Colossus (49 page)

The Bush administration did not invade Iraq because of the country’s oil reserves, contrary to the widely believed conspiracy theory.

28

However, reviving oil production is a necessary precondition for the success of the

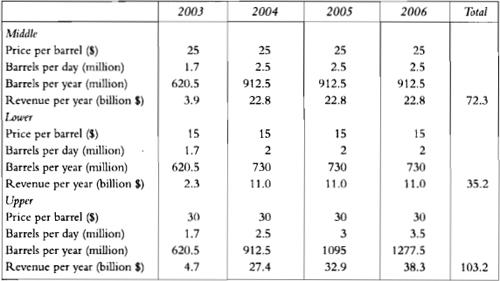

American transformation of Iraq. That Iraq has a lot of oil under the ground nobody doubts, though the exact quantity of the country’s reserves is hotly debated by industry experts. But whether Iraq has just 78 billion barrels or 300 billion barrels is a matter of purely academic interest in the short run. The real question is how much oil will be pumped out of the ground this year, next year and the year after, and what price will each barrel of it fetch? Table 13 offers three possible scenarios for an occupation optimistically assumed to last four years. In the best scenario, Iraq is able to increase production to 3.5 million barrels a day by 2006, and the price of oil remains at the high level of $30 a barrel, producing a total of around $100 billion over four years. In reality, supply is likely to grow more slowly and average prices to be lower, so that revenues for the whole period might end up being somewhat less than $40 billion. Note also that these are gross revenue projections; all kinds of costs would have to be deducted from these figures. Nor should we forget Iraq’s existing foreign debts, $120 billion to foreign lenders plus up to $125 billion in reparations claims. Only a cancellation of these “odious debts”—odious because they were incurred by the tyrant Saddam—would free future oil revenues to finance reconstruction. Nevertheless, the outlook is not hopeless. At least some of the costs of Iraq’s stabilization should ultimately be covered by oil sales.

TABLE 13. IRAQ’S OIL REVENUES: SOME PROJECTED REVENUES, 2003–06

Source: Author’s own calculations.

Finally, if stabilization is successful, not only will the country’s economy grow, but American exports to Iraq will also grow, just as happened when Germany and Japan revived in the later 1940s. Critics of the Bush administration grumble that American companies are being awarded contracts for the reconstruction of Iraq’s infrastructure. They should instead celebrate the fact that postwar policy is already creating jobs for some American workers, for without such material payoffs magnanimous policies to former foes quickly forfeit public support. The arithmetic of occupation is not the zero-sum game it sometimes appears to President Bush’s more radical critics, who insist that every dollar spent in Iraq is a dollar less for American schools or hospitals.

29

On the contrary, success in Iraq could pay significant dividends—and not just to those companies that take the risk of accepting contracts for the country’s reconstruction.

GUNS AND BUTTER

It is not, then, the cost of regime change and nation building that threatens the American empire with overstretch. It is expenditure much closer to home. For the American economy has come to rely to a greater extent than at any time in its history on consumption and credit—both public and private. Since America’s external power is predicated on the strength of the economy, there is therefore a paradox. Traditionally, empires faced a choice between guns or butter—between military expenditures and consumption—and were constrained by excessive indebtedness. But the American empire needs consumption to fuel its economic growth, out of which its military expenditures can so easily be afforded. And it seems to be able to borrow unprecedented sums in order to maintain the growth of consumption. It is a guns

and

butter empire.

The paradox is perfectly embodied in the high-mobility multipurpose wheeled vehicle, otherwise known as the Hummer. In its original incarnation, the Hummer was designed by AM General in 1979 as a light personnel carrier for the U.S. military, and it has become the transportation of choice for American patrols in nearly all the conflict zones where U.S. troops are deployed. Yet the Hummer is also a consumer durable. Since the rights to produce them for civilian use were sold to General Motors in

1999, Hummers have begun to appear in a variety of unmilitary hues on highways all over America, beginning in California.

