Never Get a ”Real„ Job (6 page)

Read Never Get a ”Real„ Job Online

Authors: Scott Gerber

If only it were so easy.

Reality might play out a little more like this: The prospective customer you met at an open-bar function probably forgot your name shortly after meeting you. She probably took your card and either never looked at it or lost it. To build a successful business, you need to understand the difference between the

theoretical

and the

actual

in order to plan for reality. Just because Facebook has hundreds of millions of users doesn’t mean that you’ll attract even a fraction of a percent of them to your Fan Page. Similarly, just because your niche market has thousands of potential prospects, doesn’t mean that you’re guaranteed to sell even one.

The only safe assumption is that growing a business made out of hopes and dreams will leave you vulnerable to collapse at the first storm.

Flawed common sense will inhibit your perceptions of reality. Avoid being an eternal optimist. Be a cautious pessimist and your business will be better off as a result.

Don’t be General Custer

. General Custer was

not

a great leader, otherwise he wouldn’t have blindly led his legions to certain doom.

There is a huge difference between broken and unfixable.

If your market has vanished, your cash flow is nonexistent or you’re taking substantial personal and financial risk without any light at the end of the tunnel, you’re likely on a fool’s errand for the sake of ego.

Decide your walk-away point

before

you launch your company, not when you’re facing bankruptcy. Knowing your threshold at the gate will keep you from jumping off the deep end. If your idea doesn’t pan out, reflect on what went wrong, what worked, and what mistakes you made. Assess what could have been done differently. Determine how you will utilize these hard-learned lessons to better yourself and your future entrepreneurial endeavors. Take it from me: A true entrepreneur finds ways to prevail over adversity and turns failures into life lessons—and turns life lessons into revenue.

THE WORST-CASE SCENARIO IS THE ONLY SCENARIO

Nothing will go as planned. Ever.

Plans change, businesses change, and markets change. Your world will be flipped upside down on a daily basis. Even the best-laid plans and the best intentions will find a way to go belly up. Failures are inevitable.

Your phone won’t ring. You’ll receive creditor statements more often than accounts receivable checks. Marketing objectives won’t meet expectations. You’ll spend a fortune on something totally ineffective. You’ll predict $10,000 in revenue for the first quarter and be lucky to earn $250. Forget thousands of people coming to your Web site; you’ll be lucky to attract 10 unique visits per day.

You get the idea.

Not only are you going to be wrong, but you’re going to be wrong often. And that’s okay. You need to learn to fail like a pro, adapt, and pay attention to details so you can make informed decisions that keep your business moving forward. How you preplan for failure and maneuver around unforeseen circumstances and harsh realities will be the key to finding success as your own boss.

The best way to avoid failure is to dissect every potential decision and to determine its worst possible outcome—or subsequent worst-case scenarios—that will stem from it being realized. I call this planning for your “rock bottom.” The more you think about how you can avoid rock bottom, the more often you’ll find yourself at the top. Some rock-bottom planning can be done prior to your launch, but unless you have ESP, rock-bottom planning is part of every decision you make.

As you learn to plan for the rock bottom in every situation, you’ll become a smarter, more resilient entrepreneur. Your skills will improve as you begin to analyze success and failure more regularly. But remember to be honest with yourself. Sugar-coating this process or failing to learn from your mistakes will render your rock-bottom plan pointless and undoubtedly will get you into trouble. You should take the following four steps before making every business decision:

1.

Weigh the pros against the cons

. Do the pros of the best-case scenario wholly outweigh the cons of a potential rock bottom so much that the decision seems like a no-brainer? Or perhaps the pros and cons are so evenly matched that after careful consideration, the risks are simply far too great. In the case of the dead advisor I mentioned earlier, you might say: “How could I ever have planned for that in a million years.” To which I would respond, I could have figured out how much stock I was putting into that one person and avoided putting all of my eggs into one basket.2.

Determine the potential fallout if your decision’s outcome goes south

. Will the rock bottom cripple the company’s finances? How hard will it be to bounce back after a potential failure of this magnitude? Will your decision affect other decisions and company activities?3.

Determine if this is an “at the time” decision or an “anytime” decision

. There’s no doubt you’ve heard someone say that something seemed like a good idea “at the time.” Avoid “at the time” regrets by thinking through the short-term, midterm, and long-term impacts of your decision. If you can imagine saying this phrase later, that should be a red flag warning.4.

Consider alternatives to ensure your course of action is best

. If you couldn’t execute your plan A, what would B, C, and D look like? Are B, C, and D better alternatives than A based on your rock-bottom planning? Or are B, C, and D better backup plans should A hit rock bottom? For example, is outsourcing or paying a monthly service fee a better alternative to hiring a part-time Web developer for your start-up’s Web site? This analysis will help you to determine if your original plan holds water or if a change in direction is warranted.

