either continue the loan or terminate the loan.

Para. 9.3: Failure by either party to deliver

The failing transferor pays all reasonable costs and expenses to the transferee. These can include, for example, interest charges and buy-in costs.

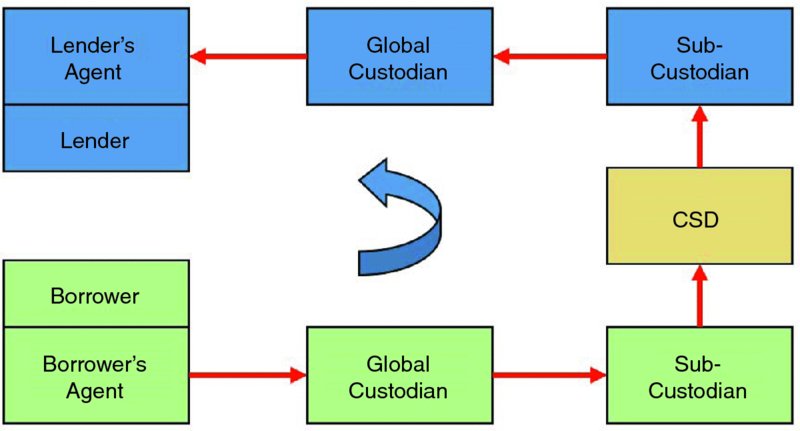

The return of securities to the lender is shown in

Figure 12.3

.

FIGURE 12.3

Loan completion

The lending fees accrue on a daily basis and are usually paid monthly. How they are calculated depends on the type of collateral provided by the borrower. You will recall that collateral can either be in cash or non-cash.

When the borrower gives cash, it will demand a return on that cash. This return is known as the

rebate rate

. The lender will reinvest the cash and expect to earn a return, known as the

reinvestment rate

, on that cash. The reinvestment return should be greater than the rebate return and the difference, the

spread

, represents the benefit to the lender.

A beneficial owner is lending US equities worth USD 10 million. The borrower is providing cash, margined at 2%, as collateral. The borrower has requested a rebate rate of 25 basis points. The benefit to the lender, assuming a reinvestment rate of 95 basis points, can be calculated as shown in

Table 12.18

.

In this example, the spread amounts to 70 basis points and the benefit amounts to USD 198.33 per day. The daily spread will change as the value of the loan changes.

TABLE 12.18

Loan spread

| Loan Value | USD 10,000,000.00 | Â |

| Margin | 2% | US equities |

| Cash Collateral | USD 10,200,000.00 | Â |

| Rebate Rate | 25 | Basis points |

| Rebate Amount | USD 70.83 | per day (360 basis) |

| Reinvestment Rate | 95 | Basis points |

| Reinvestment Amount | USD 269.17 | per day (360 basis) |

| Spread | USD 198.33 | per day (360 basis) |

For loans of securities secured with non-cash collateral, the benefit to the lender is quoted as a lending fee (known as the

non-cash premium

) based on the market value of the loan. (This is in contrast to cash collateral, where the rebate rate and reinvestment rate are calculated on the collateral.)

Fee calculation for non-cash collateral is more straightforward to manage, as the lender (or its agent) does not need to actively manage cash. Instead, both the lender and the borrower know the value of the outstanding loans, know the agreed lending fee and can therefore calculate the daily accrual without any problems.

A beneficial owner is lending a portfolio of Pacific-Rim equities, valued at USD 25 million, at a non-cash premium rate of 100 basis points. The benefit to the lender can be calculated as shown in

Table 12.19

.

The daily fee accrual will change as the value of the loan changes. Please note that the amount of non-cash collateral is not taken into account for fee calculation purposes.