30

Is the Hummer for conquest or consumption? The answer is both. Indeed, with its low mileage to the gallon (on average 11 mpg) and its huge weight and width, it exemplifies the profligacy of American fossil fuel use.

Some would of course close the circle by saying that Hummers are needed in Iraq in order to keep Hummers in California supplied with cheap gasoline. But this once again exaggerates the importance of oil in the decision for war against Saddam Hussein. For the paradox of the empire of guns and butter can also be illustrated by comparing the contrasting economic fortunes of two American companies since the election of President Bush. Anyone who invested in the oil field engineering company Halliburton in late 2000 in the expectation that the company would benefit from a Republican election victory has been disappointed. In the three years to November 2003 the company’s shares declined by more than a third and did not benefit significantly from the more aggressive Middle Eastern policy supported by its friends in high places. An investor who put his money in Wal-Mart shares in late 2000 would, by contrast, have made a capital

gain

of a fifth. From a strictly economic point of view, investment in the quintessential consumer sector company has proved much more profitable than investment in the firm supposedly at the heart of the military-petroleum complex.

The growing importance of personal consumption in American economic growth has been one of the most striking developments of the past four decades. As a percentage of GDP it has risen from around 62 percent in the 1960s to nearly 70 percent in 2002. The corollary of this has been a decline in savings: the personal savings rate has dropped from an average of 9 percent from 1959 until 1992 to just over 4 percent in the subsequent eleven years. Indeed, Americans have financed a substantial part of their increased consumption by borrowing. Household sector credit market debt rose from 44 percent of GDP in the 1960s and 1970s to 78 percent in 2002.

Nor is it only ordinary Americans who are relying on credit to cover their rising expenditures on consumption. The federal government admitted in July 2003 that the budget surplus of $334 billion that it forecast two years before had—thanks to a combination of recession, war and tax cuts—become a deficit of at least $475 billion.

31

This figure came as a

shock to many Americans. During the Clinton administration, after all, the Congressional Budget Office projected budget surpluses stretching as far as the eye could see. However, these projections were based on the assumption that regardless of inflation or economic growth, the federal government would spend precisely the same number of dollars, year in and year out, on everything apart from Social Security, Medicare and other entitlements. At the same time, the CBO confidently assumed that federal tax revenues would grow at roughly 6 percent per year. In 2001 the CBO decided that failing to adjust projected discretionary spending for inflation (but not economic growth) was no longer “useful or viable.” Making this adjustment reduced the projected 2002–11 surplus from $6.8 trillion to $5.6 trillion. But that was nothing compared with the impact of subsequent unforeseen events. Two years later, after a recession, a huge tax cut and 9/11, the CBO’s projected ten-year surplus had fallen to $20 billion. Nevertheless, the CBO was still able to predict a medium-term decline in the federal debt in public hands from 35.5 percent of GDP to 16.8 percent over ten years.

32

To generate this result, the CBO assumed, conveniently, that discretionary spending would remain fixed over the next decade even as the economy grew. In fact, these purchases, which include the additional military and security costs since September 2001, have risen more than twice as fast as economic output over the last three years. At the time of writing, the CBO has revised its projections again. It now predicts a deficit for 2004 of close to half a trillion dollars, and for the ten-year period from 2002 to 2011 the erstwhile surplus has become a $2.7 trillion deficit. That is $9.5 trillion more new debt than the CBO was anticipating before the last presidential election, less than four years ago.

Yet even the CBO’s latest projections still grossly understate the true size of the federal government’s liabilities because its “bottom line” is only that part of the liabilities that takes the form of bonds.

Americans like security. But they like Social Security more than national security. It is their preoccupation with the hazards of old age and ill health that will prove to be the real cause of their country’s fiscal overstretch, not their preoccupation with the hazards of terrorism and the “axis of evil.” Today’s latent fiscal crisis is the result not of excessive overseas military

burdens but of a chronic mismatch between earlier Social Security legislation, some of it dating back to the New Deal, and the changing demographics of American society.

