Entrepreneur Myths (5 page)

Don’t forget you also report to customers, suppliers and the government. If you piss off any of these entities, you could be headed for trouble.

Today, thanks to social media, the customer is king with a larger scepter. If you launch a product that doesn’t work, you will hear from them in real time, instantly and so will everyone else on the planet. Think about the new consumer power created through Twitter, Facebook, YouTube, Google+, etc. — the customer is just a keyboard away in expressing their dissatisfaction with your company. And people complain online at least 10X more than they give out compliments.

I funded a CEO in the enterprise software sector, Craig Wichner, who clearly understood that as the CEO he wasn’t the boss of anyone. His extensive reporting to investors, suppliers, employees and customers was impressive — to the point that I learned from him how important it was to stay humble and act as a servant when you’re at the top of the pyramid. His management pyramid was reversed. He was at the bottom, serving all.

I sold business productivity software for a company in the early 1990s when they released a new version. Sales were brisk because customers loved the previous version. Unfortunately, after shipping more than 50,000 software packages, customers discovered critical bugs. The switchboard lit up like a Christmas tree for weeks and it was Christmastime. The company ate the cost of snail mailing the updated software. We didn’t have automatically-downloaded internet updates in those days. At least someone discovered the bugs before hundreds of thousands of copies went out the warehouse door. Even after all these years, once a year I wake up in a cold sweat from nightmares that I’m answering calls from pissed off customers.

Still feeling bossy?

Your suppliers are critical and if you don’t report to them by paying them on time, you won’t get those components necessary to build your product. Then you’re shit out of fucking luck. If your cash flow sucks wind, you have to convince your suppliers to extend their terms instead of cutting you off by putting you on credit hold.

In case you didn’t know, if you don’t pay your taxes, sooner or later, you’ll be fucked because the government will come knocking on your door.

Do you still feel like you’re your own boss? If you do, you’re fucked.

Brain Candy: questions to consider and ponder

(Q1)

How do you feel about being your own boss? Do you feel the pressure? Would it be easier to work for a Fortune 1000 company or at McDonald’s?

(Q2)

Do you feel pressured by the responsibilities that come with being the boss, or do you love the pressure cooker?

(Q3)

If you are the head cheese, who is your #2? Can they take over for you like Spock took command for Captain Kirk without missing a beat?

(Q4)

As a boss do you throw your weight around, or are you collaborative in your management decision processes? Does your organization chart look more like a pyramid, an inverted pyramid or a distributed system?

(Q5)

Have you gone to your employees’ family functions? Or do you keep a distance? If you do go to employees’ personal functions, how does that change the way you think of yourself as their boss?

Entrepreneur

Myth 7

| Control is not an issue

“Don’t worry about control. It’s not an issue. It’s more important to succeed because everyone wins,” the VC assured me. I was sitting across from him in his Silicon Valley, Sand Hill Road office. My vision blurred and for a moment, I saw a cobra. Of course control’s not an issue, I thought, because

you

want to have the control — you fucking bitch.

In the film

Social Network

, Zuckerberg’s business card reads, “I’m the CEO, Bitch.” I don’t blame him. If your venture needs money, are you willing to lose control? At what price? How much money do you require to be heavily diluted? If you’re stupid enough to lose control in the seed or Series A stage of financing, make sure it is for enough capital that you’ll never need subsequent funding.

Several variables determine when you might lose control: the sector, stage of your venture, market traction, financial metrics and amount of funding received and seeking. If your venture requires massive amounts of capital to grow, like Groupon for example, it’s likely you’ll lose control at some point. The exceptions are when you self-finance, finance with partners, or when your customers finance your growth through sales and advance payments.

Bill Gates doesn’t own controlling shares of Microsoft, however he’s the second richest person in the world (Carlos Slim of Mexico is first). Steve Jobs doesn’t own the controlling interest in Apple either. These are public companies. When you go public, you lose control.

What if you’re a private company or startup?

As an investor, I prefer you keep majority ownership of your venture in the seed stage. However, if I finance later stages, the percentage increase in equity I will obtain will differ according to the milestones accomplished by your venture. If your company is smokin’ hot in the marketplace, and you require capital for growth, I don’t need majority control to meet my ROI requirements. If you need capital to bail your ass out for mistakes, my equity formula will vary depending on the level of risk. A higher level of control and equity is warranted with higher capital infusion and risk.

I funded one spineless entrepreneur in the technology services sector, with millions of dollars. This motherfucker couldn’t stay focused if you paid him. Shit, I

did

pay him and paid him well. The company missed its product launch deadlines three times. However, I believed it was a billion dollar venture, plus they had hired a new hotshot CEO. Because I was investing millions of additional dollars in subsequent rounds, there was no choice but to dilute the ownership shares of the management team, including the founder in order for the return on investment (ROI) math to work.

