MONEY Master the Game: 7 Simple Steps to Financial Freedom (54 page)

Read MONEY Master the Game: 7 Simple Steps to Financial Freedom Online

Authors: Tony Robbins

So far we’ve learned how to allocate our investments among different types and classes of assets, and to put chunks of money in separate buckets for Security/Peace of Mind and for Risk/Growth. We’ve learned we also need to set aside another chunk of money for a Dream Bucket that will add juice to our lives as we build our wealth, and incentives to do better for ourselves and others. So now we have one final, brief chapter to teach you a set of three simple skills that can increase your returns 1% to 2% per year and, more importantly, make certain you avoid the mistakes so many people make by trying to time the market. Let’s learn how from the power of knowing . . .

CHAPTER 4.4

TIMING IS EVERYTHING?

We have met the enemy, and he is us.

—POGO

What’s the secret of success for investors and stand-up comedians . . . ?

Timing. It’s everything.

The best comics know exactly when to deliver a punch line.

And the smartest investors know just when to enter the market—

except for when they don’t

!

Even the best of the best fail to hit every beat every single time. For a comedian, a mistake in timing results in an embarrassing, deathly silence in the house—and maybe a few thrown objects.

But if you’re an investor, a mistake in timing can destroy your nest egg. So we need a solution that doesn’t require us to be a psychic.

We’ve already seen how diversifying your portfolio across different asset classes and across different markets can protect you in a volatile economy.

But haven’t we all had the experience of being at the right place or doing exactly the right thing . . . but at the wrong time?

So by now you might be thinking, “Okay, Tony, so now I know how to diversify my investments—but what if my timing is off?”

I’ve asked myself the same question.

What if I put my money in the stock market at its peak, and it starts dropping? Or if I buy into a bond fund, and the interest rates begin to spike? Markets are always going to fluctuate, and we’ve learned that nobody, I mean

nobody,

can consistently and successfully predict when it’s going to happen.

So how do we protect ourselves from all the ups and downs and really succeed?

Most investors get caught up in a kind of mob mentality that has them chasing winners and running away from losers. Mutual fund managers do the same thing. It’s human nature to want to follow the pack and not to miss out on anything. “Emotions get ahold of us and we, as investors, tend to do very

stupid things,” the Princeton economist Burton Malkiel told me.

“We tend to put money into the market and take it out at exactly the wrong time.”

He reminded me of what happened during the tech bubble at the turn of the 21st century:

“More money went into the market in the first quarter of 2000, which turned out to be the top of the internet bubble, than ever before,”

he said.

“Then by the third quarter of 2002, when the market was way down, the money came pouring out.”

Those investors who bailed instead of riding out the slump missed out on one of the greatest upturns of the decade! “Then in the third quarter of 2008, which happened to coincide with the peak of the financial crisis,” said Malkiel, “more money went out of the market than ever, ever, ever before. So our emotions get ahold of us. We get scared.”

And who could blame anyone for being scared during that epic crash! In October 2009, after the stock market had lost more than $2 trillion in value, and when hundreds of thousands of Americans were losing their jobs every

month, Matt Lauer at NBC’s

Today

show called my office. He asked me to come on the air the next morning to talk about what viewers could do to cope with the crisis. I’d known Matt for years and had been on his show a number of times, so of course I agreed. When I arrived on the set, his producer told me, “Okay, you’ve got four minutes to pump the country up.”

I thought, “Are you kidding me?”

“Well, pumping people up is not what I do,” I said. “I tell them the truth.” And that’s what I did. I warned the

Today

show audience in two different segments that the stock market meltdown was not over, that the worst could still be coming. How’s that for pumping them up?

“Many stocks that were selling for fifty dollars not long ago are selling for ten dollars or five dollars, and here’s the truth: some may go down to a dollar,” I said, as news anchor Ann Curry’s eyes grew wider and wider. But I also told the viewers that, instead of freaking out, they should fight their fears and educate themselves about people who had done well in tough times. Like Sir John Templeton, who had made all his money when markets were crashing during the Great Depression. I said that if you studied history, you knew there was a great chance, based on what happened in the ’70s and even in the ’30s, that in a short period stocks that had gone down to $1 would go up again. They might not get back to $50 for a long time, but, historically, many would jump to $5 in a few months. That’s a 400% return, and it could happen in six months! “If you stay strong and smart, and the market continues to recover, you could make a thousand percent or more! This could be the greatest investment opportunity since you’ve been alive!” I said.

It was not exactly the message the

Today

show expected to hear, but it turned out to be dead-on.

How did I know the market was going to keep dropping? Because I was so brilliant?

Hardly. I wish I could say that. The reality was that my friend and client Paul Tudor Jones had been warning me about what was happening in the markets almost a year in advance of the crisis. He is one of those unicorns who can actually time the markets on a fairly consistent basis. It’s part of what made him not only one of the most successful investors in history but a legendary figure. He predicted the Black Monday crash of 1987, and when everyone else was freaking out, he helped his clients make a 60% monthly return and 200% for the year.

