Against the Gods: The Remarkable Story of Risk (47 page)

Read Against the Gods: The Remarkable Story of Risk Online

Authors: Peter L. Bernstein

The example becomes more realistic when we translate it into a

technique for measuring the utility-the degree of satisfaction-of pos sessing $1 compared to the utility of possessing a second dollar, for a

total of $2. This man's favored outcome must now be $2, which takes

the place of milk in the above example; no money takes the place of

tea, the least favored outcome, and $1 becomes the middle choice and

takes the place of coffee.

Once again we ask our subject to choose between a sure thing and

a gamble. But in this case the choice is between $1 versus a gamble that

pays either $2 or nothing. We set the odds in the gamble at a 50%

chance of $2 and a 50% chance of nothing, giving it a mathematical

expectancy of $1. If the man declares that he is indifferent between the

$1 certain and the gamble, then he is neutral on the subject of risk at

this low level of the gamble. According to the formula proposed by von

Neumann and Morgenstern, the probability on the favorite possibilityin this case the $2 outcome-defines how much the subject prefers $1

over zero compared with how much he prefers $2 over zero. Here 50%

means that his preference for $1 over zero is half as great as his preference for $2 over zero. Under these circumstances, the utility of $2 is

double the utility of $1.

The response might well differ with other people or under other

circumstances. Let us see what happens when we increase the amount

of money involved and change the probabilities in the gamble. Assume

now that this man is indifferent between $100 certain and a gamble

with a 67% probability of paying $200 and a 33% probability of coming up zero. The mathematical expectancy of this gamble is $133; in

other words, the man's preference for the certain outcome-$100-is

now larger than it was when only a couple of dollars were involved.

The 67% probability on $200 means that his preference for $100 over

zero is two-thirds as great as his preference for $200 over zero: the utility of the first $100 is larger than the utility of the second $100. The

utility of the larger sum diminishes as the amount of money at risk

increases from single digits to triple digits.

If all this sounds familiar, it is. The reasoning here is precisely the

same as in the calculation of the "certainty equivalent," which we

derived from Bernoulli's fundamental principle that the utility of increases in wealth will be inversely related to the amount of wealth

already possessed (page 105). This is the essence of risk aversion-that

is, how far we are willing to go in making decisions that may provoke

others to make decisions that will have adverse consequences for us. This line of analysis puts von Neumann and Morgenstern strictly in the

classical mode of rationality, for rational people always understand their

preferences clearly, apply them consistently, and lay them out in the

fashion described here.

Alan Blinder, a long-time member of the Princeton economics faculty, co-author of a popular economics textbook, and Vice Chairman

of the Federal Reserve Board from 1994 to 1996, has provided an

interesting example of game theory.17 The example appeared in a paper

published in 1982. The subject was whether coordination is possible, or

even desirable, between monetary policy, which involves the control of

short-term interest rates and the supply of money, and fiscal policy,

which involves the balance between federal government spending and

tax revenue.

The players in this game are the monetary authorities of the Federal

Reserve System and the politicians who determine the mix between

government spending and tax revenues. The Federal Reserve authorities

perceive control of inflation as their primary responsibility, which makes

them favor economic contraction over economic expansion. They serve

long terms-fourteen years for members of the Board, and until retirement age for presidents of the Federal Reserve Banks-so they can act

with a good deal of independence from political pressures. The politicians, on the other hand, have to run regularly for election, which leads

them to favor economic expansion over economic contraction.

The object of the game is for one player to force the other to make

the unpleasant decisions. The Fed would prefer to have tax revenues

exceed spending rather than to have the government suffer a budget

deficit. A budget surplus would tend to hold inflation in check, thereby

protecting the members of the Fed from being seen as the bad guys.

The politicians, who worry about being elected, would prefer the Fed

to keep interest rates low and the money supply ample. That policy

would stimulate business activity and employment and would relieve

Congress and the President of the need to incur a budget deficit.

Neither side wants to do what the other side wants to do.

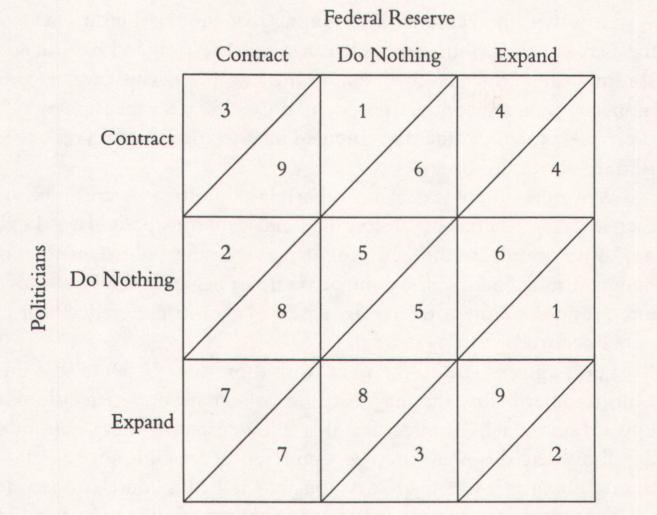

Blinder sets up a matrix that shows the preferences of each side in

regard to each of three decisions by the other: contract, do nothing, or expand. The numbers above the diagonal in each square represent the

order of preference of the members of the Fed; the numbers below the

diagonals represent the order of preference of the politicians.