TABLE 12.19

Loan fees

| Loan Value | USD 25,000,000.00 | Â |

| Non-Cash Premium | 100 | Basis points |

| Fee | USD 694.44 | per day (360-day basis) |

A repurchase agreement (otherwise known as a classic repo, or simply a repo) is a mature, money market instrument widely used in the USA, Europe and Asia. It enables:

- Companies to borrow and lend cash that is secured against collateral such as bonds;

- Market makers to go short in securities (by reversing securities in against cash) and to finance a long securities position (by buying the securities and immediately repoing them out against cash).

Unlike securities lending and borrowing, where the securities are the motivator, with repo, both cash and securities are the motivators. Those institutions that are cash-motivated are less concerned about what collateral is taken than they are about making sure that it meets certain quality criteria. This type of collateral is known as

general collateral

(or GC). Securities-motivated repo is known as

special

. The greater the demand for specials, the lower the price (the repo rate) will be.

For a cash borrower, the repo rate is usually lower than bank financing rates. For a cash lender, a repo can provide an attractive yield on what is a short-term, secured transaction in a very liquid market.

Title to the collateral passes from the collateral giver to the collateral taker, although the economic benefits of the collateral remain with the giver.

The motivations for repo buyers and sellers are shown in

Table 12.22

.

TABLE 12.22

Repo motivations

| Repo | Securities Motivation | Cash Motivation |

| Buyer | Securities borrower | Collateral taker |

| Collateral giver | Cash lender | |

| Seller | Securities lender | Collateral giver |

| Collateral taker | Cash borrower |

Please note that the direction of a repo transaction is from the securities' perspective. If an investor sells a repo, it is selling the securities (i.e. lending the securities).

There are two types of maturity: term and open.

A term repo is transacted with a specified repurchase date that can range from overnight (O/N) to typically 12 months.

These are contracts that have no fixed repurchase date when negotiated but are terminable on demand by either counterparty.

Repurchase agreements can be transacted in several ways:

- Directly negotiated;

- Voice brokerage;

- Alternative trading system (ATS);

- An ATS linked to a CCP;

- Voice-assisted systems.

There are several types of repo that are conceptually the same but differ in detail.

A classic repo transaction is negotiated between two counterparties where the collateral can either be a basket of securities (general collateral or GC) or a specific security (e.g. ABC 5% bonds due in 2030). Two examples are given in

Tables 12.23

and

12.25

: in Example A, the motivation is cash-driven and in Example B, it is securities-driven.

TABLE 12.23

Example A: Cash-driven repo

| Background | Investor “A” wants to borrow USD 25,000,000 cash against a specific | |

| Â | security for one month | |

| Counterparty | Dealer “B” | Â |

| Repo rate | 0.22% | 1 month |

| Trade date | Tuesday, 8 July 2014 | Â |

| Settlement date | Friday, 11 July 2014 | Â |

| Termination date | Monday, 11 August 2014 | Â |

| Collateral | EDF 4.60% bonds due on 27 January 2020 | Eurobond (30E/360) |

| Clean price | 112.7771 | YTM 2.13% |

| Accrued interest | 2.0956 | per USD 100 nominal |

| Dirty price (start) | 114.8727 | Clean price + accrued interest |

| Cash amount | USD 25,000,000.00 | Cash-driven |

TABLE 12.24

Example A interest calculation

| Cash amount | USD 24,999,745.70 |

| Repo rate | 0.22% |

| Term (days) | 31 |

| Repo interest | USD 4,736.06 |

TABLE 12.25

Example B: Securities-driven repo

| Background | Dealer “C” wants to borrow USD 25,000,000 BHP Billiton 2.125% bonds due on 29 November 2018 against cash for three months | |

| Counterparty | Investor “D” | Â |

| Repo rate | 0.21% | 3 months |

| Trade date | Tuesday, 8 July 2014 | Â |

| Settlement date | Friday, 11 July 2014 | Â |

| Termination date | Friday, 10 October 2014 | Â |

| Borrowed security | BHP Billiton 2.125% bonds due on 29 November 2018 | Eurobond (30E/360) |

