If Chins Could Kill: Confessions of a B Movie Actor (16 page)

Read If Chins Could Kill: Confessions of a B Movie Actor Online

Authors: Bruce Campbell

Tags: #Autobiography, #United States, #General, #Biography & Autobiography, #Biography, #Entertainment & Performing Arts - General, #Entertainment & Performing Arts, #Actors, #Performing Arts, #Entertainment & Performing Arts - Actors & Actresses, #1958-, #History & Criticism, #Film & Video, #Bruce, #Motion picture actors and actr, #Film & Video - History & Criticism, #Campbell, #Motion picture actors and actresses - United States, #Film & Video - General, #Motion picture actors and actresses

Bruce: No.

Sam: "We'll take a train."

Bruce: "We'll take a train to New York City."

Sam: It was affordable. I think the tickets were like forty bucks each.

We arranged to stay at Andrea's apartment. I had met her on a Chevy industrial shoot and we hit it off very well. So well, in fact, that as we prepared for bed in her New York apartment, she came on to me like I'd never experienced before.

Sam: How did she come on to you? Did she just put her arm around you or something?

Bruce: No, she was like, "You're sleeping in my bed and that's going to be that." She was giving me

the look

and even though I didn't know shit about women, I knew something awful was going to happen and I knew I had to get out of there.

Sam: And you left that night.

Bruce: I told her, "I have to drive back tonight 'cause I've got a lot of stuff I have to do."

This remains a great source of amusement to Rob and Sam. My only consolation was that Andrea's cat slept on Sam's face, and by morning, his eyes were swollen shut.

Humiliation aside, we came back to Detroit with a letter of intent to distribute.

15

"DO YOU VALIDATE?"

The next step was to get some notice of our abilities

artistically.

We had a pseudo seal of approval from a "major distribution company in New York City," but there was no outside opinion about our capability as

filmmakers.

In August of that year, we got whiff of a theater on the east side of Detroit (the Punch and Judy) that ran

Rocky Horror

every weekend and whose management was "open and flexible." We approached them with the idea of showing

Within the Woods

just before

Rocky Horror.

To our shock and delight, they agreed.

The only real battle with this screening was a technical one. A Super-8 projector has limited bulb power, so we had to set the thing up halfway down the aisle of the theater. It became a game of:

"The image is too dim, move it closer."

"Well, if we move it closer, the picture isn't big enough."

Eventually, with the help of a new, $21.10 EFR Halogen 150 watt, 15 volt bulb, we found a happy medium. A trip to Radio Shack provided the hundreds of feet of audio extension cable needed to patch our feeble projector amplifier into the theater sound system. The distance, combined with lousy source material, resulted in a slightly annoying hum, but hey, we were in a legit house.

The "cult" crowd gathered to see

Rocky Horror

seemed to share enough basic interest in real horror to enjoy themselves. To combat the fact that we scored the film with music we didn't own the rights to, we decided to donate the proceeds to the American Cancer Society. A week after the showing, I dropped off all of $11.40 to the Cancer Society -- about half of what the new fancy bulb cost.

On a side note, I had a chance to discuss the "cult" thing with

Rocky Horror's

star, Tim Curry, several years later, at the top of the Iruzu volcano between shots of the film,

Congo.

I told him how, indirectly, I was grateful that

Rocky Horror

provided us with such a good springboard. He explained that I wasn't alone. He had gotten a number of thank-you notes from independent theater owners across the country applauding him for being involved in a film that eventually proved to be the difference between success and failure for their theater.

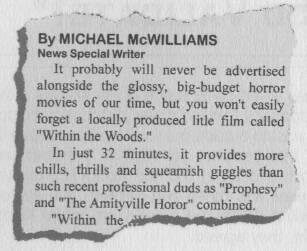

The "net benefit" of that weekend was bamboozling Michael McWilliams, a reviewer from

The Detroit News,

to come and see

Within the Woods.

It was refreshing to know that even in Detroit, people still got excited over "home-grown" stuff.

Several days later, we saw what would become our calling card printed in the

Lively Arts

section of the

Detroit News.

It was the first, best and perhaps most important review we've ever gotten. Nothing felt better than to slap that review on the desk of a potential investor and casually ask, "Read the paper today?"

16

THE QUEST FOR MOOLAH

Okay, the big ball was rolling. We had a prototype, a budget, a decided millimeter, a bogus letter from a "professional" and our "art" had been validated. Now, we had to get to the heart of the matter:

THE RAW STINKING CASH TO MAKE THE FILM.

"How

do

we raise money?" we asked ourselves.

Within the Woods

cost a whopping $1,600. We needed an amount that was exponentially more. A bank wasn't gonna just fork over $150,000 unsecured. Our friends and family weren't "fat cat" rich.

What to do?