Blinder's payoff matrix.

(Adapted from Alan S. Blinder, 1982, "Issues in the Coordination of Monetary and

Fiscal Policies," in Monetary Policy Issues in the 1980s, Kansas City, Missouri:

Federal Reserve Bank of Kansas City, pp. 3-34.)

The highest-ranked preferences of the Fed (1, 2, and 3) appear in

the upper left-hand corner of the matrix, where at least one side is contractionary while the other is either supportive or does nothing to rock

the boat. The members of the Fed clearly prefer to have the politicians

do their job for them. The three highest-ranked preferences of the

politicians appear in the lower right-hand corner, where at least one

side is expansionary while the other is either supportive or does nothing to rock the boat. The politicians clearly prefer to have the Fed

adopt expansionary policies and for the politicians to do nothing. The

lowest-ranked preferences of the politicians appear in the left-hand column, while the lowest-ranked preferences of the Fed appear in the bottom row. This is hardly a situation in which much accommodation is

likely.

How will the game end? Assuming that the relationship between

the Fed and the politicians is such that collaboration and coordination

are impossible, the game will end in the lower left-hand corner where

monetary policy is contractionary and fiscal policy is expansionary. This

is precisely the outcome that emerged in the early Reagan years, when

Blinder wrote this paper.

Why this outcome and no other? First, both sides are displaying

their character here-an austere Fed and generous politicians. Under

our assumption that the Fed cannot persuade the politicians to run a

budget surplus and that the politicians cannot persuade the Fed to lower

interest rates, neither side has any desire to alter its preferences nor can

either dare to be simply neutral.

Look upward and to the right from those two 7s. Note that there

is no number below the diagonal (the politicians' preference) looking

upward on the left-hand vertical that is lower than 7; there is no number above the diagonal (the Fed's preference) looking horizontally to

the right that is lower than 7. As long as the Fed is contractionary and

the politicians are expansionary, both sides are making the best of a bad

bargain.

That is not the case in the upper right-hand corner, where the Fed's

monetary policy is less tight and a budget surplus emerges. Looking left

horizontally and above the diagonals, we note that both the choices rank

higher than 4: the Fed would rather do nothing or even be contractionary as compared to contributing to a business expansion that might

end up in an inflationary situation. The opposite view would prevail

among the politicians. Looking downward vertically, we find that both

the choices rank higher than 4: the politicians would rather do nothing

or run a deficit than follow a policy that cost them their jobs if their constituents lose their jobs as a result.

This outcome is known as a Nash Equilibrium, named after John

Nash, another Princetonian and one of the 1994 winners of the Nobel Prize for his contributions to game theory.18 Under the Nash

Equilibrium the outcome, though stable, is less than optimal. Both sides

would obviously prefer almost anything to this one. Yet they cannot

reach a better bargain unless they drop their adversarial positions and

work together on a common policy that would give each a supportive,

or at least a neutral, role that would keep them from getting into each

other's way. An example of that radically different state of affairs arose in 1994, when Fed policy was contractionary and the politicians were

uncharacteristically willing to stand by without interfering.

Blinder's game reveals a keen insight into the way contesting powers in Washington behave toward one another. But it can be generalized into many other situations: Drop the bomb, do nothing, or sue for

peace. Cut prices, do nothing, or raise prices. Bet your poker hand on

the basis of the probabilities, fold, or bluff.

In Blinder's example, the players know each other's intentions,

which is seldom the case. It also fails to include the preferences of consumers, employees, and business managers, all of whom are very much

involved in the outcome. When we change the rules by expanding the

number of players or by restricting the information available to the

players, we have no choice but to resort to higher mathematics. As

von Neumann and Morgenstern remarked, ". . . what a complexity of

theoretical forms must be expected in social theory."

In August 1993, the Federal Communications Commission decided

to auction off wireless communications rights. Two licenses would be

issued for each of 51 zones around the country; no bidder could acquire

more than one license in any zone. The usual procedure in such auctions is to call for sealed bids and to award the contract to the highest

bidders. This time, acting on the advice of Paul Milgrom, a Stanford

University professor, the FCC chose to conduct the auction according

to game theory, calling it a "Spectrum Auction."

First, all bids would be open, so that each contestant would always

know what all the others were doing. Second, there would be successive rounds of bidding until no contestant wanted to raise its bid any

higher. Third, between rounds, contestants could switch their bid from

one zone to another or could bid simultaneously for licenses in adjoining zones; since there is an economic advantage in having licenses in

adjoining zones, a particular license might be worth more to one party

than it would be to another. In short, each decision would be based on

the known decisions of the other players.

The contestants found that making decisions was no easy matter.

Each of them had to guess about the intentions of the others, studying

their reputation for aggressiveness, their financial capacity, and their existing licensing structures. On occasion, a properly placed bid by one

contestant would clearly signal its intentions to the others, thereby

avoiding a cycle of competitive bidding for some particular license.

Pacific Telesis, which hired Milgrom as their consultant in the auction,

went so far as to take out full-page ads in cities where potential competitors were located to make clear their determination to win no matter what. Some contestants joined together to prevent costly bidding

for the same license.