In just three years, the first of around seventy-seven million baby boomers will start collecting Social Security benefits. In six years they will start collecting Medicare benefits. By the time they all are retired, an official estimates, the United States will have doubled the size of its elderly population but increased by barely 15 percent the number of taxpaying workers able to pay for their benefits. Economists refer to the government’s commitment to pay pension and medical benefits to current and future elderly as part of the government’s “implicit” liabilities. But these liabilities are no less real than the obligation to pay back the principal plus the interest on government bonds. Indeed, politically, it may be easier to default on explicit debt than to stop paying Social Security and Medicare benefits. While no one can say for sure which liability the government would renege on first, one thing is clear: the implicit liabilities dwarf the explicit ones.

The scale of these implicit liabilities was laid bare in 2003 in a paper by Jagadeesh Gokhale, a senior economist at the Federal Reserve Bank of Cleveland, and Kent Smetters, the former deputy assistant secretary of economic policy at the U.S. Treasury. They asked the following question: Suppose that today the government could get its hands on all the revenue it can expect to collect in the future, but had to use it, also today, to pay off all its future expenditure commitments, including debt service. Would the discounted present value of all its future revenues suffice to cover the discounted present value of all its future expenditures? The answer is a decided no. According to their calculations, the shortfall amounts to $45 trillion.

33

To put that figure into perspective, it is twelve times larger than the current official debt held by the public and roughly four times the country’s annual output. Gokhale and Smetters also asked by how much taxes would have to be raised or expenditures cut—on an immediate and permanent basis—to generate, in present value, $45 trillion. They offer four alternative answers (see

table 14

). The government could, starting today, raise income taxes (individual and corporate) by 69 percent, or it could raise payroll taxes by 95 percent, or it could cut Social Security and Medicare benefits by 56 percent, or it could cut federal discretionary spending altogether—to zero.

TABLE 14: PERCENTAGE INCREASES IN TAXATION OR CUTS IN EXPENDITURE REQUIRED TODAY TO ACHIEVE GENERATIONAL BALANCE IN U.S. FISCAL POLICY

Policy | Percentage Change |

Increase federal income taxes | + 69 |

Increase payroll taxes | + 95 |

Cut federal purchases | -100 |

Cut Social Security and Medicare | -56 |

Source: Jagadeesh Gokhale and Kent Smetters, “Fiscal and Generational Imbalances.”

Another way of expressing the problem is to compare our own lifetime tax burden with the lifetime tax burden the next generation will have to shoulder if the government does not do one of the above—hence the term often used to describe calculations like these:

generational accounting

. What such accounts imply is that anyone who has the bad luck to be born in America today, as opposed to back in the 1940s or 1950s, is going to be saddled throughout his working life with very high tax rates, potentially twice as high as those his parents or grandparents faced. Notwithstanding the Bush administration’s tax cuts, Americans today are scarcely undertaxed. So the idea of taxing the next generation at twice the current rate seems, to say the least, fanciful.

There is, however, one serious problem with these figures, not with the calculations that underlie them but with their

acceptance

. To put it bluntly, this news is so bad that scarcely anyone believes it. It is not that people are completely oblivious of the problem. It is common knowledge that Americans are living longer and that paying for the rising proportion of elderly people in the population is going to be expensive. What people do not yet realize is just how expensive. One common response is to say that the economists in question have a political ax to grind and have therefore made assumptions calculated to paint the blackest picture possible. But the reality is that the Gokhale-Smetters study was commissioned by Paul O’Neill when he was treasury secretary and was prepared while Smetters was at the Treasury and Gokhale at the Federal Reserve. Moreover, far from being a worst-case scenario, the Gokhale and Smetters figures are based on what are arguably optimistic official assumptions about growth in

future Medicare costs and longevity. Historically, the annual growth rate in real Medicare benefits per beneficiary has exceeded that of labor productivity by 2.5 percentage points. But official projections assume only a 1 percentage point differential in the future. (They also assume, optimistically, that it will take fifty years for Americans to achieve current Japanese life expectancy.) Under somewhat different assumptions the total fiscal imbalance could be even larger than $45 trillion.