Enter Phil Gillis -- the Tapert family lawyer. Phil had helped a younger, wilder Rob get out of trouble a time or two, and he walked us through the steps of forming a business "entity" whereby we could raise the dough.

He recommended a limited partnership because of its simplicity. Simplicity? That's a good one. This Private Placement Memorandum used terms like "Fiduciary Responsibilities" and "Willful Malfeasance" -- not exactly common usage for us. Reading the Agreement of Limited Partnership for the first time was like taking a fistful of Melatonin -- a oneway ticket to Snoresville.

Phil and his partners were unimpressed with our prototype, letter of intent, or our cool review -- it merely represented the

good

news. An offering like this had to be very careful about "hype." Phil suggested that other items would serve us better in the eyes of an investor -- things like "financial projections" and a "tax statement."

I've got to tell you, that first meeting with our new CPA, Charlie Bosler, about financial projections was a joke:

Charlie: Well, fellas, how soon do you think you'll recoup?

Bruce:... Recoup?

Charlie: Get your money back..."

Rob: Uh, well, it's gonna take the better part of six months to make the thing.

Charlie: Better make it a year.

Sam: Yeah, a year, sure -- that should be plenty safe.

Charlie: Now, how much money do you think you'll make with the film? What do you project?

Bruce/Sam/Rob: Well... that is, I...

The reality was and still is that a finished film lives on a 35mm strip of negative -- it could be worth nothing more than the stock it's printed on, or it could be the next

Titanic.

Bruce/Sam/Rob: What the hell? They'll

double

their money in two years.

If we had to live or die by the accuracy of the projection we came up with, I wouldn't be typing right now -- I'd be drinking Woolite on a street corner in downtown Detroit. The truth was, we broke even exactly six years later.

Investors, we came to learn, also got really pissy about taxes.

Whats the fuss all about?

I wondered.

I didn't even qualify for a bracket.

Folks with something to lose, however, needed a Tax Opinion.

Once these items were in place, we had to scrape together a resume for the offering -- you know, one that showed things like...

experience.

"Let's see... I worked as a newspaper delivery boy for a year and earned enough to buy a black-and-white TV set. How's that? I swept studios out for a year and took my boss home when he was drunk... that good enough? I was a cab driver for a year -- wanna see my chauffeur's license? Oh,

acting

experience? I'm a veteran of

several

community theater productions, and I also starred in at

least

thirty Super-8 films!"

You can almost see the investor's jaw drop...

We slapped the lawyer-approved document together and found, much to our shock and utter horror, that we had exactly thirty days to raise the cash or the offering would expire.

On top of that, because it was a

private

placement, we couldn't advertise in any way whatsoever -- no radio ads, no newspapers, no mass mailings...

and

there was a limit to how many people you could even

approach.

These strict guidelines were designed to protect the average schmuck investor, but it certainly didn't do us any favors.

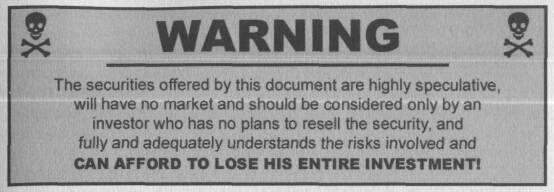

As a potential investor, the first thing you were treated to on page one was:

We also had to disclose anything that might go wrong for any reason. These were known as risk factors. We quit listing them after 11 -- it seemed embarrassing enough. They were as follows: (translation included)

- New Venture:

(We haven't done anything yet) - Limited Financial Resources:

(It's a really low budget) - Lack of Distribution Agreements:

(We have no real commitment from anyone) - Reliance on Management:

(Come hell or high water, investors were gonna be stuck with us) - Failure to Engage Certain Key Employees:

(We haven't hired a single person yet) - Liquidity of Investment:

(As an investor, you were in for the long haul. You couldn't sell your share in this venture, even if it smelled like a stinker) - Federal Tax Consequences:

(You can't write off anything) - No Guarantee of Completion:

(If we go over budget, we're screwed) - Lack of Diversification:

(We're only doing one flick and it's a very specific genre) - Production Risk:

(Bad weather, bad planning, bad anything could and

will

shut us down) - Conflict of Interest:

(We can do other stuff at the same time)

Makes you want to whip out the ol' checkbook and fire off ten grand, doesn't it?

Basically, an investor might as well have drilled for oil in the Arctic Wildlife Refuge with his or her bare hands, because it was a total crapshoot.

Combine these factors with the very practical sensibilities of Detroit businessmen, and you've got a Grade A challenge staring you in the face. If we had even a prayer of answering questions from a savvy investor, we had to know this prospectus in and out.

This became shockingly clear after the first few meetings:

Mr. Turner: How much can I write off in the first year?

Bruce: Uh...

a fair amount

...?

Mr. Gates: What's my liability?

Sam: You're

liable

to... make money?

Mr. Trump: How do you handle "Phantom Income"?

Rob: Very, very carefully...