Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency (7 page)

Read Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency Online

Authors: Daniel Forrester,Mark Solomon

The Concept Of Bitcoin Mining

Gold and silver are mined into existence. Costs for finding, licensing, mining ore, culling ore from gold and silver, then minting coins and bars, creates a value for gold and silver. Bitcoin has a similar set-up, though not as costly or involved. The key difference is that mining for Bitcoins involves solving codes or cryptographic mathematical puzzles.

The most important aspect of mining Bitcoins, is that anyone can get involved. There is no central bank, no government treasury, no board room filled with supposedly all knowing people deciding how much money to produce. We can all produce Bitcoins, provided we can set-up a mining operation.

Terms BTC Miners Use

:

Mining

- Solving the math puzzles for generating the next block. Miners hash at a certain rate based on computing power and the difficulty of the Bitcoin hash over time.

Rig

- the complete set-up for solving the Bitcoin algorithms involving power source, processing unit, code, input and output controllers. These are normally dedicated Bitcoin servers, but could be any form of computer or graphics card devoted to solving the BTC block puzzles. This involves a red-hot fast CPU, GPU (Graphic Processing Unit), ASIC (Application Specific Integrated Circuit), and now dedicated computer boxes called FPGA. Field Programmable Gate Arrays are taking the speed championship from ASICS for cracking codes.

Hash Rate

- The speed a rig can solve or make calculations for the Bitcoin network. It is expressed as TH/S for Trillion Hashes/Sec or GH/S for Giga Hashes/Sec.

Block

- A record that confirms many waiting transactions. It then becomes part of a block chain where each block relates to previous and future blocks through agreement of code segments.

Block Chain

- A grouping of blocks forming the public record of all Bitcoin transactions in chronological order. It is shared among all Bitcoin users for verifying the false from true Bitcoin spends, the balance of Bitcoin addresses, and prevents double spending of Bitcoins. Think of the block chain as the ledger for Bitcoin, with encoded entries.

Bitcoin

- These are unique codes “awarded” to miners for solving the problems that allow for creating the next block in the block chain. Bitcoin was awarding 50 Bitcoins per solution and now is awarding about 25 per solution. This will go down to 12.5 Bitcoins per block in 2017. Every four years the number of Bitcoins created per 10 minutes will go down by half, until 2139.

How To Mine Bitcoins

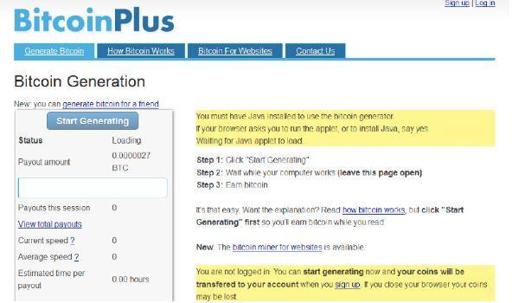

For learning about mining (and not creating any Bitcoins for a long, long time):

1. Visit -

http://www.Bitcoinplus.com/generate

2. Click “Generate”

3. Watch as your computer begins solving the Bitcoin codes - and makes almost no progress over time.

For those that want to make money with Bitcoin mining, here are a few considerations:

1. Select the lowest cost electricity state possible. CA is among the highest, and here are a few others at either end:

Lowest-Cost States:

1. Wyoming

2. Idaho

3. Utah

4. Kentucky

5. West Virginia

Highest Cost States:

47. Rhode Island

48. Alaska

49. Connecticut

49. New York

50. Hawaii

2. If you want to have your own rig (BTC mining server), buy a dedicated one, or build one with an ATI graphics cards. ATI offers the most energy efficient cards with among the fastest hash rates in the low end GPU server world. Now miners are going to ASICS and FPGA's.

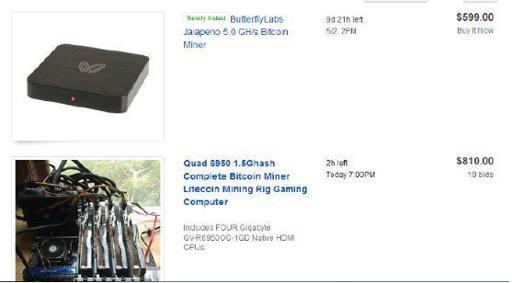

Here are a few sources to buy the rigs:

FPGAmining.com

Ebay.com (sample shown below)

Amazon.com for GPU's

We can also buy and assemble our own Bitcoin mining rig. This is similar to building our own computer.

1. We need a power supply. Bigger is better. 500 W + is ideal.

2. We need a motherboard with multiple graphic card slots.

3. We need a mid-range processor of either Intel or AMD brand.

4. We need input output cards to handle extending to other graphics cards.

5. We need multiple graphics cards from ATI. The faster and more memory the better and at the lowest price possible.

How to assemble and get the system working together is beyond the scope of this e-book. One of the better resources is from Scribd at:

http://www.squidoo.com/how-to-build-a-budget-Bitcoin-mining-rig

Fortunately, building our own mining rig is not the best option for mining Bitcoins. Much like in the real investment world, the best option is buying shares in a mining group. It’s almost like buying stock, but without the downside risk and plenty of upside. Still, there are risks.

