Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency (5 page)

Read Bitcoin Exposed: Today's Complete Guide to Tomorrow's Currency Online

Authors: Daniel Forrester,Mark Solomon

There are several Bitcoin wallets that we can set-up on our computers without access through the Internet:

- Electrum

- The Satoshi Client

- Armory

- Multibit

These local computer based Bitcoin wallets are more complicated to use and keep secure. For most users, a Bitcoin wallet with Blockchain.info (Internet/Cloud Hosted Wallet) will be their best choice.

2. A linked account for funding Bitcoin purchasing

This is usually a bank account. We have to go through verification steps that can include tracking small deposits that the Bitcoin wallet provider may make to guarantee we own this account. Paypal uses this method. Plan on a 24-72 hour wait for this process.

3. Our first Bitcoins or bitcents

We can buy from the same place where we signed up for our Bitcoin wallet. We can also get Bitcoins locally. LocalBitcoins.com is a marketplace for buying and selling bitcoins locally with cash and other payment methods of your choice. You can find a local bitcoin trader near you or can even start your own bitcoin exchange to sell your coins. This is one of the most interesting aspects of this system. Unlike the current, formally appointed exchanges, anyone can become a Bitcoin exchanger and offer there own rates of exchange.

More commonly, people go to the largest of the exchanges, Mtgox.com, and sign up for an account there. We can then use our Bitcoin wallet address for buying Bitcoins on the Mtgox.com exchange.

Once we have funded the Bitcoin wallet provider from our bank account (Coinbase for this example) we can then buy Bitcoins - possibly.

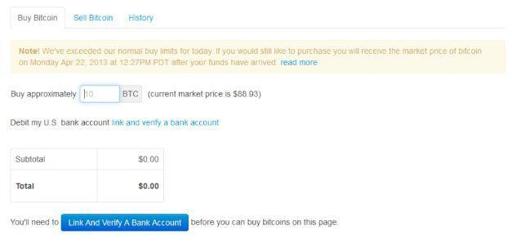

Look at this shocking screen:

Coinbase has reached their daily limit of buying Bitcoins for their clients, us. This happens frequently in the Bitcoin world. With only a small number of Bitcoins in circulation - far less than the 11 million already produced - there is more demand than supply. This lack of supply results in people not being able to get any Bitcoins at times. Eventually the price per Bitcoin rises for the buying/selling pressure to equalize.

Spending Bitcoins

Assuming we were able to get Bitcoins for our new wallet, we will have our Bitcoin wallet, Bitcoin address, and some Bitcoins. We can now spend these Bitcoins in similar fashion to other spending processes. However, it is harder to find a store or service that is offering what we want in exchange for Bitcoins. Here’s one of the longest lists of online stores that currently accept Bitcoins:

https://www.spendBitcoins.com/places/

(Appendix 4 lists these stores)

The other alternative for using Bitcoins, is person to person commerce. Any person we find on craigslist, ebay, or any auction site may allow using Bitcoins to complete the transaction.

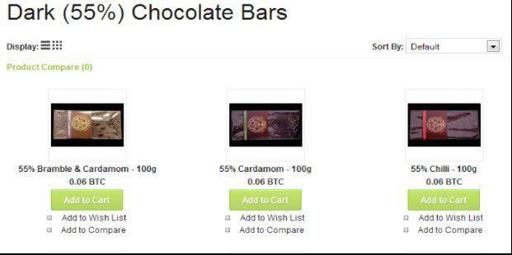

A Bitcoin transaction for a buying from a store looks like this (

http://the-chocolate-tree.bit-trade.co.uk

):

As with any other form of payment, we have to fill out the usual our name, phone, address and delivery information before getting to the payment screen:

There is a time limit for this screen and the Bitcoin address provided of about 15 minutes. We have 15 minutes to send money by one of two ways for our purchase. If we have our Bitcoin wallet client loaded on our computer and it has what is called the “URI-Compatible” wallet running, we can press the “Click Here” button and instantly send the Bitcoins from our wallet to the chocolate store.

URI-Compatible wallets include: Blockchain.info, Armory, Bitcoin Wallet, Multibit Spinner, and a few other smaller players.

The QR code - of black and white blocks in the center- is for scanning our phone and paying with a smart phone loaded Bitcoin wallet.

