Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency (3 page)

Read Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency Online

Authors: Daniel Forrester,Mark Solomon

For a standard Bitcoin mining computer (let's say, an AMD A8-3850 APU), costs range from $.305 per day to as high as $2.50 per day. For more specialized computers, the costs range from $0.55 to $4.05 per day. The number of Bitcoins produced per day depends on several factors.

The lowest level produced is about 0.050 btc and the highest per computer can reach 3.2 btc. Taking the low end on all numbers gives us a value of:

(1btc/0.0050btc/day)*$0.305/day=$61.00 base cost to create or mine a Bitcoin.

The computer's cost is not included here because this level would be for a non-specialized computer.

With a $/BTC price of $50 today, each BTC is costing the least efficient miners $11 to produce. The most efficient miners are still making a lot of money though. Here’s a look at more optimistic mining costs:

Taking the high end production numbers:

1/3.2 BTC/day*($4.05 electricity + $8 computer)=$3.77 base cost for larger scale efficient miners.

Since the $/BTC exchange rate is $100+ (and rising) today, a large scale Bitcoin miner can make money all the way down to a $/BTC exchange rate of about $4.00

This suggests that rarity is the idea backing Bitcoins. With a BTC production limit of about 21 million BTC occurring in 2140, there is very gradual growth built into the system.

A clear understanding of what inflation and deflation is important. Bitcoin is considered to have deflationary properties. Not so fast.

While on the surface Bitcoins can only reach a level of 21 million issued, with about 12 million currently around, the real story is significantly different. About 100 million times different.

Remember the smallest unit of a Bitcoin..the Satoshi? It represents 1/100,000,000 of a Bitcoin.

When we total the available units of Bitcoins relative to other currencies, we see that Bitcoins are not nearly as deflationary as they appear.

The real number of Bitcoin units available now is:

1,200,000,000,000,000 or roughly 1 million billion units.

That is not deflationary number. Still, most calculations are based on the 1 BTC unit, and not the smallest denomination. But there is a possibility, as shown above, for Bitcoin to inflate into numbers most of us cannot pronounce. So far that has not happened.

The key thing is understanding what inflation and deflation mean to us in the real world. We can then understand how Bitcoin - or any currency - will behave over time.

Inflation is the amount of money and debt pumped into a system COMPARED TO THE GROWTH OF PRODUCTS AND SERVICES. Notice what has been emphasized. Many analysts focus on the growth of money and debt and forget about the growth of products and services.

The Bitcoin daily growth rate is roughly 0.46% while it decays at a much lower 0.025%. Decaying refers to Bitcoins being used up or disappearing from the pool of available Bitcoins, somewhat like bad debts cause money in a system to disappear. At a net growth rate of 0.44% per day and slowing down, Bitcoins will generally tend to increase in value compared to the large national currencies such as USD, Euro, or Yen.

Here is a critical comparison:

- Bitcoin growth rate is approximately 1.5-2% per year.

- USD monetary growth rate is approximately 5-8% based on ShadowStats.com using the more accurate 1990 methodology and including estimates of M3, the broadest measure of money.

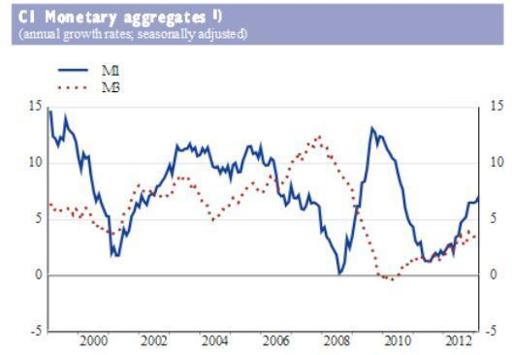

- Euro monetary growth rate has varied from a rare low of 1%, all the way up to 12%, according to the - European Central Bank (ECB) figures. These official figures are almost always understated. The real growth rate of the currency and debt in circulation could be even higher. Typical growth rates are around 5-8%.

(source:

http://sdw.ecb.europa.eu/reports.do?node=100000141

)

By checking with the other side of the world, once can find that the Japanese central bankers have been busy! The JCB (Japans Central Bank) has promised to buy trillions of yen in government bonds. This is almost exactly like printing trillions for eventually pumping into the market place. Prices will rise and potentially explode. The JCB statistics do not show this huge and dangerous monetary growth, with only a 2-5% range of growth rate. The truth will be felt on the street for everyone buying real goods and services in the market place.

This brief currency tour shows that Bitcoins will always be more rare than the competing national and central bank currencies. This fact alone brings value to Bitcoins.

History Of Digital Currencies – And How They Lead To Bitcoin

“Failure is a detour, not a dead-end street.”

Zig Ziglar

Digicash and eCash, YodelBank, 1mdc, e-bullion, ePassport, Liberty Reserve, Liberty Dollar, e-gold, and many others inhabit the museum of former digital currencies. For most of these currencies, they failed from lack of market acceptance. In other cases, such as with e-gold and Liberty Dollar, the banks and governments take them down for being too successful. A charge of money laundering is slapped on the fledgling currency and then the hammer falls.

Understanding the why, who, and what is behind the powerful drive for creating widely accepted digital currencies is the mission of this chapter. Knowing the reasons other currencies went under is critical. If, for example, we know why Digicash disappeared, we can spot the same problem with another currency, such as Bitcoin, long before it loses all value.

Great stock market traders and great investors of any assets have in depth knowledge of the history of their investments. This knowledge enables them to spot trends early both up and down. Using this knowledge they can jump on an up trend early, and off when they spot a downtrend. Sounds basic, right? However, most investors get changes in trends all wrong.