When I initially invest into a venture, I inform the founder that if I have to invest into their second round by myself, they’d better have traction — otherwise they need to find other investors. If they don’t have traction, as in this case, I would be forced to take control to reduce my risk. If I risk millions of additional dollars on a venture, you’d better believe I’m going to want the highest fucking return possible. There are no freebies in VC-land. When this founder came back for a third round of capital, he was pissed off because he was diluted to less than 10%. I explained I was bailing his fucking ass out and he was the majority of the problem.

I expect you to increase the value of your company after my investment. I expect you to reach your milestones — the same milestones you designed. If I put money into subsequent rounds it is because I want to keep my equity percentage position the same or higher due to the positive financial metrics of your company. Listen, I don’t have time to run your company. If I end up with controlling interest, it is due to simple mathematics. If I invest additional money in order to save your ass, my financial risk increases. It comes down to risk vs. reward.

VCs have varying opinions on the ratio of dollars invested versus risk and equity percentages. A large portion of them want a huge chunk of your venture from the start. But when a VC invests millions of dollars, they have to get their ROI.

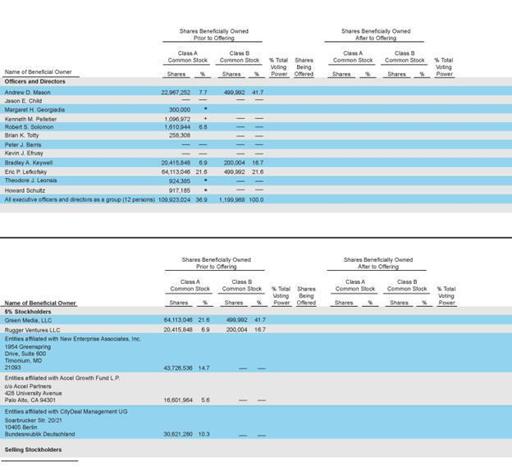

Look at the recent Groupon capitalization table (below) during its IPO filing. The largest equity shareholders are investors and founders. Eric Lefkovsky cofounded and funded ThePoint, which later turned into the social-group-buying behemoth Groupon. For taking a huge risk, Lefkovsky owns 21.6% of the company. NEA (New Enterprise Associates), a prominent VC firm, owns 14.7% for investing into ThePoint and following up with an investment into Groupon. CityDeal Management owns 10.3% after Groupon acquired them in May 2010. Bradley Keywell owns 6.9%. Surprisingly, the other cofounder and CEO, Andrew Mason, owns only 7.7% of the company.

Tally them all up, and the above members own a total of 61.2% of the company. It doesn’t stop there. Groupon has Class A and Class B common stock. Class B shares, while making up a small percentage of the overall shares, receive higher voting rights to continue the management control influence. The founders were smart. Both Lefkofsky and Mason have 41.7% of Class B shares. Bradley Keywell has 16.7% of the Class B Shares.

Groupon IPO Cap Table (Equity Percentages)

2

:

My advice: Entrepreneurs should turn down investors who want to control the venture in the seed or early stages of the cycle. Those investors are control freaks who’ve never run a business, want to run yours because they see a big play, or they want one of their cronies to step in to manage. If you’re an entrepreneur, do not get into a position of losing control quickly — even to me.

Once you lose controlling interest, you become an employee of the company you founded.

Brain Candy: questions to consider and ponder

(Q1)

Do you think control is not an issue when you are funded by a VC? Have you ever lost control of your venture? In what stage?

(Q2)

Under what conditions are you willing to lose control of your venture?

(Q3)

If you lost control of your venture, how did you feel? Did you still think you were in charge? Or did you feel you’d become just a highly-paid employee?

Entrepreneur

Myth 8

| Failure is not an option

Years ago, The Sunday Times quoted me telling an audience of Oxford MBA students that I’d been turned down more than the Starbucks founder who had 175 rejections before raising capital. It’s true. It’s not in my personality to give up. As Ed Harris said in the film

Apollo 13

, “Failure is not an option.” As a young soccer player, I scored more goals in the last 10 or 20 minutes of a game than I can remember. My psychological stubbornness of never wanting to give up on anything goes back to one game in particular.

Other books

Gettin' Hooked by Nyomi Scott

Desolation Boulevard by Mark Gordon

Angel Seduced by Jaime Rush

12 Days by Chris Frank, Skip Press

Highland Fires by Donna Grant

Just A Step Away (Closer) by Roberts, Flora

Survivor by Saffron Bryant

A Prideless Man by Amber Kell

In the Blood by Steve Robinson

The Revolt of the Eaglets by Jean Plaidy