| Clean price | 106.5765 | YTM 0.60% |

| Accrued interest | 1.3104 | per USD 100 nominal |

| Dirty price (start) | 107.8869 | Clean price + accrued interest |

| Nominal amount | USD 25,000,000 | Securities-driven |

| Cash collateral | USD 26,971,725.00 | Â |

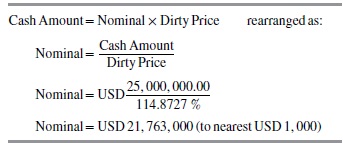

In Example A, we know the cash amount but not the nominal amount of the EDF bonds. By taking the usual formula for calculating the cash amount of a bond transaction and rearranging it, we can calculate the face value, as shown in

Figure 12.4

.

FIGURE 12.4

Nominal amount of bonds required

The exact nominal amount would have been USD 21,763,221.37. However, as the board lot size of the bond is USD 1,000, it would not be possible to deliver this amount. We have therefore rounded the nominal amount down to USD 21,763,000, giving us a cash amount of USD 24,999,745.70 (a small shortfall of USD 254.30). Securities such as government bonds can have a minimum transferable amount of 0.01, enabling a much closer match between the nominal amount and the required cash amount.

On the settlement date, Investor A delivers the bonds to Dealer B against payment of the cash amount. As this is a term repo, the transaction will terminate one month later on Monday, 11 August 2014 when the bonds will be returned and the cash repaid plus interest of USD 4,736.06 (see

Table 12.24

for the calculation).

It should be noted that:

- The dirty price at the start of the transaction remains the same on termination of the transaction.

- This transaction was cash-driven. We calculated the amount of collateral using the dirty price. It is more usual to apply a margin to the securities and we will cover this later in this chapter.

Example A demonstrated a transaction where cash was the motivating asset, with Investor A wishing to borrow cash. In Example B, we will examine a classic repo transaction where a counterparty (Dealer C) wishes to borrow a particular (specific) security from Investor D (see

Table 12.25

).

On the settlement date, Investor D delivers the bonds to Dealer C against payment of the cash amount. As this is a term repo, the transaction will terminate after three months (91 days) on Friday, 10 October 2014 when the bonds will be returned and the cash repaid plus interest of USD 14,317.49, calculated as shown in

Table 12.26

.

TABLE 12.26

Example B interest calculation

| Cash amount | USD 26,971,725.00 |

| Repo rate | 0.21% |

| Term (days) | 91 |

| Repo interest | USD 14,317.49 |

In both examples above, the currencies of both the cash and securities were the same, in our case US dollars.

Cross-currency repo

, by contrast, involves two different currencies; an example is shown in

Table 12.27

.

TABLE 12.27

Cross-currency repo

| Cash | vs. | Securities |

| USD | vs. | Euro-denominated securities such as German Bunds, French OATs, Italian BTPs, Belgian OLOs, etc. |

| JPY | vs. | US treasury bonds |

| GBP | vs. | Japanese government bonds (JGBs) |

There will be the extra complication of foreign exchange exposure when ensuring that the transaction remains fully collateralised.

These are contracts where the collateral given/taken is made up of shares rather than bonds.

This type of repo works best in markets where the delivery of shares is as efficient as the delivery of government securities and corporate bonds. If, for example, it takes several days to re-register shares out of the deliverer's name into the receiver's, then the vast majority of transactions will be delayed for this reason. The ideal situation here would be instantaneous re-registration on settlement of the share deliveries.

These are contracts with a floating repo rate that is reset at specified intervals. This repo type is often used when the collateral also has a floating coupon rate (e.g. an FRN). The repo reset date coincides with the FRN coupon dates.

As mentioned above, sell/buy-backs (or buy/sell-backs) are simply two outright transactions, dealt simultaneously, both with the same trade date but with separate settlement dates. The first transaction is therefore a sale at a spot price and a repurchase at a forward price. In Example C (see

Table 12.28

), we will use the same information as in Example B. You will notice that whilst the cash flows are the same, the prices are different.