NO ONE WILL INVEST IN YOUR IDEA

Guess what. No one will invest in your idea. There, I said it. In fact, let me say that again because it bears repeating:

No one will invest in your idea!

I had considered bolding and underlining the sentence as well, but I assume you get the point.

No investors want you to lose their money

. When you actively tell people that you need money to “make a business work,” you are actually telling them that you don’t have a business, you’re clueless and lazy, your business is a long shot, and you want to take a gamble with their money.

Good luck with that.

In the eyes of investors, you’re far from credible, reliable, or viable. Banks won’t lend without proven management, years’ worth of historical financial data, and substantial collateral. Angel investors see hundreds of thousands of businesses each year and the majority goes unfunded. Venture capitalists won’t acknowledge your existence. Nor should they. If you haven’t created or produced anything and you’re already asking for money, but you still truly believe that you need millions to launch your start-up, you offer absolutely nothing of value to them and deserve absolutely no attention.

Forget about raising investment capital. At this stage in the game it’s not a real option. Get it out of your head!

Entrepreneurship is a beginner’s sport, not a banker’s sport

. Building a business is more about ingenuity and hustle than obtaining a wad of cash—which is why young people are the ideal candidates to build businesses. Compared to older generations, we have minimal living expenses and have the ability to scale down our lifestyles dramatically without major consequences. We also have the ability to bounce back after rock bottom far easier. And our belief that we can do anything drives us to solve problems.

Six Fund-Raising Pillars to Attract Investors

Without a successful business under your belt, investment dollars won’t be coming your way anytime soon. Don’t even try to raise capital until your business has a handle on all six of these fundraising pillars. Otherwise, real investors and lenders won’t even give you the time of day:

1.

History

. Inspire confidence with facts, not fiction. Companies built from the ground up have a huge advantage over those seeking start-up capital because they have proven they are

real

businesses with

real

customers and

real

revenues. Your company must have cash flow, a track record, and real-world experience before any credible investor will listen to what you have to say.2.

Equity

. The only thing investors and lenders care about more than making money is getting their money back. And the only way to do that is to base their investments on something with real value that they can sell off if times get rough. Banks may ask for personal guarantees supported by a home and investors might tie their money to a company’s patent. Either way, know that investors care about their money before your property.3.

Leadership

. Money people invest in operations people, not businesses. Your leadership abilities must inspire investors. They have to believe that their investments are in capable hands and that you can effectively execute a strategy.4.

Stewardship

. Your company must be debt-free, or close to it. Red balance sheets are nonstarters for most investors. No one wants to be responsible for paying off someone else’s mistakes or debt.5.

No Liability

. Your business must be clear of any pending or active litigations or lawsuits and free from personal or business debts that could endanger the company—or more importantly—the investor’s money. If you can’t pass a background or credit check, you won’t be getting a check—period. But don’t lie. Lies and partial truths will end up hurting your company and your relationships with investors in the future.6.

Direction

. Get investors excited about the big picture, but be reasonable and responsible. Avoid hockey stick projections. Respectable investors will not take you seriously if you present them with nonsensical financial graphs that claim your company’s revenues will grow from $100,000 to $50 million in three years—if

only

they would invest. Show investors that you have a grasp on reality by clearly outlining how you plan to use their funds.Remember, getting outside financing still doesn’t offer any guarantee of success—all it guarantees you is more mouths to feed before you can feed yourself and more cooks in your kitchen. It also means trading in many of the freedoms you worked so hard to achieve—and could even mean giving up the controlling stake in your business.

If you take on any investor—and that’s a big if—be sure to do your due diligence. Don’t just take money for the sake of taking money. Know what else your investors have invested in, what they specialize in, their track records, how deep their pockets are and what they bring to the table besides cash. Make decisions based on what’s best for your business, not the investor.

The best businesses are built with blood, sweat, and tears,

not funding

. Your personal energies are far more important and valuable than any investment dollars anyway. This is why it is important not to overlook your most valuable asset: time.

Use time wisely and effectively. There is never enough of it and there never will be enough of it. Money comes and goes, but when your time is gone, it’s gone forever. The beauty of entrepreneurship is being able to put every hour into something that benefits you directly. You are actively investing in your future with every decision and every sale.

Now it’s time to teach you to do just that—invest in yourself and generate income as a result.

PART II

Building a Foundation

4

Get Off Your Ass and Start Up!

The closest thing I’ve ever had to a “real” job was an internship at an independent film production company during college.

I was fired in a little more than a month.

