Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (46 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

Just one year later, however, American was struggling to maintain compliance with this covenant. According to reports from the Center for Financial Research and Analysis at the time, several changes may have enabled the company to stay compliant in early 2004, including (1) a change in assumptions on revenue recognition for nonrefundable tickets, (2) low reserving for expenses, and (3) a reclassification of leases. Alas, by September 2004, American ran out of fuel. The company announced that it was seeking to refinance this bank facility (at a higher cost) because it was no longer in compliance with its EBITDAR covenant.

Europe’s Enron

Parmalat Finanziaria SpA, the Italian-based dairy company and one of the world’s largest packaged food companies, grew its business rapidly in the 1990s by aggressively acquiring food service companies around the world. Parmalat relied heavily on the debt markets to fund its shopping spree, borrowing at least $7 billion in various offerings between 1998 and 2003. As its business ran into serious problems, Parmalat began having trouble generating sufficient cash to pay down this debt. Moreover, top executives of this family-owned and family-dominated company began funneling hundreds of millions of dollars to other family businesses. As a consequence, when bonds came due, Parmalat had a desperate need to issue new bonds and float equity offerings to raise enough cash to pay off the older debt.

Normally, investors would be reluctant to purchase new bonds and equity from a poorly performing company that was strapped with heavy debt obligations and had no cash. So to attract investors, Parmalat concocted a widespread scheme to fraudulently hide its debt and conceal bad assets. By dressing up its Balance Sheet, Parmalat fraudulently portrayed itself to investors as a company that was in robust economic health. At September 2003 (the quarter before the fraud was revealed), Parmalat’s unreported debt amounted to an astonishing €7.9 billion. The company’s net worth, reported to be €2.1 billion, was actually

negative

€11.2 billion—an inconceivable €13.3 billion overstatement!

The centerpiece of Parmalat’s fraud seems to have been the company’s use of offshore entities to fraudulently hide fictitious or impaired assets, fabricate the reduction of debt, and create fake income. The scope of the fraudulent activities that Parmalat is alleged to have engaged in is actually quite amazing. SEC litigation against the company names a few, including forging the repurchase of its debt, faking the sale of bogus or uncollectible receivables, falsifying the payment of payables, recording fictional revenue, mischaracterizing debt as equity, disguising intercompany loans as income, and diverting company cash to various businesses owned by members of the CEO’s family.

As usual, there were warning signs for perceptive investors to find. One key warning occurred in late October 2003 when Parmalat’s auditors (Deloitte & Touche) wrote in an audit report that they were unable to certify certain transactions involving an investment fund called “Epicurum,” which later turned out to be one of these fraudulent offshore entities. These transactions were quite significant. Parmalat had recorded gains on a derivative contract just signed with Epicurum that

accounted for more than all of Parmalat’s € 119.9 million in pretax earnings

in the first half of 2003, according to a CFRA report at the time. Moreover, these gains were revealed as a result of Parmalat’s commenting on Deloitte’s review report, but had not previously been disclosed by Parmalat in its June 2003 earnings release.

Less than two weeks later, in early November 2003, Parmalat decided to formally respond to Deloitte’s report in a very public manner. It issued four press releases over a span of three days seeking to clarify Deloitte’s reasons for not signing off on its financial statements and trying to explain its Epicurum investment in further detail. To be clear, Parmalat decided to refute its auditor in a public forum over a transaction with an obscure offshore entity that had accounted for all of its recent earnings.

Okay, now take a deep breath, have a glass of Parmalat milk, and get ready for the final exam multiple-choice question. Imagine it is mid-November 2003 and you are a Parmalat investor. How would you have reacted to the news coming out of the company? (Try to take this quiz seriously.)

a. Parmalat is the cream of the crop. I am not a-moo-sed that the news media are milking this story.

b. No need to cry over spilled milk. This minor issue won’t spoil the fundamentals.

c. The news is sour, but not enough to get me to moooove my investment.

d. Holy cow, this is udderly ridiculous! I butter moooove my money out of Parmalat before I get creamed!

We are nearing the end of this book. If you answered anything but (4), then please close the book and start over from the beginning, or just give up on investing in individual companies and buy a stock index fund.

The late 2003 series of events at Parmalat is perhaps the reddest of red flags. As an investor, you should cringe when you see a company having a public disagreement with its auditor, particularly on a shady transaction of significant magnitude. Surprisingly, many investors in Parmalat did not feel that way. It was not until several weeks later that Parmalat’s stock price plunged as the company defaulted on its debt.

Your impressive ability to identify red flags will give you a big edge over most investors, and you can proudly say that you now really know how to detect accounting gimmicks and fraud in financial statements.

Looking Back

Warning Signs: Distorting Balance Sheet Metrics to Avoid Showing Deterioration

• Distorting accounts receivable metrics to hide revenue problems

• Failing to prominently disclose the sale of accounts receivable

• Converting accounts receivable into notes

• Increases in receivables other than accounts receivable

• A huge decline in DSO following several quarters of growing receivables

• Inappropriate or changing methods of calculating DSO

• Distorting inventory metrics to hide profitability problems

• Moving inventory to another part of the Balance Sheet

• Distorting financial asset metrics to hide impairment problems

• Stopping the reporting of certain key metrics

• Distorting debt metrics to hide liquidity problems

Looking Ahead

Chapter 15 completes not only the section on Key Metrics Shenanigans, but also the last of the three parts of the Financial Shenanigans mosaic. Part 5, “Putting It All Together,” takes you on a quick return tour of all the shenanigans covered in this book and suggestions for how investors can spot them.

