MONEY Master the Game: 7 Simple Steps to Financial Freedom (16 page)

Read MONEY Master the Game: 7 Simple Steps to Financial Freedom Online

Authors: Tony Robbins

“It’s not about having some arbitrary amount of money in your account

on some given day,” exclaimed Dr. Jeffrey Brown, professor of finance at the University of Illinois and consultant to the US Treasury and the World Bank. “I think a lot of people are going to get to retirement and suddenly wake up and realize, ‘You know what? I did a fairly good job. I have all this money sitting here, but I don’t know how long I am going to live, and I don’t know what my investment returns are going to be, and I don’t know what inflation is going to be. What do I do?’ ”

After I read one of his recent

Forbes

columns, I called Dr. Brown to see if he would be willing to sit down and share specific solutions for investors of all shapes and sizes. (We’ll hear from Dr. Brown on how to create income for life and even how to make it tax free in his interview in section 5, “Upside Without the Downside: Create a Lifetime Income Plan.”) And who better to outline the solution than the man who is not only a top academic expert but was also one of only seven people appointed by the president of the United States to the Social Security Advisory Board.

BREAK THE CHAINS

In the words of David Swensen, one of the most successful institutional investors of our time, to have unconventional success, you can’t be guided by conventional wisdom.

Let’s shatter the top nine financial myths that misguide the masses, and, more importantly, uncover the new rules of money, the truths that will set you financially free.

Let’s start with the biggest myth of all. . . .

3

. According to the website Investopedia: “Active managers rely on analytical research, forecasts, and their own judgment and experience in making investment decisions on what securities to buy, hold, and sell. The opposite of active management is called passive management, better known as ‘indexing.’ ”

CHAPTER 2.1

MYTH 1: THE $13T LIE: “INVEST WITH US. WE’LL BEAT THE MARKET!”

The goal of the nonprofessional should not be to pick winners—neither he nor his “helpers” can do that—but should rather be to own a cross section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.

—WARREN BUFFETT, 2013 letter to shareholders

When you look at the results on an after-fee, after-tax basis, over reasonably long periods of time, there’s almost no chance that you end up beating the index fund.

—DAVID SWENSEN, author of

Unconventional Success

and manager of Yale University’s more than $23.9 billion endowment

FINANCIAL ENTERTAINMENT

When you turn on the financial news today, you can see that it is less “news” and more sensationalism. Talking heads debate with zeal. Stock pickers scream their hot picks of the day while sound effects smash, crash, and “ka

ching

!” through our living room speakers. Reporters film “live on the scene” directly from the trenches of the exchange floor. The system, paid for by advertisers, breeds the feeling that maybe we are missing out! If only we had a hot tip. If only we knew the next “must-own” mutual fund that would surely be the “5 star” comet. (Mutual funds are rated between 1 and 5 stars by rating authority Morningstar.)

Chasing returns is big business. Personal finance writer Jane Bryant Quinn once referred to this sensational hype as “financial porn.” Luring us into glossy pages where the centerfolds are swapped with five-star ratings and promises of carefree walks on the beach and fishing off the dock with

our grandkids. The bottom line is that advertisers are fighting to get a grasp on our money. The war for your assets rages on!

So where

do

you put your money? Who

can

you trust? Who will protect you and get you the best return on your investment?

These are the immediate questions that are sure to come to mind now that you’ve committed to becoming an investor—now that you’ve committed to socking away a percentage of your income. So where do most people put their money for the long haul? Usually the stock market.

And the stock market has indeed been the best long-term investment over the past 100 years. As Steve Forbes pointed out at one of my financial events in Sun Valley, Idaho, in 2014, “$1 million invested in stocks in 1935 is worth $2.4 billion today (if you held on).”

But the moment you open an IRA or participate in your 401(k) plan at work, there will be a jolly salesman (or sales process) telling you to park your money in a mutual fund. And by buying an actively managed mutual fund, what exactly are you buying? You are buying into the fund manager in hopes that his or her stock-picking abilities will be better than yours. A completely natural assumption, since we have insanely busy lives, and our method of picking stocks would be the equivalent of throwing darts!

So we hand over our money to a “five-star”

actively managed

mutual fund manager who by definition is “actively” trying to beat the market by being a better stock picker than the next guy. But few firms will discuss what is sometimes called the $13 trillion lie. (That’s how much money is in mutual funds.) Are you ready for this?

An incredible 96% of actively managed mutual funds

fail to beat the market

over any sustained period of time!

So let’s be clear. When we say “beat the market” as a whole, we are generally referring to a stock

index.

What’s an index, you ask? Some of you might know, but I don’t want to risk leaving anyone in the dark, so let’s shed a little light. An index is simply a basket or list of stocks. The S&P 500 is an index. It’s a list of the top companies (by market capitalization) in the United States, as selected by Standard & Poor’s. Companies like Apple, Exxon, and Amazon make up the list. Each day, they measure how all 500 stocks performed, as an

aggregate, and when you turn on the news at night, you hear if the market (all the stocks on the list collectively) was either up or down.