So you can bet I was grateful for Paul’s insights! In early 2008 he told me a

stock market and real estate crash was coming, and soon. I was so concerned that I reached out to my

Platinum Partners,

an exclusive group of my clients who I work with three to four times a year in intimate, intensive sessions to transform their relationships, businesses, and finances. I called a surprise meeting and asked them all to fly and meet me in Dubai in April 2008 to warn them about the coming crisis and help them prepare for it. Remember, anticipation is power. With a four- to six-month jump, many of my clients were able to actually profit from one of the worst economic times in history.

Yes, sure enough, stock prices plummeted throughout the last quarter of 2008.

By March 2009, the market was so bad, Citigroup bank shares had dropped from a high of $57 to—you guessed it!—as I had warned, $0.97. You could literally own the stock for less than it cost you to take your money out of one of its ATMs!

So what should an investor do in this extraordinary kind of situation? If you believe Sir John Templeton’s motto, “The best opportunities come in times of maximum pessimism,” or Warren Buffett’s mantra, “Be fearful when others are greedy, and be greedy when others are fearful,” it was a great time to scoop up bargains. Why? Because smart, long-term investors know that seasons always change. They’ll tell you that winter is the time to buy—and the early months of 2009 were definitely winter! It’s the time when fortunes can be made, because even though it may take awhile, spring always comes.

But what if you got scared or felt you had to sell when the markets collapsed? You might say, “Tony, what if I lost my job in 2008 and had no other source of income? Or my kid’s tuition was due and the banks wouldn’t loan me any money?” If you sold your stocks in 2008, all I can say is, I feel your pain, but I wish you could have found another way to make ends meet. Individual investors who liquidated their funds when the market plunged learned an agonizing lesson. Instead of riding the tide back up, they locked in their losses—permanently. If and when they got back into stocks, they had to pay a much higher price, because as you know, the market roared back to life.

Seeing so many people lose so much in such a short time, and feeling the suffering that all this created, is what started my obsession with wanting to bring the most important investment insights to the general public. It literally was the trigger for the birth of this book.

It also made me search to see if the same level of financial intelligence

that created high-frequency trading (where the HFT investors truly have the upside without the downside) could be harnessed in some way for the good of the average investor. Remember, the HFT investors make money and virtually never lose.

So what’s the good news? In the upcoming section of this book, “Upside Without the Downside: Create a Lifetime Income Plan,” you’re going to learn there’s a way for you to never leave the market yet never take a loss.

Why? Because there are financial tools—insurance products, to be specific—where you don’t have to worry about timing at all. You make money when the market goes up, and when it goes down 10%, 20%, 30%, or even 50%, you don’t lose a dime (according to the guarantees of the issuing insurance company). It sounds too good to be true, but in reality, it’s the ultimate in creating a portfolio that truly offers you peace of mind. For now let me show you three tools that can help you limit many of your investment risks and maximize your investment returns in a traditional investing format.

The future ain’t what it used to be.

—YOGI BERRA

Prediction is very difficult, especially about the future.

—NIELS BOHR

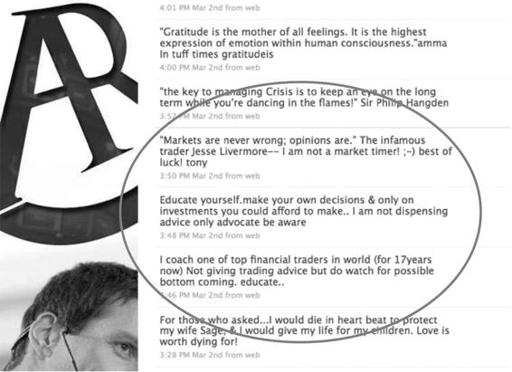

On March 2, 2009, Paul Tudor Jones told me that the market was hitting its absolute bottom. Prices would start rising again. Spring was coming. So I tweeted:

By the way, it was the first time I ever tweeted any information on the potential direction of the stock market! As it

turned out, only seven days later, the US stock exchange indexes did exactly that: bottomed out on March 9.

Prices started rising gradually and then took off. And sure enough, Citigroup stocks, which were $1.05 on March 9, 2009, closed on August 27, 2009, at $5 a share—a 400% increase!

12

What an incredible return you could have had if you’d managed your fear and bought when everyone else was selling!

Now, I’d love to be able to say that past market behavior can predict the future, or that Paul Tudor Jones or anyone else I know could continuously successfully forecast these market swings, but it isn’t possible. Based on analysis from those “in the know,” I put out another heads-up warning for potential challenges in 2010, this time on video, when it looked like the market was overextended and heading for another correction. I wanted people to make a conscious decision whether they wanted to protect themselves from the potential of another huge hit. But this time we were wrong.

Nobody could guess that the US government would do something that no government has ever done in human history—it decided to prop up the markets by “printing” $4 trillion, while telling the world that it would continue to do so indefinitely, literally until the economy recovered!

By magically adding zeroes to its balance sheet, the Federal Reserve was able to pump cash into the system by buying back bonds (both mortgage-backed bonds and Treasuries) from the big banks. This keeps interest rates unnaturally low and forces savers and anyone looking for some sort of

return into the stock market. And the Fed kept doing it year after year. No wonder US stocks never came down from that sugar high!