Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition (41 page)

Authors: Howard Schilit,Jeremy Perler

Tags: #Business & Economics, #Accounting & Finance, #Nonfiction, #Reference, #Mathematics, #Management

Evaluation of Accounts Receivable Management.

Investors worry if collection of customer receivables begins stretching out. Analysts use a days’ sales outstanding (DSO) metric to catch signs of collection problems. Higher DSO (as discussed earlier) typically suggests that customers have been paying more slowly. Or worse, perhaps management has used Earnings Manipulation Shenanigans to inflate revenue and profits. Now, if management wants to hide these problems from investors, it may distort the true accounts receivable balance. Investors should evaluate accounts receivable to gauge whether the DSO metric provided by management fairly presents the underlying economics of the business. Remember, distorting accounts receivable metrics could indeed be an attempt to hide revenue problems.

Evaluation of Inventory Management.

A healthy and prudent level of inventory is essential for a well-run business. Holding too much of an undesirable product leads to write-downs, and not having enough of a hot one will lead to missed sales opportunities. Naturally, investors monitor inventory level closely and use a metric called days’ sales of inventory (DSI, as introduced in Chapter 6). Management may create misleading inventory metrics to hide profitability problems. Or it may simply classify inventory incorrectly on the Balance Sheet to trick investors into using the wrong input when computing DSI.

Evaluation of Asset Impairments for Financial Companies

. Financial institutions provide metrics that give investors insight into the quality or strength of their financial assets. Companies may disclose, for example, delinquency rates on mortgage loans or the fair value of their investments. Investors must monitor these supplementary data to ensure that proper reserves and impairments are being recorded. With the recent financial crisis, investors who were unable to spot lax impairment decisions took an undue hit.

Evaluation of Liquidity and Solvency Risks

. Investors can face devastating losses, often with little warning, if they fail to monitor imminent threats of a massive cash crunch. Enron’s demise came very rapidly when credit rating agencies swiftly downgraded its bonds to “junk” status and the company’s liquidity sources immediately dried up. In a similar way, any company with debt outstanding could face equally serious consequences if it were to fall out of compliance with the conditions of its debt covenants. If a company fails to provide data on such threats (or worse, if it intentionally covers up those threats), investors will be in serious jeopardy.

The next two chapters walk you through the two Key Metrics Shenanigans. Investors should generally be delighted if management provides additional useful information to help them better assess the company’s performance and economic health. Unfortunately for investors, management provides information on a fairly regular basis that not only adds nothing of value, but involves metrics that could be deemed downright misleading. Chapter 14 highlights metrics that either camouflage revenue, earnings, or cash flow problems from investors or simply put an overly positive spin on modest achievements. Chapter 15 describes misleading economic health metrics that hide problems.

14 – Key Metrics Shenanigan No. 1: Showcasing Misleading Metrics That Overstate Performance

Above all, do no harm.

—Hippocrates, the father of Western medicine

Newly minted doctors are required to take the Hippocratic oath and pledge their commitment to practice medicine ethically. This oath is widely attributed to Hippocrates, the father of Western medicine, in the fourth century BC, and the gist of it can be boiled down to “above all, do no harm.”

Perhaps corporate managers should be made to study this solemn oath taken by physicians and apply it in earnest when they communicate with investors. In so doing, they would pledge to never knowingly harm investors and always refrain from showcasing metrics that misrepresent performance. Based on what you already have seen in this book, that day seems way off in the horizon. Well, we can only dream that such a day will eventually come! Until it arrives, however, investors must be alert to the following three techniques that management can use to obfuscate company performance.

Techniques to Showcase Misleading Metrics That Overstate Performance

1. Highlighting a Misleading Metric as a Surrogate for Revenue

2. Highlighting a Misleading Metric as a Surrogate for Earnings

3. Highlighting a Misleading Metric as a Surrogate for Cash Flow

1. Highlighting a Misleading Metric as a Surrogate for Revenue

Many people consider revenue growth to be an important and straightforward measure of the overall growth of a business. Companies also frequently provide additional data points to supplement revenue, providing investors with more insight into product demand and pricing power. As discussed in the previous chapter, investors should welcome this additional information and analyze these supplemental non-GAAP (generally accepted accounting principles) revenue metrics to better assess the sustainable business performance. However, sometimes these revenue surrogates provided by management can be misleading and can harm investors if they have not put appropriate safeguards in place. In this first section, we highlight ways in which companies can be less than honest using fairly common revenue surrogates and how careful investors can protect themselves.

Same-Store Sales

Revenue growth at retailers and restaurants is often fueled by the opening of additional stores. Logically, companies that are in the middle of a rapid store expansion show tremendous revenue growth, since they have many more stores this year than they had the prior one. While total company revenue growth may give some perspective on a company’s size, it gives little information on whether the individual stores are performing well. Investors should therefore focus more closely on a metric that measures how the company’s stores have actually been performing.

To provide investors with that insight, management often reports a metric called “same-store sales” (SSS) or “comparable-store sales.” This metric establishes a comparable base of stores (or “comp base” for short) for which to calculate revenue growth, allowing for more relevant analysis of true operating performance. For example, a company may present its revenue growth on stores that have been open for at least one year. Companies often prominently disclose SSS in their earnings releases, and investors use it as a key indicator of company performance. Many consider same-store sales to be the most important metric in analyzing a retailer or restaurant. We agree that if it is reported in a logical and consistent manner, SSS is extremely valuable for investors.

