On the Brink (56 page)

Authors: Henry M. Paulson

Tags: #Global Financial Crisis, #Economics: Professional & General, #Financial crises & disasters, #Political, #General, #United States, #Biography & Autobiography, #Economic Conditions, #Political Science, #Economic Policy, #Public Policy, #2008-2009, #Business & Economics, #Economic History

Although fourth-quarter earnings at the nation’s banks were as bad as I had feared, I was encouraged by what appeared to be a light at the end of the tunnel. Bankers throughout the country were telling me that the earnings environment had improved significantly in January. It didn’t surprise me that the banks could make good money with the government support programs and low interest rates. What surprised me was that it had taken so long.

Friday, January 16, was my last working day at Treasury. I am not a particularly sentimental man, and though we had all enjoyed an extraordinary camaraderie at Treasury, I had planned no parting words or special ceremony. Jim Wilkinson and Neel Kashkari came by in the later afternoon; they wanted to be with me in the last moments I was in the office. They seemed to expect some memorable valediction, but I told them, simply, I was never emotional about moving on.

Looking back now, I can’t help but be awed by the hard work and incredible dedication of the Treasury team, and those at the Federal Reserve, and in the many other government agencies, who gave selflessly in some of the darkest moments they or this country had ever seen.

As I prepared to leave office, I knew that we had succeeded in averting the collapse of the system. As controversial as TARP and our other actions had been, they had prevented a much greater disaster that would have caused far more pain to the American people.

I understood that many of my fellow citizens viewed the bailouts—if not the whole financial industry—with bitterness and anger. Though I shared some of their feelings, the crisis did not shake my faith in the free-market system. Yes, our way of doing things occasionally needs repairs and overhauls—that is true now more than ever—but I’ve yet to see an alternative to our system that can provide as many people not only with their needs but also with the promise of much better lives.

How many weekends and holidays did my team at Treasury give up during the crisis? What would have happened had I not been able to rely on their devotion, talent, and creativity?

As with my Treasury team, so with my colleagues in government. Ben Bernanke, Tim Geithner, Sheila Bair, Chris Cox, John Dugan, Jim Lockhart—at times we differed on philosophy and strategy, but I never doubted their dedication to this country or their commitment to taking the bold actions necessary to save the system. I was able to leave Treasury confident that, with Tim as my successor and Ben continuing to chair the Federal Reserve, many of our plans and programs would continue into the next administration.

I’d often found the political realities of Washington frustrating, but I had also met politicians willing to make unpopular decisions to serve the greater good. No one showed more courage than President Bush, who not only unstintingly supported me but set aside ideology, and often the preferences of some of his own staff, to do what needed to be done. This must have been personally difficult for him on many occasions, but he never let me see it.

As I left Treasury that last time and drove by the White House, which was busy with preparations for a new president, I took a moment to feel good about what we had accomplished.

We had been on the brink, but we had not fallen.

1963: Preparing to embark on a canoe trip in Ely, Minnesota. Left to right: My cousin Lisann; me; my mother, Marianna; my sister, Kay; my brother, Dick; and my father, Merritt.

As All-Ivy, All-East Dartmouth College tackle.

Dartmouth archives

1969: With Wendy during my first year of Harvard Business School.

Brooks Zug

1973: Banding a peregrine falcon at Assateague Island National Seashore with F. Prescott Ward.

Wendy Paulson

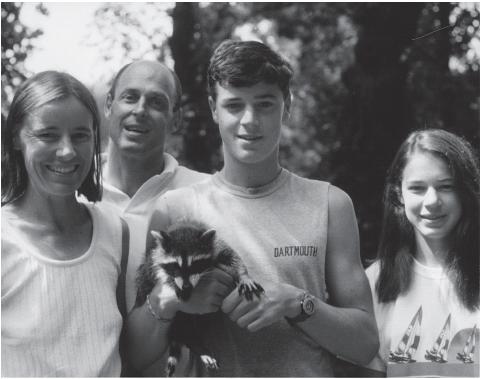

At home in Barrington, Illinois. Left to right: Wendy, me, Merritt, and Amanda. Merritt is holding one of several raccoons we raised.