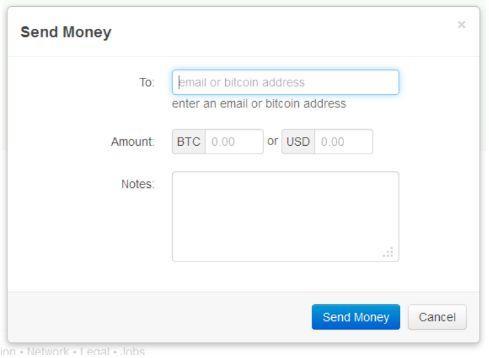

The most common and simplest way is using the long and unique Bitcoin address for sending the payment. To send Bitcoins via email from our Bitcoin wallet address to the chocolate company for this purchase, we must go to our Bitcoin wallet. Here, we go to our wallet on Coinbase.com and head to the page for “sending money”. Depending on where you have your wallet located, it may appear a bit different than the image below. However, they all have a send money screen that is similar and operates almost exactly the same way:

In the “To:” section we put the Bitcoin address of the chocolate company, which they’ve listed, on their buying screen. Cut and paste the Bitcoin address in, and then set the Bitcoin amount of 0.86 btc for the price of the chocolates. Hit send, and chocolates are on the way!

In the “To:” section we put the Bitcoin address of the chocolate company, which they’ve listed, on their buying screen. Cut and paste the Bitcoin address in, and then set the Bitcoin amount of 0.86 btc for the price of the chocolates. Hit send, and chocolates are on the way!

Important to note, there can be a delay time of around 10 minutes for the merchant or seller to accept your purchase. Generally, this delay of 10 minutes just applies to the computer and phone-based Bitcoin wallets. The merchant has to confirm that the Bitcoin spend is legitimate by checking around the network of all Bitcoin holders. Online wallets generally provide instant recognition of Bitcoin spends or sends.

There are other ways of spending Bitcoins. There can be bulk sends, donations, and escrow versions. Each system of wallets and exchanges has slightly different ways of spending Bitcoins.

For sending donations or tips, the format in forums and other systems looks like this:

+Bitcointip @Username $1usd

Sending tips, donations, bulk payments, can all be handled through Bitcoin wallets instead of memorizing codes.

Saving Bitcoins

We started saving in Bitcoins the minute we transferred money and bought Bitcoins for our wallet. We have become our own bank. We will not gather interest by just holding Bitcoins in our wallets, but we will probably see the value of our Bitcoins rise every year on average (versus our national currency).

When using Bitcoins, our expectations for how we receive, save and spend money has to change slightly. We have all the power of a bank with our Bitcoin wallet. We do not depend on a bank for confirming that there is money in our account. Bitcoin handles this automatically. We are completely free of the government FDIC system and the banking system, for the better according to most Bitcoin supporters.

What about collecting interest such as banks, credit unions, and financial institutions offer?

There are Bitcoin banks popping up that offer Bitcoin interest: Flexcoin.com offers an unknown quantity of Bitcoins monthly based on average account balances. It also acts as a Bitcoin wallet.

By now, a reader could be understandably confused about the difference between having a Bitcoin wallet and some of the services for Bitcoin. Confusion is a hallmark of any new technology. For now, the important tip is that we Bitcoin users will have multiple Bitcoin wallets, with multiple Bitcoin addresses at different sites for different wallets, and use different exchanges (mtgox.com, localBitcoin.com, etc.) as we wish.

Unlike the challenge of opening new accounts forced on us by banks, Bitcoin allows us to have as many wallet addresses as we wish. This helps maintain our anonymity. One Bitcoin wallet can have many Bitcoin addresses. The Bitcoin applications we decide to use keeps track of all of this for us.

Investing In Bitcoins Or Not

Buying a Bitcoin is a form of investment. Buying Bitcoins also works almost like a foreign currency trade. We “sell” our national currency - USD, Euro, GBP, Yen, etc., and “buy” Bitcoins at the same instant. The huge difference between foreign currency investing and Bitcoin, is that there is almost no friction cost to the trade.

Fees for buying and selling currency can be steep. Buying Bitcoins or selling Bitcoins for a national currency is almost completely free of any fees. The big cost is the Bid and Ask spread, or the difference between what people will pay versus what people are asking for a Bitcoin.

Opening a foreign currency, commodity, stock, or any investing and trading account can be a hassle. We often have to prove income, net worth, years of experience trading, credit score, and other private details. Bitcoin investing offers a smoother, easier, and simpler way to invest.

Buying and selling Bitcoins offers foreign currency investing profit and loss opportunities. Already the early adopters of Bitcoins have multiplied their net worth many thousand fold. Those who bought Bitcoins around $5/btc around early to mid 2012, are now sitting on almost 20 fold profits in less that a year.

More sophisticated investors can buy derivatives (similar to options in the stock and commodities world) from two new exchanges: iCBIT and with the IG Group. Neither of these markets are being heavily traded thus far.

There is also a Bitcoin mutual fund of sorts, based out of Malta. Primarily for institutions and high net-worth investors that want Bitcoin portfolio exposure. At the moment, this is not a recommended approach for buying.

While admittedly risky, the upside for investing in Bitcoins is life-changing gains.