This chapter will help bring anyone up-to-date on the origin of this digital and distributed currency movement. Once the background is understood, one can navigate the future of Bitcoin with greater wisdom, and potentially profit with an accurate assessment of the currency.

Digital Gold, Silver, False Promises And Digital Scams

Digicash, later acquired by eCash, could be called the parent to the idea behind Bitcoin. David Chalms, a brilliant programmer and cryptographic expert (cryptography is the math study focused on creating codes that are difficult or impossible to break for securing data), founded this digital currency. His ideas worked with some of the same concepts for creating online payment “tokens” similar to Bitcoin.

Digicash went bankrupt in September of 1998, although it had been more of a promise of major electronic currency, than a reality. With multiple failed business deals from Visa, Microsoft, ABN AMRO, ING and others, Digicash was unable to gain market traction.

According to an article about the demise of Digicash in NEXT! Magazine, January 1999:

“The dogma of Chaum, that DigiCash should aim for the virtual world, was abandoned. It was no use trying to compete against the credit card companies; they would squash you if you upset them. “

David Chalm repeatedly ruined market joint venture agreements by insisting on too much money and too much secrecy. Digicash and eCash died through mismanagement partly, and competitors that realized it could eat their lunch.

Lesson #1: A digital or alternative currency needs to partner early, often, and profitably to survive and grow.

Knowing this historical lesson, anytime we see Bitcoin gaining a significant store, business, or website as a user, it is time to load up!

A great showcase of this effect occurred between December 2012 and February 2013. Wordpress.org started accepting Bitcoins, and the first Bitcoin bank (Bitcoin-central.com) opened up. Bitcoin rose from under $20 to over $34 in this period.

After Digicash and eCash went away, there were hobbyists that kept working on the concept for a new digital currency.

Something old and something new came together first, however, and e-gold hit the market. A Florida doctor and his computer savvy partner came up with a precious metals backed electronic currency. Unlike Bitcoin or eCash, real gold and silver backed up the value of e-gold.

e-Gold eventually reached a user base of over 5 million. While it used sophisticated encryption for handling transactions, it was a centralized currency. This is what ended up killing e-gold.

The U.S. government accused e-gold and it's founder of money laundering and other crimes. E-gold was soon finished. Even though the e-gold system still exists, it is no longer a live e-currency.

Lesson #2: Any alternative currency with a central office, authority, or person will be shut down, jailed, or destroyed by a government and/or bank.

Even when the new alternative currency has no similarities with U.S. currency, the government will accuse the currency producer or promoter of the crime of counterfeit under Title 18 section 471 of the United States Code. Being found guilty results in a 20-year sentence (approx.).

Bernard Von NotHaus, founder of the Liberty Dollar, was convicted in 2011 of “making, possessing and selling his own currency.” People who bought the Liberty Dollar made a lot of money with his currency. It was silver backed, beautiful, and began to gain acceptance.

Anne M. Tompkins, a prosecuting attorney during the trial in Western North Carolina described the Liberty Dollar as "a unique form of domestic terrorism" trying "to undermine the legitimate currency of this country"(New York Sun, March 2011).

The jailing of a person founding a currency explains one of the reasons why the founder of Bitcoin is largely a secret.

Lesson #3: Any person controlling a popular alternative currency will become vulnerable to legal actions sooner or later.

Who Hates Bitcoin And Why?

As we have seen during the brief history of alternative currencies on the Internet, they often fail spectacularly. Governments have a monopoly on currency. Banks have a monopoly on storing, distributing, transferring, making loans, and exchanging currency.

Governments want to tax anything and everything. That is what they do best. Taxing transactions and people requires knowing who spends what and with whom. Any alternative currency that offers anonymity such as Bitcoin, presents governments with a hard challenge.

How can they track Bitcoins and the users to tax them?

If we set-up our Bitcoin accounts in a certain fashion, and do not bring Bitcoins back into our bank accounts, then governments have a hard time of accessing this information. Banks look at Bitcoin as an enemy stealing their wire fees, currency exchange fees, late fees, overdraft fees, and even their bank vault fees. Banks of all kinds, governments around the world, and the centuries old power structure of world banking families and institutions all hate Bitcoin.

While they may hate Bitcoin, we can also be sure they are involved.

Recently, an individual slammed the value of Bitcoin by selling a huge quantity in less than one hour. Mtgox.com, the major trading exchange for converting and trading Bitcoins, shut down for over 12 hours. This caused Bitcoin value to plummet because nobody could get their value in their national currency out of Bitcoin. Almost like a bank closure, termed a bank holiday, Bitcoin experienced a triple digit to almost zero value in less than a day.

Some theorized that this was a test run by banking and financial powers, backed with government approval, to see how they could ruin this new competitor. While a banking entity or government crashing Bitcoin is a possibility, a private individual can crush any currency in similar fashion. George Soros famously helped devalue the British pound in September 16, 1992. Soros sold British pounds aggressively which he had borrowed, and eventually forced the Bank of England to break it's peg to the European Exchange Rate Mechanism. Soros made over $1 billion in this trade.

Unfortunately for most Bitcoin users, they all lost money when the mega seller struck.

One of the main portions of this book will help readers avoid that waterfall plummet in value. Not losing money is the first rule of investing and trading.

Why Bitcoin Is Different And Better Than Everything – Almost.

Since nobody owns Bitcoin, it is hard to shut down. With thousands of people creating Bitcoins in what are called mining operations, there is every incentive for people to get involved. Profit brings participation. The software running Bitcoin is open source. Everybody can see the code, comment on it, and verify that it is legitimate. Developers gather in several places online, but the main hub is:

https://github.com/Bitcoin/Bitcoin