PART FIVE:

Putting It All Together

Congratulations. You have descended the shenanigan mountain, and you are now almost ready to cross the finish line. As “world-class” athletes ourselves, we know the exhilaration of completing a long, arduous run. (We, as you have no doubt surmised, are two of the most fleet-footed accountants you will find anywhere.) You should feel both intellectually nourished and invigorated.

Let’s take one more lap around the “shenanigan track” to take it all in, and to review the key lessons throughout the book. We are confident that you will experience much success in all future competitions when it really counts: with your money on the line.

The final chapter provides a recap of

(1)

the holistic approach to detecting financial shenanigans,

(2)

the breeding ground for shenanigans,

(3)

Earnings Manipulation Shenanigans,

(4)

Cash Flow Shenanigans, and

(5)

Key Metrics Shenanigans.

16 – Shenanigans Recap and Recommendations

Chapter 16 provides a thorough recap of Parts 1 through 4, and the accompanying tables can serve as handy reminders of what to look for when reviewing financial statements and searching for financial shenanigans.

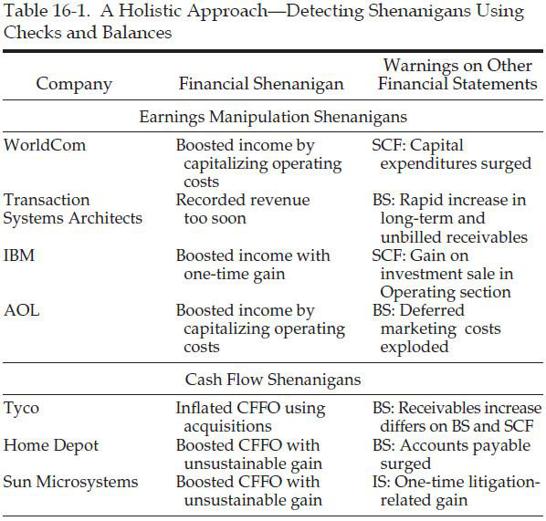

A Holistic Approach to Detecting Financial Shenanigans

In Part 1, we drew an analogy between the checks and balances provided by the three branches of the U.S. government and those provided by the three major financial statements (the Balance Sheet, the Statement of Income, and the Statement of Cash Flows). Just as the three branches of government rein in bad behavior by government officials, the three financial statements help to protect investors from misbehaving corporate executives. Specifically, investors can sniff out Earnings Manipulation Shenanigans by scrutinizing the Balance Sheet and the Statement of Cash Flows. Similarly, they can detect signs of misleading operating cash flow by finding unusual or troubling changes on the Statement of Income and the Balance Sheet. Additionally, investors can use the supplementary

disclosures and key metrics provided by management as another form of “checks and balances.” (See Table 16-1.)

Breeding Ground for Shenanigans

Part 1.

This part established the foundation and described the breeding ground for shenanigans. The following box summarizes the key warning signs that investors should consider as creating a higher likelihood that shenanigans will be present.

Warning Signs: Breeding Ground for Shenanigans

• Absence of checks and balances among senior management

• An extended streak of meeting or beating Wall Street expectations

• A single family dominating management, ownership, or the board of directors

• Presence of related-party transactions

• An inappropriate compensation structure that encourages aggressive financial reporting

• Inappropriate members placed on the board of directors

• Inappropriate business relationships between the company and board members

• An unqualified auditing firm

• An auditor lacking objectivity and the appearance of independence

• Attempts by management to avoid regulatory or legal scrutiny

Earnings Manipulation Shenanigans

Part 2.

This part introduced seven Earnings Manipulation (EM) Shenanigans used to trick investors. The first five inflate current-period income, and the last two inflate that of future periods. The boxes given here show various techniques that management uses for each of the seven shenanigans.

Warning Signs: Recording Revenue Too Soon (EM Shenanigan No. 1)

• Recording revenue before completing any obligations under contract

• Recording revenue far in excess of work completed on a contract

• Up-front revenue recognition on long-term contracts

• Use of aggressive assumptions on long-term leases or percentage-of-completion accounting

• Recording revenue before the buyer’s final acceptance of the product

• Recording revenue when the buyer’s payment remains uncertain or unnecessary

• Cash flow from operations lagging behind net income

• Receivables (especially long-term and unbilled) growing faster than sales

• Accelerating sales by changing the revenue recognition policy

• Using an appropriate accounting method for an unintended purpose

• Inappropriate use of mark-to-market or bill-and-hold accounting

• Changes in revenue recognition assumptions or liberalizing customer collection terms

• Seller offering extremely generous extended payment terms

Warning Signs: Recording Bogus Revenue (EM Shenanigan No. 2)

• Recording revenue from transactions that lack economic substance

• Recording revenue from transactions that lack a reasonable arm’s-length process

• Lack of risk transfer from seller to buyer

• Transactions involving sales to a related party, affiliated party, or joint venture partner