The Classical World (74 page)

Read The Classical World Online

Authors: Robin Lane Fox

This new era developed into our idea of a Roman Empire. Already under Augustus, Romans wrote of ruling ‘from Ocean to Ocean’: maps of this world were constructed, especially the map which Agrippa displayed publicly at Rome.

1

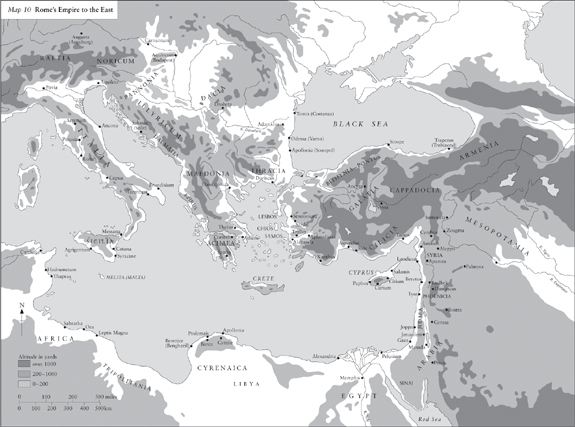

There were still no clear ideas of frontiers, and the basic notion of empire was still not so much a territorial one as one of obedience to Romans’ commands. By Hadrian’s reign the territory under Roman command would stretch from Northumberland in Britain to the Red Sea, from the coast of modern Portugal to the river Euphrates. This huge territory has never been ruled by one power since. It would also shape Hadrian’s career, as he spent more than half his reign touring round more than thirty of its provinces. There were soldiers in each of them, but not every province even had a full legion. The remarkable thing is how few officials were still being sent out to govern such a huge area.

At the top of a province, both ‘public’ and ‘imperial’, the crucial figure was still the governor, who was usually a senator. A few underlings might assist him and he could always call on any local army-officers and troops: military architects in the local camps would also be helpful in carrying out major building projects. The governor had detailed instructions from the emperor, a practice which began with Augustus and which Augustus had probably extended already to both types of province. The governor’s overriding duty was to preserve peace and quiet. After the 30s

BC

Rome’s provinces were never seriouslyat risk to an outside invader until long after Hadrian’s death. The greater danger was a rebellion by Rome’s subjects or civil strife between or within the province’s local communities. Most governors, then, were focused on judging and resolving local disputes. Like Cicero in his province, they visited their provinces yearly on an

assize-tour, during which they dispensed justice and settled disputes in recognized assize-cities. Calls on their time were potentially very heavy: we happen to know that at least 1,406 petitions were prepared for submission to a governor in one town in Egypt on a single visit.

2

Naturally, justice could not be done solely by one annual visitor. Local cities and communities did retain their courts in which they would try most of the civil cases. They heard criminal cases too, but usually only those without serious penalties. There were also cases heard by Roman procurators, officials who were of two different types. In imperial provinces, some of the procurators were financial officials with the duty of overseeing tax-collection. This business always provokes disputes and the procurator was likely to try such cases himself. Undesirably, he was both the prosecutor and the judge of those before him. Other procurators were the emperor’s land agents: they managed lands and properties owned by the emperor in his provinces. Under Claudius, they too were confirmed in the right to try cases arising from such properties and then, near the end of his life, their judgements were made final, without the possibility of appeal.

These alternative sources of justice did help the governors’ workload, but nonetheless governors were kept busy. On entering a province, a governor still published an edict which announced offences which he would particularly consider, but in the new age, the emperor’s instructions might guide him. Above all, he alone could impose the death penalty (with very few exceptions). There was also the bother of civil cases which were referred back to him from the emperor. For communities and individuals would sometimes take a case directly off to the emperor, only to find that they were encouraged by him to approach their local governor with (or without) a particular recommendation. It was then quite hard for governors to apply the law, because many of these cases were not covered neatly by accepted rulings of Roman law, and Roman law did not apply to most of the provincials anyway. There was a real need for patience and discretion on a governor’s part. After a preliminary hearing, he could send a case off for trial by a local court; he could also consult with local advisers before deciding. Under the Empire, he could attend to a case personally as ‘inquisitor’ and after investigating it in person, he could

pass sentence on it. All sorts of twisted cases and allegations would be brought up for his decision and it was best if he was impartial: he was urged in law books to avoid becoming too friendly with his provincials. It was also best if he left his wife in Rome, as she might become too involved: governors were made liable for their wives’ misbehaviour in their province.