It was my second semester of sophomore year at NYU. I found myself spending many a Friday and Saturday night staying in, fleshing out a small business concept that I planned to launch on campus to earn a few extra bucks. A week or so before I was about to get going, I received an e-mail from my career advisor reminding me to attend a previously scheduled appointment the following day. I’d forgotten about the meeting entirely, and in hindsight, I wish I hadn’t been reminded.

During our meeting the next day, my career counselor droned on about how important internships are and strongly encouraged me to look into securing one. Although internships weren’t mandatory, he thought it would be a great opportunity for me to “experience” my industry and gain “invaluable” knowledge.

So my own business venture took a backseat while I searched the career center’s database and scheduled an interview with what seemed like a reputable company. I was hired on the spot, congratulated by my future boss, and asked to start immediately. I found out later that congratulations were hardly in order. Every candidate was accepted, regardless of qualifications.

My college workload, social commitments, and three-day-a-week internship became nearly unmanageable. I quickly realized that my entrepreneurial ambitions were going to have to be put on hold indefinitely. I shelved my start-up again, and told myself it was just until I found more free time.

Two weeks passed—and the internship got worse by the day. Valuable experience, my ass. I wasn’t learning a damn thing about the entertainment business. Each day my fellow indentured servants and I were reduced to file clerks and office gophers who fetched coffee and lunch for our superiors. Only if we were lucky did we receive the occasional chance to read and critique scripts as the internship description had indicated.

However—the worst part of the gig

by far

was the power-drunk middle manager whose severe anger issues earned him the nickname “Director Dickhead.”

A month or so into the internship I was invited to have lunch with some of the top-level executives. When they asked about my experience working at the company, I smiled like an idiot, and lied my ass off. When they inquired about my opinion on the company’s script review and evaluation process, I answered with what I believed were innocent suggestions to help the company organize, categorize, and evaluate the scripts more carefully and thoroughly.

I thought that was the end of it. But as it turns out, I was

very

wrong.

Word about my brief conversation got back to Director Dickhead, who—wouldn’t you know it—was actually the creator of the archaic system on which I was asked to comment. Out of nowhere, he reminded me that I was just a lowly intern and that I was to keep my mouth shut. Suffice it to say it wasn’t long before I was unceremoniously let go.

I was dejected and bitter and—to top it all off—I found out that another student had recently launched a start-up with an almost identical concept as the one I had been putting on hold. Not only was I now without an internship, but my start-up idea seemed to be dead in the water. I felt like I had lost out because I did what someone else expected of me instead of following my own instincts and exploring my own interests.

It was at that moment that I decided to never again allow myself to fall into the trap of becoming distracted from my entrepreneurial ambitions.

Now is the time for you to do the same and get rid of that miserable bastard known as the “real” job. No longer should you slog it out for the benefit of others, or let shareholders, idiot bosses, and dismal job markets decide how you make your living. It’s time for you to delete or set fire to your resumes or tell your employers where they can shove that imaginary gold watch and stick that useless employee of the month certificate.

However—before you can open the doors to your new dream job and overcome your paycheck dependency syndrome, your business idea must first survive a series of tests designed to make sure that it has what it takes to make it in the real world.

GET REAL WITH YOUR FINANCES

Fact: Without you, there isn’t a business. You and your start-up are one in the same. You share the same wallet, breathe the same air, and thrive (or nose dive) based on the same experiences, but you aren’t in sync quite yet, or even on the same page. Before you can put pen to paper to flesh out your big idea, you must fully understand, deconstruct, and modify your financial life—so that you’ll be prepared to make smart fiscal decisions based on fact.

How much is your life worth?

Mind you, I’m not asking you to pull a nonsensical, hypothetical figure out of thin air in an attempt to make you feel better about yourself. Instead, you need to calculate a tangible number that corresponds to liquid capital—or assets that could be liquidated—that you currently possess.

Unless you’ve suddenly inherited property or forgot about your flourishing stock portfolio, the cash in your checking and savings accounts—and possibly a few inheritances from good old granny—will make up the majority of your assets. Amassing your bankroll will help you to determine your available start-up funds as well as the length of time in which you can sustain yourself without making a single penny. Obviously, if you don’t have a dime to your name, this exercise should be relatively simple.

Prince or pauper?

Many consultants and so-called experts spout oversimplified sound bites about cutting all your expenses in half. This is utterly useless advice. Only a small part of the equation is cutting down on expenses. You need to do something far more dramatic: Reprogram the way you think about money.

A real wake-up call can be developing a clear picture of your financial situation. Every dollar counts, and the little expenses you tend to overlook often add up to jaw-dropping totals. The first time that I sat down and analyzed my annual expenditures, I found that I had spent nearly $500 on ATM fees and $1,500 on NYC taxis—unreal! Regularly reviewing your finances can help you locate money you didn’t know you had and decide judiciously what expenses can stay, what needs to be reduced, and what should be eliminated altogether.