Problems In Mining Bitcoins

Initially, Bitcoin mining was not very profitable. With BTC/$ values as low as $.06 - $.30, there was not much incentive to mine too actively. As the value of the Bitcoins increased, miners began to make huge margins mining Bitcoins. At the peak, ($/BTC of about $260), miners could be making 50 -60 times their investment in the mining rig and electricity. The complexity of the puzzles to solve has increased, as has electricity cost, and the number of miners working to solve the next block, all while the $/BTC value crashed. These factors have made it so the individual miner does not stand to make much profit from Bitcoin mining unless they invest in serious equipment. Some of the top end Bitcoin mining boxes run over $10,000.

A better approach for most would-be Bitcoin miners is either to buy into a mining group, or join a mining pool. Mining pools allow individual members to get a smaller piece of the BTC awards given for solving a single block in the chain. Otherwise, an individual miner could be mining for a long time before ever solving the block at the right point to receive their 25 BTC's. Not a wise investment.

We can either build or buy a Bitcoin mining rig as previously described, or join a mining group. We would link our solving power with the rest of the group and split the Bitcoins awarded based on calculations performed.

You can see one of these mining pools here:

https://deepbit.net/

This area of Bitcoins is ripe for scams, so “buyer beware” applies here.

Potential Bitcoin Disasters, Problems, And Challenges

“Man cannot discover new oceans unless he has the courage to lose sight of the shore.”

Andre Gide

Bitcoin has produced huge positive returns for early adopters - Bitcoin millionaires - and huge loses for those that bought the $260+ hype bubble in April of 2013. Even the most staunch supporters know Bitcoin has already had multiple stoppages at the site handling 80% of exchanges (mtgox.com), along with hacks of Bitcoin wallets, price crashes from major sellers entering the market, and now government notice of Bitcoin's success. The future will bring more challenges, as this section explains.

Failure Analysis Of The Bitcoin System

Bitcoin relies on a network. The network relies on computers. Internet, telecom, satellite and other communication systems must be free and functional for the computers to form the network. Computers and the network rely on electricity. Any one of these legs of the Bitcoin system can take it down.

Ultimately, Bitcoin relies strictly on the belief that they are rare and worth holding, spending, and transacting with. Unlike gold and silver, there is no use for a Bitcoin and never will be, other than the role as a token residing within a computer network.

Even though there are services now working on creating physical forms of Bitcoins, there is no practical method of confirming the legitimacy of that Bitcoin address and spending power without computing power. Eventually, without electricity and computing power, Bitcoin would cease to exist. This is a critical issue with Bitcoin that will initially prevent wide spread adoption for critical wealth storage.

Some of the physical forms of Bitcoin now afloat are:

https://www.casascius.com

- offers coins that represent Bitcoins

http://www.bitbills.com

- offers cards with Bitcoin values on them.

The distributed nature of the Bitcoin network and mining is both a great strength and somewhat of a weakness. The network verifies all the transactions. It also solves any disputed transactions. With a huge and growing number of nodes, there is no single server to hack for the miners, spenders, merchants, or governing body. Without a central storehouse of key data such as a CitiBank, Bank of America, or any number of other major banks, the system is much more robust than almost any other currency system.

Bitcoin has also passed the acceptance test because it has a four-year history. Though major retailers have not adopted Bitcoins, smaller ones have accepted it. Wordpress, Reddit, and many smaller businesses are Bitcoin friendly. There are at least 1,000 stores using Bitpay for merchant services already.

Now that Bitcoin has recovered from the $260 to $100 crash and sits comfortably at $130 today on April 22, 2013, it confers stability to Bitcoin. Time is Bitcoin's friend. There will be fewer options for destroying Bitcoin. Large retailers will no longer be able to ignore it as it continues building credibility and reaches a more predictable exchange value.

Bitcoin is not out of the woods at all. There are dark forces after Bitcoin's hide, and they have already struck. They have a few key targets we will explore next.

Main Targets For Hacks And Attacks

Mtgox.com covers about 80% of the transactions where people buy and sell Bitcoins. It looks a lot like a stock market with price charts, buy/sell orders, and small fees for the transactions. Mtgox.com shut down during the April 2013 crash. They claimed that too many people were signing up for accounts - about 60,000 per day - but that does not seem to be a valid excuse for a shut down that lasted from $260+ down to around $100 in BTC exchange value on April 11, 2013.

Bitfloor.com shut down immediately and for good when the crash happened. The exchange function where we trade out of Bitcoins and into dollars, euros, yen, or any other currency or payment system exposes the exchange to significant currency risk. They can lose our Bitcoins and/or our national currency in a blink. This will continue to be an inherent risk in the near future.

A brief history of some of the main shut downs:

Mtgox and other Bitcoin exchanges shut down for block chain issues; there are splits in the block chain because of differing claims to be the valid chain. Another similar problem shut down the exchange on June 23, 2012.