Entrepreneur Myths (31 page)

How do you value your business? Is it based on financial projections you pulled out of your ass? Or perhaps you use IBM mainframes to run thousands of variables to prove your company’s worth. Where did those numbers come from? What assumptions did you use?

In the real world, no matter what any financial wizard or accountant tells you, valuations are not based solely on numbers.

Learn from The Donald

Donald Trump, The Donald, has revealed the secret of how he values his businesses. The magic formula slipped out while Trump was giving a deposition for a lawsuit he filed against a publisher of a book about him. Reading between the lines, there was a lot of smoke and mirrors from The Donald, but there was a lot of wisdom too.

According to The Wall Street Journal, during his December 2007 deposition, Trump stated, “My net worth fluctuates, and it goes up and down with markets and with attitudes and with feelings, even my own feeling.”

7

This might sound absurd to most entrepreneurs, but being a complexity scientist, I see a lot of truth and intelligence in his statement. When you’re a “Master of the Universe” like The Donald (or at least you think you are), the value of anything you do in business depends on how you feel about things, and how people around you feel about you and your ventures — especially in the real estate sector.

How does anyone value their business? How do you value your startup when you have no revenues? If you have an existing company with revenues, what metrics are used? What if you’re on Wall Street? I’m not an accountant but I do know what GAAP means — unlike The Donald, who claimed he didn't know much about GAAP. However, accounting and accounting rules have little to do with valuations of companies in the early stage of the life cycle.

What are the intangible assets in your venture?

According to The Wall Street Journal, in 2007 The Donald stated that his estimate of his net worth, over $4 billion, “is a very conservative number, in my opinion.” He also said $6 billion was a good number, counting his brand value. (In a more recent interview, he claimed to be worth $5 billion, not counting brand value.)

Billion here, billion there — it adds up.

It appears the value of Trump's ventures and net worth fluctuates like the stock market. I wonder if he did any stress tests like the banks did for the U.S. Government, during the recent Great Recession, to prove their financial wherewithal.

“Brand equity” is a fuzzy term. Marketing people love to use it. Brand equity is important, but placing monetary value on it can be voodoo finance. What’s the brand equity of Mickey Mouse, for example? The Mickey Mouse brand used to rule. Because Mickey Mouse (one of my favorite characters) is not as hip as he used to be, I doubt his brand equity is as high as The Simpsons

or

Sponge Bob Square Pants

these days

.

Disney got smart. They bought Pixar because Pixar was beating the crap out of Mickey at their own animation game. Pixar caught the Mickey Mouse brand guardians sleeping at the wheel. The brand equity of Pixar’s characters is now more valuable than Mickey.

8

When entrepreneurs or investors put a specific financial value on brand equity — they are likely pulling the number out of their ass, like The Donald. Sure, they have to set some value from a financial and accounting standpoint, but brand equity is more subjective than people want to believe or admit. It’s not set in stone.

Which currently has higher brand equity: Coca-Cola or Pepsi? Toyota or GM? Jaguar or Lexus? Microsoft or Apple? Google or Apple?

The value of brand equity depends on the brand's history, current market conditions and the potential future. Estimating brand value, in my opinion, is complete bullshit. It depends strongly on how people feel — just like The Donald said.

Why numbers cannot be certain

Business is based on simple mathematics. You don’t have to be an accountant to run a business — although it’s odd that Trump does not understand that GAAP means “generally accepted accounting principles.” How the hell anyone can become a billionaire not knowing what GAAP means is beyond my comprehension. Maybe you shouldn’t know GAAP either.

The problem with using mathematics and modern-day finance terminology is that people treat numbers as if they are of biblical significance. For instance, discounted cash flow models are great, but everything is based on assumptions. And if there's anything I learned in my entrepreneurial and venture capital life, it’s that assumptions are the foundation of all clusterfuck situations. Whatever financial models are used, whether for a sales forecast or figuring out the value of a venture, you must study the assumptions and data behind them. You will be surprised how many assumptions are based on feelings like The Donald’s.

As an investor, I’ve had entrepreneurs tell me the value of their business was around $100 million, despite having minimal revenues. They based this value on bubblepreneur metrics of the potential size of the market and the value of their technology. You could say they thought like The Donald. Good for them. Hmm, at least The Donald owns some real estate.

Predicting the future is impossible — why should valuations be any different? Wall Street, like Silicon Valley, is based on predictions. I’m fine with people trying to predict the future, but when people act as if they know for sure what’s going to happen next and start believing their own bullshit, it becomes a problem.

If all else fails, go with the direction of the wind

Sometimes you have to go with whatever direction the wind blows. Currently, the direction in Silicon Valley for the high-tech sector, especially early stage, is bubble-ish. My entrepreneur friend, strike while the money is hot. You could take of advantage of the market and try to ride these high valuations quickly. However, watch for those down rounds, which can happen if you run into a hiccup or the market swings the other way.