This travelling circuit had formed Cicero’s career as a governor in the 50s

BC

and, as it spread, it did bring a new source of justice to many provincials’ lives. Under the Empire, from Augustus onwards, there was also the new possibility of direct appeal to the emperor himself. However, there were limitations to both processes. To present a case, a petitioner had to travel in person, gain access and, if possible, speak eloquently. As ever, this sort of justice was not realistic for the poor, especially the poor in the countryside. It was also justice at the expense of local political freedom. The Roman governors monopolized penalties which even the Athenians’ classical Empire had only controlled at second hand. Offences now included many which had been created by the very existence of the Empire in the first place. From their own experience at Rome, Rome’s ruling class had become very suspicious of popular associations in a city, the ‘clubs’ which might conceal political purposes: we thus find a governor being told to ban local fire brigades in his province’s cities (‘better dead than red’

3

). Subjects also became liable to charges of ‘treason’ for supposed insults to an emperor, his statues or property. Anonymous accusations were strongly discouraged, but these sorts of charges were a direct consequence of Empire.

So, above all, was tax. Here, Roman governors became responsible for a major Roman innovation, imposed under Augustus: the regular census of their subjects. Censuses listed individuals and property as a basis for the collection of taxes. Officials were charged with carrying them out and the details were often complex: Augustus never decreed ‘that all the world should be taxed’, as the Gospel of Luke puts it, but he did record his holding of separate censuses in Rome’s provinces.

4

Separate officials (quaestors and procurators) then took direct responsibilityfor the taxes’ yearly collection. They had slaves, freedmen and the possibility of using soldiers to help them, but even so they were far less numerous than the tax-collectors of a modern state.

It was not even that taxes were very much simpler than ours nowadays. Direct tax took two rather complicated forms, a tribute on land and one on persons. The details varied between provinces, but they could include taxes on slaves and rented urban property and even on movable goods, including the equipment of a farm. Occasionally they were based on the produce of a farm rather than on its extent and value. There were also important indirect taxes, including harbour-dues, and further impositions, especially for the provision of animals, supplies and labour for public transport. It is this burden to which Jesus refers in the Gospel of Matthew: ‘whosoever shall go compel thee to go a mile, go with him twain’, an idealistic bit of advice.

Occasionally, exemptions from taxes might be granted (especially to cities after a natural disaster) but they certainly did not belong by right to holders of Roman citizenship. In the provinces, Roman citizens and their land were liable to tax like everyone else. The one privileged area was Italy, which paid indirect taxes but no tribute. Rome also benefited from a particular type of payment: grain was taken as tax from Egypt and elsewhere and was shipped directly to the city. There, it supplied the huge population, including those who were entitled to free distributions. If we ask why further tax was necessary, the main answer is the big Roman army. Taxes paid its costs, even when the tax-paying province was itself a province without legions. Such are the injustices of Empire.

With hindsight, it might seem that the total levels of tax under Augustus were not too burdensome: the fact is that they could be doubled and extended in the 70s. At the time, however, they were more than enough of a load. Tax-collectors were ferocious and often used force. Conspicuously, there were revolts in Gaul, north Africa, Britain and Judaea soon after the imposition of direct Roman rule, and in each of them, the financial impact was the major cause. If provincials could not pay tax in cash, collectors were content to be paid in kind, including cattle-hides which supplied essential leather. Giving a provincial a thorough exaction was described as ‘shaking him down’: in newly annexed provinces, Italian moneylenders were soon found to be profiteering from the inhabitants too.