However, because same-store sales (and the other metrics discussed in Part 4) fall outside of GAAP coverage, no universally accepted definition exists, and calculations may vary from company to company. Worse, a company’s own calculation of SSS in one quarter may differ from the one used in the previous period. While most companies compute their same-store sales honestly and disclose them consistently, “bad apples” try to dress up their results by routinely adjusting their definition of SSS. Investors, therefore, should always be alert to the presentation of same-store sales to ensure that it fairly represents a company’s operating performance.

Compare Same-Store Sales to the Change in Revenue per Store.

When a company experiences fairly consistent growth, same-store sales should be trending up consistently with the average revenue at each store. By comparing SSS with the change in revenue per store (i.e., total revenue divided by average total stores), investors can quickly spot positive or negative changes in the business. For example, assume that a company’s SSS growth has been consistently tracking well with its revenue per store growth. If a material divergence in this trend suddenly appeared, with SSS accelerating and revenue per store shrinking, investors should be concerned. This divergence indicates one of these two problems: (1) the company’s new stores are beginning to struggle (driving down revenue per store, but not affecting SSS because they are not yet in the comp base), or (2) the company has changed its definition of same-store sales (which affects the SSS calculation but not total revenue per store).

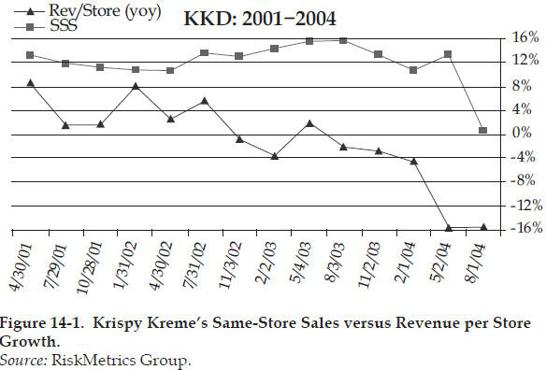

This framework was used by the Center for Financial Research and Analysis (CFRA) to successfully identify problems at Krispy Kreme Doughnuts Inc. in 2004 and Starbucks Corporation in 2007, and to warn investors before these companies unraveled. As shown in Figure 14-1, Krispy Kreme maintained its high SSS level in 2003 and 2004, despite a tremendous drop-off in total revenue per store.

Watch for Changes in the Definition of Same-Store Sales

. Companies usually disclose how they define same-store sales. Once the definition is disclosed, investors should have little difficulty tracking it from period to period. Companies can manipulate same-store sales by adjusting the comp base in two possible ways. The first involves simply changing the length of time before a store enters the comp base (for example, requiring a store to be open for 18 months, versus 12 months previously). The second trick involves changing the types of stores included in the comp base (for example, excluding certain stores based on geography, size, businesses, remodeling, and so on).

Watch for Bloated Same-Store Sales Resulting from Company Acquisitions.

The comp base can also be influenced by unrelated company activities, such as acquisitions. For example, from 2004 to 2006, the universe of stores in the comp base of Starbucks kept changing each quarter as the company continuously bought up its regional licensees and put them into the comp base. As a result, Starbucks calculated same-store sales using a slightly different universe each quarter—hardly a comparable metric. If Starbucks had been purchasing its strongest licensees, this acquisition activity would have had a positive impact on SSS performance, thereby misleading investors about the company’s underlying sales growth.

Like Krispy Kreme’s, Starbucks’s 2006 same-store sales trend began diverging from its revenue per store trend. The gap widened in 2007, and in September 2007, Starbucks reported that U.S. traffic had fallen for the first time ever. When same-store sales in the United States turned negative in December, Starbucks announced that it would no longer disclose SSS, stating that it will “not be an effective indicator of the Company’s performance.”

Be Wary When a Company Stops Disclosing an Important Metric.

Just as Starbucks stopped disclosing same-store sales when business went sour, Gateway stopped disclosing the number of computers sold when times were tough in late 2000. This metric had been an important data point provided to investors, and Gateway’s change in disclosure led the SEC to censure the company and label its actions “materially misleading” because it obscured the softening consumer demand for computers.

Tip:

Sound the alarm if a key metric goes missing.

Look for Strange Definitions of Organic Growth.

Affiliated Computer Systems (ACS) had an odd way of presenting its organic growth, or what it called “internal growth.” Rather than simply excluding all revenue from acquired businesses when calculating internal growth, ACS calculated a fixed amount to remove based on the acquired business’s revenue for the previous year. (See ACS’s disclosure in the accompanying box.) This meant that ACS was able to include in its own internal growth any large deals that the acquired company booked just before the acquisition.

ACS’S INTERNAL REVENUE GROWTH DEFINITION

MARCH 2005 EARNINGS RELEASE

Internal revenue growth is measured as total revenue growth less acquired revenue from acquisitions and revenues from divested operations. Acquired revenue from acquisitions

is based on pre-acquisition normalized revenue of acquired companies.

[Italics added for emphasis.]

To illustrate, let’s hypothetically assume that ACS acquired a company on January 1, 2005. In 2004, that target company had generated $120 million in revenue ($30 million per quarter). In the weeks before the acquisition, the target company also closed a large deal that would bring in an additional $10 million in revenue each quarter beginning in 2005.