Financial Markets Operations Management (28 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

Before we look at the topic of cash forecasting, here is an imaginary situation in our private lives. You believe that you have a balance of Hong Kong dollars 13,000 in your bank account and you go online to check the balance, only to discover that you have an overdrawn position of Hong Kong dollars 7,000. Furthermore, you went overdrawn one week ago and have been incurring overdraft interest at a rate of 500 basis points over the Hong Kong interest rate of, say, 0.02%, i.e. 5.02% per annum.

What has possibly gone wrong? Firstly, it would appear that you have made a payment of Hong Kong dollars 20,000 and omitted to record the entry in your records. Secondly, having forgotten to record the payment, you failed to cover the overdraft. Even if you had had sufficient funds on a deposit account at your bank, the bank would not automatically transfer funds from your deposit to your current account to cover the payment. The net result would be that overdraft charges would accrue at approximately

one Hong Kong dollar per day until the overdraft was repaid.

We can apply the same idea in our clearing activities. Firstly, we need to know what cash is available now, secondly, which transactions that should have settled have not and, finally, which cash payments and receipts are to be expected. All three points of view need to be considered from one particular day.

The first question we need to ask ourselves is what value date do we need to consider in order to cover our cash forecast? We can consider this from three angles:

- The time zones in which we are based and in which the currencies are based.

- The external payment system's payment deadlines.

- Internal deadlines to meet our Treasury Department's funding requirements.

Where we are dealing in the currencies of countries located to the east of us, we have less time available. This might result in performing our cash forecasting today for a value date tomorrow.

Where we are dealing in the currencies of countries close to our time zone, our respective business days will open and close at much the same time. This should result in us being able to forecast today for a value date today.

Where we are dealing in the currencies of countries located to the west of us, we have more time available. Not only can we forecast today for a value date today, but we will have more time to make the necessary funding arrangements.

These tend to be in the late afternoon, towards the market's close of business.

The Treasury Department requires sufficient time for its funding requirements, allowing it to meet its bank's deadlines as well as the payment system's deadlines.

For the purposes of the settlement simulation example, we are able to fund today for a value date today (same-day value) and there is a 12:00 deadline for funding instructions to be received by the Treasury Department.

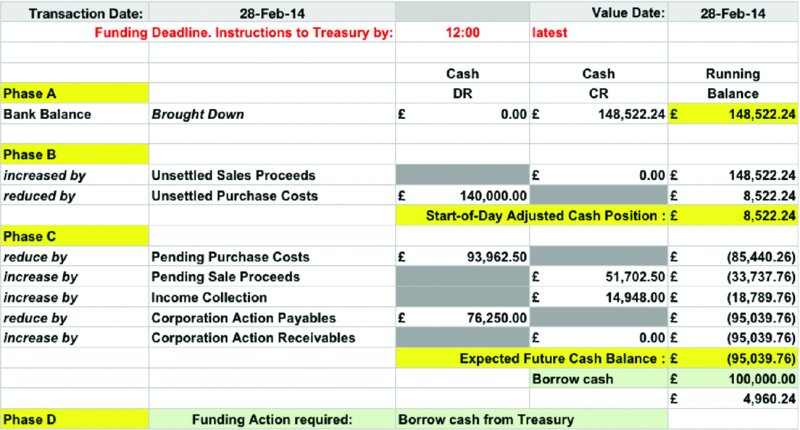

We can forecast our funding requirements in four phases (see

Figure 7.22

).

FIGURE 7.22

Cash forecasting

We have a balance on the bank account of GBP 148,522.24 and this agrees with the dealer's blotter. A cash reconciliation shows that there are payments and/or receipts that were expected but not debited/credited.

One or more purchases that should have settled have failed. The cash total amounts to GBP 140,000.00. We therefore need to reduce the balance in Phase A by this amount to leave us with a start-of-day adjusted position of GBP 8,522.24.

These are the items that are due to be settled on the value date (i.e. 28 February 2014 â the intended settlement date for the six transactions executed on the 25 February). We have also included other types of transaction such as income collection and corporate actions receivable/payable. In reality, you consider all items that fall due on the value date.

The total of Phases B and C amounts to an expected future cash balance of GBP (95,039.76). In other words, if all the items were cleared, your account would be overdrawn and incurring interest charges. Furthermore, if your credit limit were GBP 50,000.00, then some of the payments might be blocked and not clear.

You have an expected cash shortfall of GBP 95,039.76 and you can cover this by borrowing from your Treasury Department. You could borrow the exact amount, but it might be preferable to borrow a “round amount” of, say, GBP 100,000.00. As your deadline for this transaction is 12:00, it would be a good idea to start preparing your funding requirements as early as possible.

You have now completed your cash funding for value date 28 February 2014. You are sure that Phases A and B are correct, but how certain can you be that the items in Phase C will actually settle as expected?