April 2002: The family at Little St. Simons Island, Georgia. Left to right: Merritt, me, Wendy, and Amanda.

Clark Judge

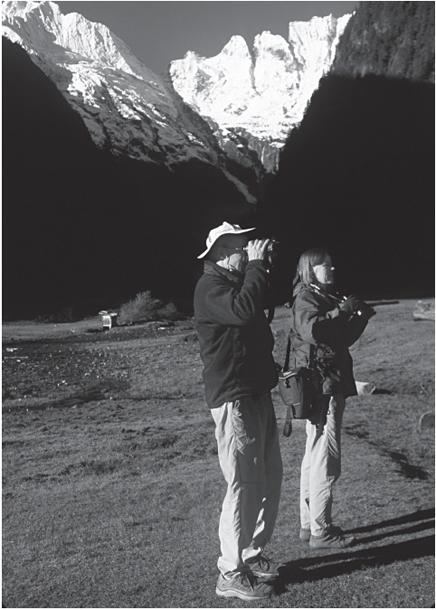

November 2002: As co-chairman of the Asia-Pacific Council of the Nature Conservancy, with Wendy, in Yunnan Province in China, working to establish national parks.

Amanda Paulson

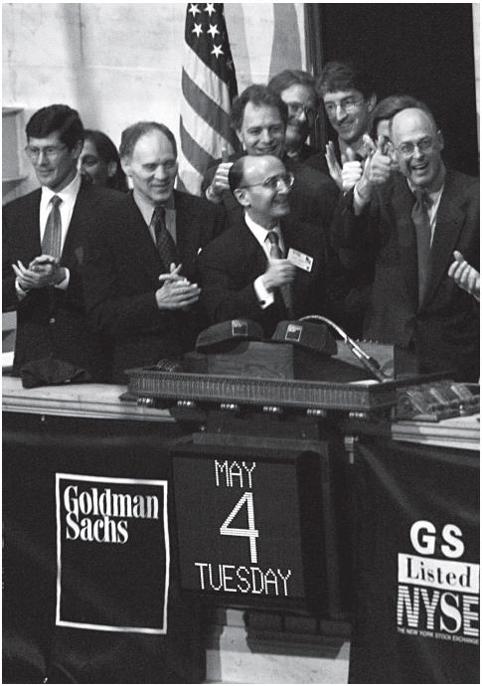

May 4, 1999: Trading begins at the New York Stock Exchange as the Goldman Sachs IPO ends the firm’s 130 years as a private company. Front row, left to right: Co-president and co-COO John Thain, board member and former senior partner Steve Friedman, NYSE CEO Dick Grasso, and me. Behind, left to right: Co-general counsel Esta Stecher, CFO David Viniar, partner and head of financial institutions group Chris Cole, treasurer Dan Jester, and co-president and co-COO John Thornton.

Mike Segar/Reuters

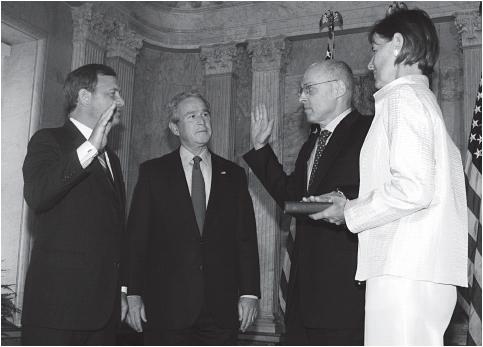

July 10, 2006: Chief Justice John Roberts swearing me in as 74th U.S. secretary of the Treasury in the Cash Room, with President George W. Bush and Wendy.

Chris Taylor, Treasury Department