What’s your life burn rate?

There’s no denying it: You need a certain amount of monthly income to survive and sustain yourself. I call this your life burn rate. Definitively knowing—and subsequently editing and revising—your life burn rate is essential to determining the types of companies you’ll be able to start.

Examine your expenditures from the previous year. How much money did you spend each month, and on what? Break down your expenses into three categories:

1.

Essentials:

Things you need to survive such as food, clothing, and shelter.2.

Liabilities:

Recurring expenses you have no choice but to pay, such as student loans.3.

Expendables:

One-time luxuries such as entertainment or taxi rides.

Then find a way to make cuts in each category.

Essentials

. Where could you have used your money more efficiently? What inconsequential substitutions could you have made to save a little here and a little there? What purchases could you have avoided entirely? With each substitution, increase the severity of the cut to give yourself a wide range of savings options. For example, if you are thinking about ways to save money on rent, the option with the least amount of savings and lowest impact to your lifestyle might be to live with a roommate—whereas the option with the highest amount of savings and largest impact to your lifestyle is to move back in with your parents. In the end, you’re the one who needs to weigh the cost-benefit analysis for each category that works best for you.

Liabilities

. How much of your money was spent on liabilities? Much like the approach you took with the essentials category, determine three potential alternatives for each liability. Paid a lot of money in taxes? Maybe you or your accountant can find new write-offs you didn’t previously consider. High credit card debt? Maybe you can consolidate all of the debt onto a single zero-or-low-interest card. College loans killing you? Perhaps you can renegotiate your monthly payments by refinancing with a different bank.

Expendables

. This is often the biggest eye opener—because no matter what the number is, it will always seem absurdly high. What luxuries can you limit or reduce? Which can you eliminate entirely? For some, it might be as simple as eating out fewer times per month. For others, it might be a major overhaul such as getting rid of a car in favor of public transportation, cutting down on travel, and putting a strict cap on recreational activities. I’m not advocating that you live like an impoverished monk in a cave—but you can’t have it all. If you plan to keep any of your luxuries, you need to choose them wisely. Learn to see these more extravagant items as goal purchases rather than impulse buys. Make them rewards; this will motivate you to work that much harder and save you a boatload of cash in the interim.

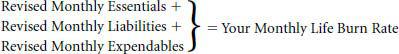

Use the following formula to calculate your life burn rate:

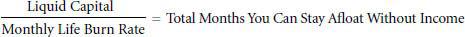

Once you’ve calculated your life burn rate, you can determine how long you can survive without making a single penny with the formula below:

Whether your total is zero or 15, use this information when brainstorming your business idea. All you’ll have to get your business started is what you currently have; you can’t count on outside funding. More importantly, your start-up will need to—at a minimum—allow you to break even based on your life burn rate.

The test of your new fiscal responsibility comes in daily practice. Can you survive a day without straying from your new life burn rate? A week? A month? You’ll undoubtedly find that some cuts work, and others don’t. New experiences may prompt new ideas, alternatives, and cost-cutting techniques. Assess your method’s effectiveness daily and adapt it as necessary. Don’t treat this like some short-lived diet. This is a life-altering game plan and the first major step in your becoming your own boss.

Eight Tools to Cut Your Bills, Save You Money, and Keep Your Finances on Track

Cut costs, find bargains, and lower your life burn rate with these eight personal finance tools:

1.

Mint.com

is a free personal finance management tool that keeps track of your bank accounts, credit card bills, budgets, and financial transactions. Mint also compares and recommends financial products, such as credit cards and bank accounts, to ensure that you get the best prices. Cost: Free.2.

BillShrink.com

enables you to slash expenses by helping you find the lowest price on essential expenses such as gas providers and wireless carriers. Cost: Free.3.

Wesabe.com

is like an online team of financial advisors. This service combines practical budgeting tools to aggregate your financial life into one place with an online community that offers free advice to help you reach your personal saving and budgeting milestones. Cost: Free.4.

NerdWallet.com

compares credit card rates and rewards to find the perfect card to fit your personal or business needs. Cost: Free.5.

Coupons.com

is exactly what the URL implies: A repository for hundreds of thousands of offers with new coupons added every day. Cost: Free.6.

PriceGrabber.com

lets you compare prices on millions of products to guarantee that when you buy almost anything it’s at the lowest price possible. Cost: Free.7.

Experian.com

provides you with a free annual credit score. Be sure to get this report every year to know exactly what your financial picture looks like. Cost: Free once per year.8.

WiseBread.com

is a daily blog dedicated to helping readers make smart financial decisions and get the most out of their personal lives and businesses on small budgets. Cost: Free.