The challenge is, wherever possible, to predict which items are unlikely to settle. For your purchases, you will have no forewarning that they are about to settle. However, for your sales, you are in control of your inventory and should know in advance what securities are available for delivery.

This challenge can be overcome by adopting one of two approaches:

- Fund to settle.

- Fund to fail.

This approach is subject to the following caveats:

- That your sales will settle. This requires a high degree of confidence that you have sufficient inventory.

- That your purchases might settle. As you cannot be sure, it is prudent to ensure that there is sufficient cash available.

- Where you know that payment has to be made on the value date, for example a corporate action payable.

In conclusion, this is an optimistic approach.

This approach is subject to the following caveats:

- That your sales will not (or probably will not) settle and that you will fund the proceeds only on receipt.

- That your purchases will not (or probably will not) settle and that you will fund the costs only on the date payment is to be made. This particular approach may not leave you enough time to fund the position.

- Where you suspect that payment will not be made to you on the value date, for example, a late dividend or coupon payment.

In conclusion, this is more of a pessimistic approach.

The reality is that the funding officer has to weigh up the chances that an item may or may not settle as expected. Reference to internal records of historic settlement activity and, where available, market information can help the funding officer be more accurate in anticipating cash-funding requirements.

The main object of predictive forecasting is to make sure that there is sufficient cash to cover all activities. Performed well, the cost of funding can be reduced; indeed, it is quite possible to make a positive return, especially when interest rates are reasonably high. Errors in cash forecasting can be expensive and will add to the overall cost of providing an operational service to the Front Office. At worst, there is a reputational risk should counterparties become aware of funding issues in your organisation.

These questions are posed to make the distinction between securities that you legally own (or not) and the availability of securities for delivery. Forecasting for securities is similar in concept to cash forecasting (e.g. we are looking at one particular date â the settlement date). The main difference is that we are focusing on our sales rather than our total trading activities.

The situation is different regarding derivatives contracts. Market participants and investors can buy “long” and sell “short”. Unlike securities, derivatives contracts cannot be delivered and received in the same way that equities, bonds, etc. are delivered. In fact, the only delivery we have to worry about is when contracts are exercised into the underlying asset.

Please refer back to the settlement simulation and in particular to the following documents:

- Dealer's blotter (see

Figure 7.9

): This lists the securities that have been previously purchased. - Dealing sheet (see

Figure 7.10

): There are six transactions, two of which are sales.

Are you able to deliver the 2,500 HSBA shares and 15,000 MRW shares? According to the dealer's blotter, there are sufficient securities (40,000 HSBA shares and 90,000 MRW shares); however, are they available for delivery (AFD)?

You reconcile both positions with the results shown in

Table 7.8

and

Table 7.9

.

TABLE 7.8

Reconciliation of HSBA shares

| HSBA Shares | |||

| Ownership | Balance | Balance | Location |

| Trading book | 40,000 | â40,000 | Custodian |

| Totals: | 40,000 | â40,000 |

TABLE 7.9

Reconciliation of MRW shares

| MRW Shares | |||

| Ownership | Balance | Balance | Location |

| Trading book | 90,000 | â90,000 | Custodian |

| Totals: | 90,000 | â 90,000 |

Both positions reconcile and, as the shares are located at the custodian, they are available for delivery. You can now be confident that if your delivery instructions are matched at the clearing house, you will settle both sales and receive the cash proceeds.

We can change the scenario by altering the location of both holdings. The reconciliations now look like those shown in

Table 7.10

and

Table 7.11

.

TABLE 7.10

Reconciliation of HSBA shares â second version

| HSBA Shares | |||

| Ownership | Balance | Balance | Location |

| Trading book | 40,000 | â25,000 | Custodian |

| â15,000 | Counterparty 01 | ||

| Totals: | 40,000 | â40,000 |

TABLE 7.11

Reconciliation of MRW shares â second version

| MRW Shares | |||

| Ownership | Balance | Balance | Location |

| Trading book | 90,000 | â10,000 | Custodian |

| â25,000 | Counterparty 02 | ||

| â35,000 | Counterparty 03 | ||

| â20,000 | Counterparty 04 | ||

| Totals: | 90,000 | â90,000 |

As before, both positions reconcile; however, there are only 25,000 HSBA shares and 10,000 MRW shares that are AFD. Whilst the sale of 2,500 HSBA shares can settle, the sale of 15,000 MRW shares cannot.

There are various options available:

- Do nothing. Allow the sale to fail and wait until one of the outstanding purchases settles.

- Borrow 5,000 MRW shares. This will provide the availability to settle the trade.

- Offer a partial delivery of 10,000 shares to your counterparty T04.

We will take a more detailed look at the management of settlement fails in the next chapter.