So instead of buying all the stocks individually, or trying to pick the next highflyer, you can diversify and own a piece of all 500 top stocks simply by investing in a low-cost index fund that tracks or mimics the index. One single investment buys you a piece of the strength of “American capitalism.” In a way, you are buying into the fact that over the past 100 years, the top-tier companies have always shown incredible resiliency. Even through depressions, recessions, and world wars, they have continued to find ways to add value, grow, and drive increasing revenues. And if a company fails to keep making the grade, it falls off the list and is replaced with another top performer.

The point here is that by investing in the index, you don’t have to pay a professional to try picking which stocks in the index you should own. It’s effectively been done for you because Standard & Poor’s has selected the top 500 already. By the way, there are number of different indexes out there. Many of us have heard of the Dow Jones index, for example, and we will explore others soon.

TEN THOUSAND OPTIONS

There are 7,707 different mutual funds in the United States (but only 4,900 individual stocks), all vying for a chance to help you beat the market. But the statistic is worth repeating: 96% will fail to match or beat the market over any extended period. Is this groundbreaking news? No, not to insiders. Not to the smart money. As Ray Dalio told me emphatically, “You’re not going to beat the market. No one does! Only a few gold medalists.” He just happens

to be one of those medalists honest enough to issue the warning “Don’t try this at home.”

Even Warren Buffett, known for his incredibly unique ability to find undervalued stocks, says that the average investor should never attempt to pick stocks or time the market. In his famous 2014 letter to his shareholders, he explained that when he passes away, the money in a trust for his wife should be invested only in indexes so that she minimizes her cost and maximizes her upside.

Buffett is so sure that professional stock pickers can’t win over time that he was more than happy to put his money where his mouth is. In January 2008 Buffett made a $1 million wager against New York–based Protégé Partners, with the winnings going to charity. The bet? Can Protégé pick five top hedge fund managers who will collectively beat the S&P 500 index over a ten-year period? As of February 2014, the S&P 500 is up 43.8%, while the five hedge funds are up 12.5%. There are still a few years left, but the lead looks like the world’s fastest man, Usain Bolt, running against a pack of Boy Scouts. (Note: for those unfamiliar with what a hedge fund is, it is essentially a private “closed-door” fund for only high-net-worth investors. The managers can have total flexibility to bet “for” the market and make money when it goes up, or “against” the market, and make money when it goes down.)

THE FACTS ARE THE FACTS ARE THE FACTS

Industry expert Robert Arnott, founder of Research Affiliates, spent two decades studying the top 200 actively managed mutual funds that had at least $100 million under management. The results are startling:

From 1984 to 1998, a full 15 years, only eight out of 200 fund managers beat the Vanguard 500 Index. (

The Vanguard 500, put together by founder Jack Bogle, is a mirror image of the S&P 500 index.

)

That’s less than 4% odds that you pick a winner. If you’ve ever played blackjack, you know the goal is to get as close to 21 without going over, or “busting.” According to Dan and Chip Heath in their

Fast Company

article “Made to Stick: The Myth of Mutual Funds,” “by way of comparison, if you get dealt two face cards in blackjack (each face card is worth 10, so now your

total is 20), and your inner idiot shouts, ‘Hit me!’ you have about an 8% chance of winning!”

Just how badly does chasing performance hurt us? Over a 20-year period, December 31, 1993, through December 31, 2013, the S&P 500 returned an average annual return of 9.28%. But the average mutual fund investor made just over 2.54%, according to Dalbar, one of the leading industry research firms. Ouch! A nearly 80% difference.

In real life, this can mean the difference between financial freedom and financial despair. Said another way, if you were the person who simply owned the S&P 500, you would have turned your $10,000 into $55,916! Whereas the mutual fund investor, who was sold on the illusion that he or she could outperform the market, ended up with only $16,386.

Why the huge performance gap?

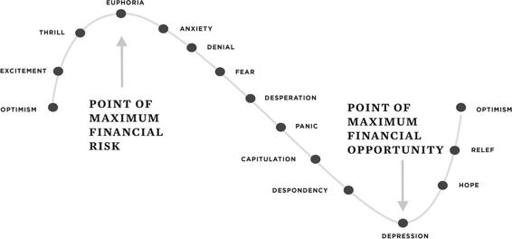

Because we buy high and sell low. We follow our emotions (or our broker’s recommendations) and jump from fund to fund. Always looking for an edge. But when the market falls, when we can’t take the emotional pain any longer, we sell. And when the market is up, we buy more.

As a famous money manager named Barton Biggs observed, “A bull market is like sex. It feels best just before it ends.”

WISDOM OF AGES

At 82 years young, Burt Malkiel has lived through every conceivable market cycle and new marketing fad. When he wrote

A Random Walk Down Wall Street

in 1973, he had no idea it would become one of the classic investment books in history. The core thesis of his book is that market timing is a loser’s game. In section 4, we will sit down and you’ll hear from Burt but for now what you need to know is that he was the first guy to come up with the rationale of an index fund, which, again, does not to try to beat the market but simply “mimics,” or matches, the market.

Among investors, this strategy is called

indexing

or

passive investing.

This style is contrary to active investing, in which you pay a mutual fund manger to actively make choices about which stocks to buy or sell. The manager is trading stocks—“actively” working with hopes of beating the market.