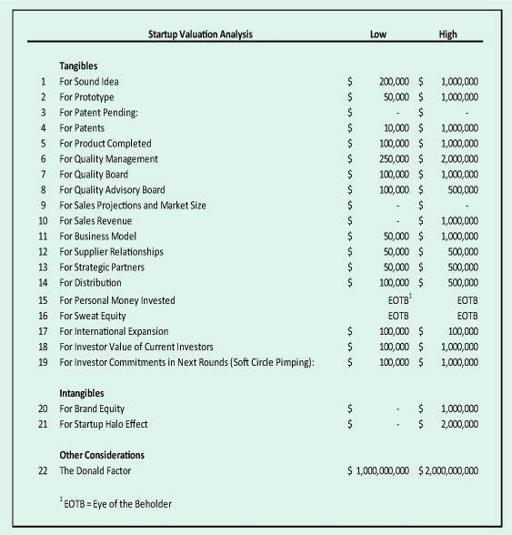

With all the financial mumbo jumbo out there, what’s an entrepreneur to do? How do you value your venture? Startups can use rule of thumb metrics based on what is currently playing out in the marketplace (see Myth 31). For example, social media valuation metrics differ from alternative energy or biotech valuations. You can also break down the business into specific components and give some quantification to each. For instance, the value of your management team should be based on their previous track record and experience.

If the product is complete but the venture is pre-revenue, then you can add some additional value to the total value of the business. If the venture is already experiencing revenue, but is in the early stages of the business cycle, you can add additional value to the total valuation.

If your venture has been around for some time but the revenue is dismal, unless you discovered a cure for cancer, the value of your company might be lower because you are taking your sweet time finding the business model that generates higher revenues.

Company Valuation Rules of Thumb for Startups

Damir Perge Valuation Notes:

Below are some of my notes on how to value a startup. Most these variables apply to valuating private companies in different stages of the life cycle. The valuation model does not apply to public companies although some of the principles could be helpful.

For Sound Idea:

The value for any sound idea should be between $100,000 and $1,000,000. Business accelerators offer an average total company valuation of $300,000 to $500,000, which is low compared to my valuation exercise. Because accelerators invest smaller chunks of money, it comes down to whether an entrepreneur is willing to part with 5% to 10% of the company for $25,000 to $35,000. Many entrepreneurs are willing to do this because after they go through the business accelerator class, they are usually pimped out at a significantly higher valuation.

For Prototype:

The value of the prototype depends on the type of product or service. If your venture is a software app,

fuck

the prototype. I don’t want to see a prototype because you should be able to develop a beta or complete product on your own IQ dime. However, if it is hardware-related or the product is a combination of hardware and software, I do treat it differently. The value also depends on the quality of the prototype. My dog can make better prototypes than some of the ones I've seen. I’ve also seen prototypes that would fucking blow you away.

For Patent Pending:

It’s nice to have the patent drawn up and filed. It feels good to file, but there's no cigar when it comes to giving it any value. Sure, you spent $5K to $20K, or even more, on filing your patent using a patent attorney, but there's no guarantee until the U.S. Patent office approves it.

For Patents:

The value of a patent fluctuates depending on the invention, market, market size, significance, etc. If the invention is a kitchen gadget, it will be lower in value than a patent on a cure for cancer.

For Product Completed:

Depending on the product or service, the company value goes up once the product is completed, in most sectors. You have a lot more leverage against investors when the product is complete.

For Quality Management:

The worth of the founding team depends on multiple variables. The range is simple in this table. For a more in-depth explanation see the Entrepreneurdex Partner Valuation Analysis (EPVA) in Myth 54.

For Quality Board:

The value of the board depends on its market power, prestige and domain expertise. You can actually place a value on each advisory member. For example, imagine if you had Marc Andreessen sitting on your board. This would greatly increase the value of your startup, especially if you’re in the social media sector because Marc sits on the board of Facebook. However, the board members must be active in your business and not become a bunch of drones or figureheads that meet once a year, jerk off and nothing gets done.

For Quality Advisory Board:

The same principles apply as above. In addition, the value depends on whether you are collecting names or choosing advisors carefully. I funded a few companies that had enough advisors to form a soccer team, but these assholes did nothing for the company. They were worthless. I have very few advisory board members in my current ventures, and they do help when I need help. My input: more advisors do not equal higher value.

For Sales Projections:

Zero value

9

is allocated for sales projections in a startup mode because they are just projections (See Myth 20).

For Sales Revenue:

A lack of sales in a startup is understandable. Multiply your current sales as a startup by 1X to 3X,

10

and add that number to the value of the company. Actually, just put a big zero in the column and you will get instant “cred” with the investor. Startup sales don’t mean much unless they make you cash flow positive. If you’re burning $100,000 per month and your sales are only $1,000 in the startup phase, I wouldn’t be pounding my chest over the sales accomplishment. Notice: If the sales are during the startup phase and rapidly accelerating, it’s cool to point that out, and put some value to it. Use common sense. If the sales are in the later stages, the value will depend on the acceleration of the revenue stream.

For Solid Business Model

: A unique business model adds tremendous value to your company. Just look at the Google business model. It is not their search algorithm that made them billions. It was their search advertising business model. Value depends on business model uniqueness, ability to create barriers to entry for competitors, customer lock-in, monetization, and other considerations.

For Supplier Relationships:

Suppliers that offer extended terms to startups add value because they are financing the startup through their own resources. They do it to get business. Supplier relationships add value to the business if your products require critical parts from the suppliers. Apple, for example, has major supplier lock-in for their iPhone and iPad product line, creating a nightmare for competitors.

Other books

To The Stars (The Harry Irons Trilogy) by Stone, Thomas

The Girl in the Polka Dot Dress by Beryl Bainbridge

The Playboy of the Western World and Other Plays by J. M. Synge

Deux by Em Petrova

Secrets of Midnight by Miriam Minger

Oda a un banquero by Lindsey Davis

Algernon Blackwood by The Willows

Marie Harte - [PowerUp! 08] by Killer Thoughts

Against The Wall by Dee J. Adams

Loose Ends by Parks, Electa Rome