TABLE 12.28

Example C: Sell/buy-back

| Background | Dealer “C” wants to borrow USD 25,000,000 of a bond against cash for three months (buy/sell-back) | |

| Counterparty | Investor “D” | Lends the bond against cash (sell/buy-back) |

| Pricing rate | 0.21% | 3 months |

| Trade date | Tuesday, 8 July 2014 | Â |

| Settlement date | Friday, 11 July 2014 | Â |

| Termination date | Friday, 10 October 2014 | Â |

| Borrowed security | BHP Billiton 2.125% bonds due on 29 November 2018 | Eurobond (30E/360) |

| Purchase price (clean) | 106.5765 | YTM 0.60% |

| Accrued interest | 1.3104 | per USD 100 nominal to 11 July 2014 |

| Purchase price (dirty) | 107.8869 | Clean price + accrued interest |

| Nominal amount | USD 25,000,000 | Delivered by Investor “D” to Dealer “C” |

| Cash amount | USD 26,971,725.00 | Paid by Dealer “C” to Investor “D” |

| Interest | USD 14,317.49 | Cash amount @ 0.21% for 91 days |

| Sell-back amount | USD 26,986,042.49 | Cash amount + interest |

| Sell-back price (dirty) | 107.9442 | Total cash repayment/nominal bond amount |

| Accrued interest | 1.8358 | per USD 100 nominal to 10 October 2014 |

| Sell-back price (clean) | 106.1084 | Dirty price minus accrued interest |

Please note that the cash flows at the start and at the end are the same as for a classic repo. The difference for a buy/sell-back (or a sell/buy-back) is that the forward price is calculated as a clean price. This is the repayment amount (dirty price) less the accrued interest up to the forward settlement date.

Sell/buy-backs are now mostly documented within the GMRA. Those transactions that are not documented are more risky than those that are. Undocumented transactions contain no provision for variation margin calls, are not subjected to a legal agreement and the seller has no legal right to any coupons.

It is useful to gain some insight into the comparative use of repurchase agreements and sell/buy-back transactions. The ICMA publishes a semi-annual survey on the European repo markets and the surveys can be found on the ICMA website

6

(see

Tables 12.29

,

12.30

,

12.31

and

12.32

).

TABLE 12.29

Contract types â ATS and tri-party

| Contract Type | December 2013 | ATS | Tri-Party |

| Repurchase agreements | 86.0% | 67.3% | 100.0% |

| Documented sell/buy-back | 12.4% | 32.7% | 0.0% |

| Undocumented sell/buy-back | 1.6% | 0.0% | 0.0% |

| Total: | 100.0% | 100.0% | 100.0% |

Source:

ICMA European Repo Survey §26 (December 2013) published in January 2014.

TABLE 12.30

Rate comparison â ATS and tri-party

| Repo Rate Comparison | December 2013 | ATS | Tri-Party |

| Fixed rate | 78.8% | 88.3% | 48.2% |

| Floating rate | 8.6% | 11.7% | 0.0% |

| Open repo | 12.6% | 0.0% | 51.8% |

| Totals: | 100.0% | 100.0% | 100.0% |

Source:

ICMA European Repo Survey §26 (December 2013) published in January 2014.

TABLE 12.31

Trading analysis

| Trading Analysis | December 2013 |

| Directly negotiated | 53.2% |

| Voice brokered | 15.1% |

| Alternative trading systems (ATSs) | 31.7% |

| Total: | 100.0% |

Source:

ICMA European Repo Survey §26 (December 2013) published in January 2014.

TABLE 12.32

Cash currency analysis

| Cash Currency Analysis | December 2013 |

| EUR | 66.3% |

| GBP | 10.2% |

| USD | 14.8% |

| DKK, SEK | 2.5% |

| JPY | 4.9% |

| CHF | 0.1% |

| Other currencies | 1.3% |

| less Rounding: | â0.1% |

| Total: | 100.0% |

Source:

ICMA European Repo Survey §26 (December 2013) published in January 2014.