Inevitably, there was scope for sharp practice. In Britain, governors

are said to have bought up stocks of local grain and only then sold it back to the locals at a much higher price. In Gaul, Augustus’ financial agent, or procurator, is said to have declared that there were fourteen months in the year, not twelve, in order to claim two more months’ tax. In principle, such sharp practitioners could be accused at Rome under one of two procedures before senatorial judges. Augustus had introduced these procedures, and it is too cynical to see senators in the more serious of the two as simply acquitting their own kind. A harsh decision by the Emperor Tiberius had denied senators the right to make a valid will when found guilty of extortion. This penalty hurt an offender’s family and so, with good reason, fellow senators hesitated to impose it. Such cases were thus often examined at great length. But there was a parallel intrusion of Romans on provincial lives, one which was not regulated to this limited degree. In the Athenian Empire, individual Athenians had sometimes acquired land in allied territory, a practice which came to be widely resented. In the Roman Empire, individual Romans acquired land in the provinces on a vastly greater scale. Some of it was bought or acquired after owners had defaulted on a debt but some, no doubt, was the result of offers which owners could not refuse. The emperor and his family were major beneficiaries, not least through a process of bequests by provincials. In Egypt, members of the imperial house acquired properties by the score. In north Africa in the 60s most of the land was said to be owned by no more than six hugely rich senators (not necessarily African by birth). But even so, Romans’ estates abroad were still liable for tax.

How ever did the tax system work if there was not a big bureaucracy to collect it all? Part of the answer is that collection was delegated. Generally, the sums required were assessed on communities who were left to raise what was necessary. The point here is that their politically dominant class could pass most of the burden on to their inferiors. Rome thus reversed the pattern of the former Athenian Empire. Then, democracies in the allied Greek cities had voted that the rich should pay a hefty share of tribute. Under Roman rule, democracies were watered down or non-existent and so the dominant city-councillors could lessen the impact of tax on themselves. Even when they paid, the tax applied at the same rate to one and all: the poll tax was as unfair as always, and there was no surtax.

Collection was also eased by privatization. Julius Caesar had abolished the auctioning of direct taxes in a province to ‘private’ companies of tax-collectors at Rome: as a result, the tax imposed at Rome on Asia is said to have been reduced by a third. In the Empire, however, the cities and local communities would still use such companies locally to raise the prescribed sums on their behalf. These tax-collectors, the ‘publicans’ of the Gospels, guaranteed a sum in advance, but then collected much more from individuals as their profit. There was also the particular problem of indirect taxes. Their yield varied yearly with the underlying volume of business and, in order to be sure in advance of an agreed sum, Roman officials preferred to sell off, or ‘farm’, the right to their collection. Privatization suited the authorities but not the taxpayers.

Roman taxation built on existing practices in most provinces, but it was most people’s main point of contact with Roman rule. Year in, year out, even small farmers and tenants were affected, whether or not they knew their governor’s name or a single word of Greek or Latin. The emperor’s image and its public prominence were less significant in his subjects’ awareness of his rule, though for us this ‘image’ is so much more evident in the art and objects which survive. Most provinces had public cults which offered sacrifices and prayers ‘for’, or to, the emperors, but they were concentrated in cities, both in the city centres of provincial ‘assemblies’ and in individual cities with cults of their own. Statues represented emperors, often in military dress; coins carried their titles, and even the coins which were struck in provincial mints showed their images; in the third century we find the portrait of an emperor at his accession being escorted into a province’s cities and being lit by candles. There was scope for ingenious exploitation in all this publicity. In the 30s

AD

the governor of Asia had to curb people who were already celebrating all sorts of supposed ‘good news’ from Rome, whether or not it existed.

5

False rumours were a chance for sharp provincials to sell ‘celebratory’ goods to other provincials. In Britain and Hungary, there have been finds of moulds, apparently for sacrificial cakes or buns, which were to be imprinted with stamps of the emperor shown sacrificing to the gods. The buns would be eaten by his subjects at their religious festivals.

6